QUOTE(thecurious @ Aug 8 2024, 01:00 PM)

no one knows for surebut can feel it all of a sudden

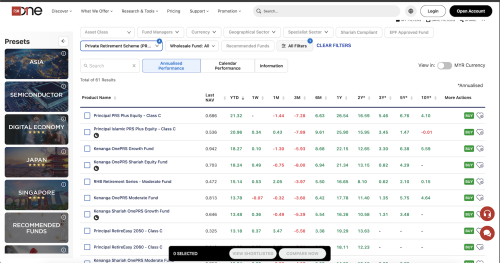

has been going up so much since Jan 2024

take profit first ..........i didnt do that greedy for it to higher

now all back to square 1 as in jan 2024 values

lost RM7000 just like that.

QUOTE(Ramjade @ Aug 8 2024, 02:08 PM)

yeah now prices dropped back to Jan 2024 levelsclimbing up needed so many months

dropping down few days only....all gains wiped out liao..

Aug 8 2024, 09:16 PM

Aug 8 2024, 09:16 PM

Quote

Quote

0.0204sec

0.0204sec

0.66

0.66

6 queries

6 queries

GZIP Disabled

GZIP Disabled