Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

redza2k4

|

Nov 14 2024, 06:28 PM Nov 14 2024, 06:28 PM

|

New Member

|

Has anyone hired one of those wealth management firms? Thinking of getting one. I found this list of top firms and wondering if anyone has had any experience with this kind of firm. This post has been edited by redza2k4: Nov 18 2024, 05:39 PM |

|

|

|

|

|

Ramjade

|

Nov 14 2024, 06:29 PM Nov 14 2024, 06:29 PM

|

|

QUOTE(redza2k4 @ Nov 14 2024, 06:28 PM) Has anyone hired one of those wealth management firms? Don't bother. |

|

|

|

|

|

SUSfuzzy

|

Nov 14 2024, 07:11 PM Nov 14 2024, 07:11 PM

|

|

QUOTE(redza2k4 @ Nov 14 2024, 06:28 PM) Has anyone hired one of those wealth management firms? Bro if you wish to burn money away via WM firms I suggest you donate it a good cause haha. |

|

|

|

|

|

alexwsk

|

Nov 15 2024, 12:24 PM Nov 15 2024, 12:24 PM

|

|

So, if I want to contribute 3k for prs, do I need to sign up at PPA or just fsmone will do?

|

|

|

|

|

|

MUM

|

Nov 15 2024, 01:05 PM Nov 15 2024, 01:05 PM

|

|

QUOTE(alexwsk @ Nov 15 2024, 12:24 PM) So, if I want to contribute 3k for prs, do I need to sign up at PPA or just fsmone will do? If I can recall correctly, .... previuosly, ...just fsmone will do, they will provides you the form to open the PPA Accoount too. Not sure about latest, but I believes it is still the same |

|

|

|

|

|

bouncy

|

Nov 24 2024, 12:33 AM Nov 24 2024, 12:33 AM

|

Getting Started

|

Hi. My relative plans to withdraw his PRS of RM10K and move to EPF (he reached the retirement age so there won't be any penalty). Can he contribute PRS of RM3K at the end of the year to enjoy tax relief since it's not specifically mentioned net movement like SSPN ?

|

|

|

|

|

|

MUM

|

Nov 24 2024, 01:17 AM Nov 24 2024, 01:17 AM

|

|

QUOTE(bouncy @ Nov 24 2024, 12:33 AM) Hi. My relative plans to withdraw his PRS of RM10K and move to EPF (he reached the retirement age so there won't be any penalty). Can he contribute PRS of RM3K at the end of the year to enjoy tax relief since it's not specifically mentioned net movement like SSPN ? Not a 100% sure answers Not a qualified tax claim person Not a qualified tax comment Just a kay poh post while waiting for real value added responses to your query. I believes can still get tax relief. Just like those that withdrew from kwsp and self contributed some of it back to claim tax relief. |

|

|

|

|

|

SUSfuzzy

|

Nov 25 2024, 10:28 AM Nov 25 2024, 10:28 AM

|

|

QUOTE(bouncy @ Nov 24 2024, 12:33 AM) Hi. My relative plans to withdraw his PRS of RM10K and move to EPF (he reached the retirement age so there won't be any penalty). Can he contribute PRS of RM3K at the end of the year to enjoy tax relief since it's not specifically mentioned net movement like SSPN ? Can, the tax relief is based on amount put in PRS for that particular year rather than net basis like you said. |

|

|

|

|

|

Duckies

|

Nov 25 2024, 10:32 AM Nov 25 2024, 10:32 AM

|

|

QUOTE(alexwsk @ Nov 15 2024, 12:24 PM) So, if I want to contribute 3k for prs, do I need to sign up at PPA or just fsmone will do? QUOTE(MUM @ Nov 15 2024, 01:05 PM) If I can recall correctly, .... previuosly, ...just fsmone will do, they will provides you the form to open the PPA Accoount too. Not sure about latest, but I believes it is still the same Ya that's correct. I just opened mine recently. Can do it via the mobile app. Not sure about PBB Mutual fund tho..is it the same process? |

|

|

|

|

|

MUM

|

Nov 25 2024, 12:12 PM Nov 25 2024, 12:12 PM

|

|

QUOTE(Duckies @ Nov 25 2024, 10:32 AM) Ya that's correct. I just opened mine recently. Can do it via the mobile app. Not sure about PBB Mutual fund tho..is it the same process? I believes, those that knows FSM or eunittrust platforms seldom chooses PM to buy PRS funds as PM charges 3% sales charges for each buy whereelse, others charges 0% |

|

|

|

|

|

Duckies

|

Nov 25 2024, 12:34 PM Nov 25 2024, 12:34 PM

|

|

QUOTE(MUM @ Nov 25 2024, 12:12 PM) I believes, those that knows FSM or eunittrust platforms seldom chooses PM to buy PRS funds as PM charges 3% sales charges for each buy whereelse, others charges 0% But if one wants to buy PRS from PBB then need to use PMO right? |

|

|

|

|

|

MUM

|

Nov 25 2024, 01:14 PM Nov 25 2024, 01:14 PM

|

|

QUOTE(Duckies @ Nov 25 2024, 12:34 PM) But if one wants to buy PRS from PBB then need to use PMO right? If PBB funds, I think those Public bank branches that has wealth management services or CS counter can process too. I saw many times, they promotes to seniors....potentually earn more interest than FD. I believes too, that buying through agent or PMO also has sales charges. I think that UT funds that has the "e" infront (E series UT funds from PM) will have lower SC This post has been edited by MUM: Nov 25 2024, 01:19 PM |

|

|

|

|

|

Duckies

|

Nov 25 2024, 01:15 PM Nov 25 2024, 01:15 PM

|

|

QUOTE(MUM @ Nov 25 2024, 01:14 PM) If PBB funds, I think those Public bank branches that has wealth management services or CS counter can process too. I saw many times, they promotes to seniors....potentually earn more interest than FD I saw that we can actually apply it online via Public Mutual Online but I am unsure if PMO will help with the PPA application  This post has been edited by Duckies: Nov 25 2024, 01:16 PM This post has been edited by Duckies: Nov 25 2024, 01:16 PM |

|

|

|

|

|

MUM

|

Nov 25 2024, 01:23 PM Nov 25 2024, 01:23 PM

|

|

QUOTE(Duckies @ Nov 25 2024, 01:15 PM) I saw that we can actually apply it online via Public Mutual Online but I am unsure if PMO will help with the PPA application  Go to this PM site https://www.publicmutual.com.my/pmb/private...ment-scheme-prsClick on that link Attached thumbnail(s)

|

|

|

|

|

|

aubergine6958

|

Nov 27 2024, 03:04 PM Nov 27 2024, 03:04 PM

|

Getting Started

|

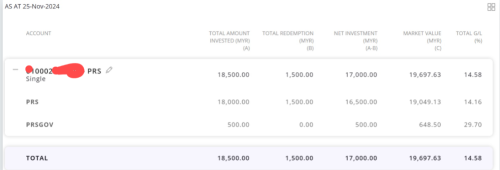

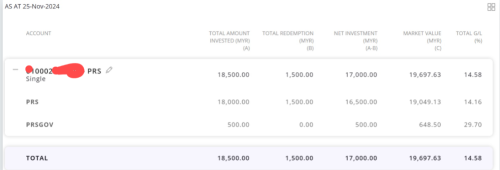

QUOTE(guy3288 @ Oct 29 2024, 11:07 PM) tax relief cukup, put RM3k every year. buy and keep only do nothing since 2013. few months ago profit near RM15k now down already started since 2018, for the purpose of tax relief also.. Have quite a different fate with your portfolio. Before this year the return was worst only less than 5%.  |

|

|

|

|

|

alexwsk

|

Nov 30 2024, 05:25 PM Nov 30 2024, 05:25 PM

|

|

QUOTE(Duckies @ Nov 25 2024, 10:32 AM) Ya that's correct. I just opened mine recently. Can do it via the mobile app. Not sure about PBB Mutual fund tho..is it the same process? ok confirmed just need to open with FSMone |

|

|

|

|

|

kimi0148

|

Dec 2 2024, 09:26 AM Dec 2 2024, 09:26 AM

|

Getting Started

|

If I transfer out from provider A to provider B in current year, can the amount be considered deposit for the year? I have receipt and transaction confirmation for the "deposit".

Cause the amount is reflected in PPA website as contribution.

This post has been edited by kimi0148: Dec 2 2024, 09:27 AM

|

|

|

|

|

|

leanman

|

Dec 2 2024, 01:44 PM Dec 2 2024, 01:44 PM

|

|

QUOTE(kimi0148 @ Dec 2 2024, 09:26 AM) If I transfer out from provider A to provider B in current year, can the amount be considered deposit for the year? I have receipt and transaction confirmation for the "deposit". Cause the amount is reflected in PPA website as contribution. I doubt that.... |

|

|

|

|

|

SUSfuzzy

|

Dec 2 2024, 02:14 PM Dec 2 2024, 02:14 PM

|

|

QUOTE(kimi0148 @ Dec 2 2024, 09:26 AM) If I transfer out from provider A to provider B in current year, can the amount be considered deposit for the year? I have receipt and transaction confirmation for the "deposit". Cause the amount is reflected in PPA website as contribution. No, its not considered. |

|

|

|

|

|

cempedaklife

|

Dec 9 2024, 05:46 PM Dec 9 2024, 05:46 PM

|

|

took me a while to clear my confusion and figure out why ramjade said the principle retireeasy got more exposure to US.

thanks.

|

|

|

|

|

Nov 14 2024, 06:28 PM

Nov 14 2024, 06:28 PM

Quote

Quote

0.0301sec

0.0301sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled