QUOTE(chicaman @ Oct 22 2011, 12:48 PM)

Hi,

I am a fresh grad and I think I have to pay income tax soon.

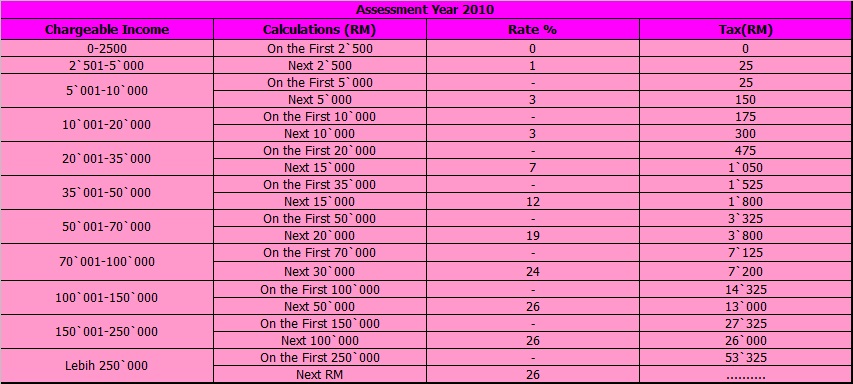

From the table, the income tax to be paid is based on our annual income right?

The annual income is inclusive of the allowances in salary or only the basic of salary?

The tax reliefs, for example, RM500 (max) for broadband, we deduct that RM500 from our annual income together with other tax reliefs, then the balance will be match to the table above to determine how much tax to be paid?

Thanks for answering my questions in advance =)

A simple example below:I am a fresh grad and I think I have to pay income tax soon.

» Click to show Spoiler - click again to hide... «

From the table, the income tax to be paid is based on our annual income right?

The annual income is inclusive of the allowances in salary or only the basic of salary?

The tax reliefs, for example, RM500 (max) for broadband, we deduct that RM500 from our annual income together with other tax reliefs, then the balance will be match to the table above to determine how much tax to be paid?

Thanks for answering my questions in advance =)

Your annual gross income + bonus + special + etc. = RM36,000

Your rental + dividend + direct sales + any other income = RM15,000

Total = RM51,000

Less : 9k? relief, other deductions like broadband, books, insurance/epf, etc.

let's say RM13,000

Taxable amount

= 51k - 13k

= 38k

Refer your table 35k-50k

On the first 35k = 1,525

Next 15k = 12% x (38k-35k) = 360

Total tax payable = 1525 + 360

= RM1,885

Oct 24 2011, 12:04 PM

Oct 24 2011, 12:04 PM

Quote

Quote 0.0315sec

0.0315sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled