Market_Wrap_041213__MG_.pdf ( 456.19k )

Number of downloads: 8

Market_Wrap_041213__MG_.pdf ( 456.19k )

Number of downloads: 8Public Mutual v4, Public/PB series funds

Public Mutual v4, Public/PB series funds

|

|

Apr 15 2013, 08:28 PM Apr 15 2013, 08:28 PM

Return to original view | Post

#1

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

|

|

|

Apr 16 2013, 09:23 PM Apr 16 2013, 09:23 PM

Return to original view | Post

#2

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Public Industry Fund (PIF) and Public Balanced Fund (PBF) will be re-opened for cash investments with effect from 2 May 2013 (Thursday).

|

|

|

Apr 17 2013, 10:56 PM Apr 17 2013, 10:56 PM

Return to original view | Post

#3

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

For me, I don't recommend this 2 funds, PIF nor PBF due to under performing.

Yes, the reopening of these 2 funds information is via PM's UTC email. |

|

|

Apr 19 2013, 10:40 AM Apr 19 2013, 10:40 AM

Return to original view | Post

#4

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

Apr 22 2013, 08:43 PM Apr 22 2013, 08:43 PM

Return to original view | Post

#5

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

PM's Market wrap and bond market review for the week/ fortnight ended 19 April 2013 for your information.

Market_Wrap_04_19_13__MG_.pdf ( 365.74k )

Number of downloads: 4

Market_Wrap_04_19_13__MG_.pdf ( 365.74k )

Number of downloads: 4 |

|

|

Apr 22 2013, 09:15 PM Apr 22 2013, 09:15 PM

Return to original view | Post

#6

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

I did read on it (sometime) to gathering some information such as P/E ratio and some regional market valuations.

The 2013 Q1 QFR (softcopy) is just available in their website:- http://www.publicmutual.com.my/LinkClick.a...aw%3D&tabid=248 This post has been edited by transit: Apr 22 2013, 09:16 PM |

|

|

|

|

|

Apr 24 2013, 07:34 AM Apr 24 2013, 07:34 AM

Return to original view | Post

#7

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Public Mutual has recently added the Public China Access Equity Fund (“PCASEF”) under its management.

PCASEF is an equity fund that has the mandate to invest in the China market. The fund will focus its investment in China A-share market. China A-share market refers to stocks that trade on the Shanghai and Shenzhen exchanges. These companies are incorporated in mainland China and their shares are denominated in Renminbi. China A-shares trade in a closed market and can only be purchased by domestic Chinese investors. Foreign investors who intend to invest in China A-shares have to hold the Qualified Foreign Institutional Investor (“QFII”)License under the Strategic Investment Scheme, of which Public Mutual is a license holder. Please be informed that units of PCASEF will only be held by funds of Public Mutual which have a mandate to invest in China shares and will not be offered to the public. This post has been edited by transit: Apr 24 2013, 07:35 AM |

|

|

Apr 25 2013, 09:57 PM Apr 25 2013, 09:57 PM

Return to original view | Post

#8

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

Apr 25 2013, 10:12 PM Apr 25 2013, 10:12 PM

Return to original view | Post

#9

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

To me, it become less competitive compare to other fund houses :-(

|

|

|

May 1 2013, 09:25 AM May 1 2013, 09:25 AM

Return to original view | Post

#10

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Please be informed that the following funds will be opened for investment under the EPF-MIS with effect from 16 May 2013:-

1. Public Select Alpha-30 Fund 2. Public Islamic Select Bond Fund |

|

|

May 15 2013, 11:55 PM May 15 2013, 11:55 PM

Return to original view | Post

#11

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

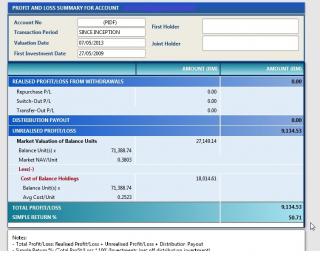

U may ask a report from your servicing UTC. (since is PB series, should you go back to the PB Staff to ask for it). Best Luck!!!

Below is the example of the Public Series P/Loss Report.

Personally this PB Mixed Asset Conservative Fund is not suitable for me, I like higher risk funds. :-) PBMAX is low risk fund [Here u go]

This post has been edited by transit: May 16 2013, 12:01 AM |

|

|

May 16 2013, 08:37 AM May 16 2013, 08:37 AM

Return to original view | Post

#12

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

May 21 2013, 08:12 PM May 21 2013, 08:12 PM

Return to original view | Post

#13

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Yes, as long as your EPF Account 1 is fulfilled the basic criteria set up by KWSP.

However without employment, your regular EPF withdrawal in Account 1 to invest in PM fund may not sustainable for long run due to no new savings is coming in during non employment period. :-) |

|

|

|

|

|

May 29 2013, 04:02 PM May 29 2013, 04:02 PM

Return to original view | Post

#14

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

May 31 2013, 11:19 AM May 31 2013, 11:19 AM

Return to original view | Post

#15

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

May 31, 2013 Fund Distributions

Public Balanced Fund - Final - 2.50 Public Ittikal Fund - Final - 5.00 Public Islamic Equity Fund - Final - 2.00 Public Dividend Select Fund - Final - 2.00 Public Select Bond Fund - Final - 3.25 Public Islamic Select Treasures Fund - Final - 2.00 |

|

|

Jun 9 2013, 08:48 PM Jun 9 2013, 08:48 PM

Return to original view | Post

#16

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

What is the most competitive S.C% to be charged in mind? Any thought?

|

|

|

Jun 20 2013, 11:29 PM Jun 20 2013, 11:29 PM

Return to original view | Post

#17

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

Jun 27 2013, 09:32 PM Jun 27 2013, 09:32 PM

Return to original view | Post

#18

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Personally, I won't recommend PSF (Public Savings Fund). The CAGR is below my expectation. (Since commencement CAGR is only PSF 29/03/1981 7.7897%)...My minimum CAGR is at least 8% and above.

|

|

|

Jun 27 2013, 10:02 PM Jun 27 2013, 10:02 PM

Return to original view | Post

#19

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

In the other hand, your relative - the servicing UTC should update you your account information via CAMS2. All unitholder's profit/loss is accessible by your existing servicing UTC. Good Luck!!

|

|

|

Jun 28 2013, 02:37 PM Jun 28 2013, 02:37 PM

Return to original view | Post

#20

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

Xuzen is RIGHT !!!

|

|

Topic ClosedOptions

|

| Change to: |  0.0372sec 0.0372sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:09 AM |