QUOTE(!@#$%^ @ Feb 29 2024, 07:07 PM)

You will be. Better double confirm with customer service.Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Feb 29 2024, 07:17 PM Feb 29 2024, 07:17 PM

Show posts by this member only | IPv6 | Post

#5581

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 1 2024, 11:59 AM Mar 1 2024, 11:59 AM

|

Junior Member

335 posts Joined: Mar 2014 |

QUOTE(Medufsaid @ Feb 18 2024, 04:14 PM) Use moneymatch. Remit on weekday 9am and it'll appear in sg bank by lunchtime. If under RM3k, can use duitnow overseas transfer is the duitnow overseas transfer only applicable to participating banks in SG such as OCBC? btw, what are the minimum balance required for both your ocbc acct? if CIMB SG, able to transfer MYR to SGD using duitnow overseas transfer? |

|

|

Mar 1 2024, 12:04 PM Mar 1 2024, 12:04 PM

|

Senior Member

3,501 posts Joined: Jan 2003 |

Use mbb Singapore, cimb sg not part of duitnow

If you need to send S$850 and above just use moneymatch as it'll be cheaper Duitnow only worth it for sub$850 This post has been edited by Medufsaid: Apr 24 2025, 03:15 PM |

|

|

Mar 1 2024, 02:44 PM Mar 1 2024, 02:44 PM

|

Junior Member

335 posts Joined: Mar 2014 |

QUOTE(Medufsaid @ Mar 1 2024, 12:04 PM) Use ocbc or mbb Singapore, cimb sg not part of duitnow i see..If you need to send S$850 and above just use moneymatch as it'll be cheaper Duitnow only worth it for sub$850 how about mobile number used? can register in our m'sian mobile number to say, our OCBC SG account, and received SGD through duitnow transfer? |

|

|

Mar 1 2024, 02:52 PM Mar 1 2024, 02:52 PM

|

Senior Member

3,501 posts Joined: Jan 2003 |

jas029 yes i believe a few here manage to send to their sg bank account (via registered +60 number) https://forum.lowyat.net/topic/1440794/+5420 jas029 liked this post

|

|

|

Mar 1 2024, 03:19 PM Mar 1 2024, 03:19 PM

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(jas029 @ Mar 1 2024, 02:44 PM) i see.. yes, i can confirm that you can use a Malaysian phone number for OCBC Singapore and to receive money via DuitNowhow about mobile number used? can register in our m'sian mobile number to say, our OCBC SG account, and received SGD through duitnow transfer? |

|

|

|

|

|

Mar 6 2024, 11:33 AM Mar 6 2024, 11:33 AM

Show posts by this member only | IPv6 | Post

#5587

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(Afterburner1.0 @ Mar 6 2024, 11:30 AM) I guess the diff is all the misc fees we need to pay ofr the multi currency acc.... bank needs to make a profit all the time! However need advise from all sifu here..... if i open SG CIMB acc purely just for FD purposes is it worth it? can i use CIMB SG as my core base and transfer the amount to other banks FD in SG? or to have an FD in SG it is mandatory to open a savings account first b4 depositing the FD amount? FD interest won't stay high. If you have been around long enough you will know before COVID, the rates are only 1.x%p a. What then?Singapore FD rarely on par with Malaysian rates in the olden days. This post has been edited by Ramjade: Mar 6 2024, 11:39 AM |

|

|

Mar 6 2024, 11:58 AM Mar 6 2024, 11:58 AM

|

Junior Member

772 posts Joined: Jun 2015 |

QUOTE(Ramjade @ Mar 6 2024, 11:33 AM) FD interest won't stay high. If you have been around long enough you will know before COVID, the rates are only 1.x%p a. What then? yes ive been around that long enuff...... yeah its pathetic back then 1.xx % only..... but now its almost 3.4% but for 3 mths only.... worth it to open an sg acc just for FD purposes?Singapore FD rarely on par with Malaysian rates in the olden days. |

|

|

Mar 6 2024, 12:15 PM Mar 6 2024, 12:15 PM

Show posts by this member only | IPv6 | Post

#5589

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(Afterburner1.0 @ Mar 6 2024, 11:58 AM) yes ive been around that long enuff...... yeah its pathetic back then 1.xx % only..... but now its almost 3.4% but for 3 mths only.... worth it to open an sg acc just for FD purposes? Nope. Opening sg bank account is not for FD purpose. That is just me.But having an account in sg is always worth it. This post has been edited by Ramjade: Mar 6 2024, 12:17 PM CommodoreAmiga liked this post

|

|

|

Mar 7 2024, 07:07 AM Mar 7 2024, 07:07 AM

Show posts by this member only | IPv6 | Post

#5590

|

Junior Member

75 posts Joined: Feb 2009 |

Tried registering for an account for OCBC Digital, tried many different phones also cannot scan my passport

Pass through custom scan ok, but iPhone scan cannot. Fuck CIMB though i don't want to make an account through them. |

|

|

Mar 7 2024, 07:55 AM Mar 7 2024, 07:55 AM

|

All Stars

17,518 posts Joined: Feb 2006 From: KL |

QUOTE(whit3feather @ Mar 7 2024, 07:07 AM) Tried registering for an account for OCBC Digital, tried many different phones also cannot scan my passport after so many months still same issue huhPass through custom scan ok, but iPhone scan cannot. Fuck CIMB though i don't want to make an account through them. |

|

|

Mar 7 2024, 09:41 AM Mar 7 2024, 09:41 AM

|

Senior Member

3,501 posts Joined: Jan 2003 |

i actually don't want to create CIMB sg acct

|

|

|

Mar 7 2024, 10:25 AM Mar 7 2024, 10:25 AM

|

All Stars

17,518 posts Joined: Feb 2006 From: KL |

QUOTE(Medufsaid @ Mar 7 2024, 09:41 AM) i actually don't want to create CIMB sg acct i think all debit and credit cards are at risk. i have not heard of any bank that do not fraud transactions.

one sc bank was the worst. i got a notification to approve an unknown transaction which i declined of course. contacted cs and was told to continue using the same card with the same number as transaction did not go through and therefore no fraud transaction. |

|

|

|

|

|

Mar 7 2024, 04:36 PM Mar 7 2024, 04:36 PM

Show posts by this member only | IPv6 | Post

#5594

|

Junior Member

75 posts Joined: Feb 2009 |

|

|

|

Mar 8 2024, 01:01 AM Mar 8 2024, 01:01 AM

Show posts by this member only | IPv6 | Post

#5595

|

Junior Member

500 posts Joined: Aug 2014 |

QUOTE(Ramjade @ Mar 6 2024, 11:33 AM) FD interest won't stay high. If you have been around long enough you will know before COVID, the rates are only 1.x%p a. What then? Last time fixed deposit rate normally at what rate? Like from year 2010 to 2019 precovid? All the while 1.2 to1.5%?Singapore FD rarely on par with Malaysian rates in the olden days. |

|

|

Mar 8 2024, 03:46 AM Mar 8 2024, 03:46 AM

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(mavistan89 @ Mar 8 2024, 01:01 AM) Last time fixed deposit rate normally at what rate? Like from year 2010 to 2019 precovid? All the while 1.2 to1.5%? Depends on banks. But generally I think 1-1.2%p.a mavistan89 liked this post

|

|

|

Mar 8 2024, 06:31 AM Mar 8 2024, 06:31 AM

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(jas029 @ Mar 1 2024, 11:59 AM) is the duitnow overseas transfer only applicable to participating banks in SG such as OCBC? if CIMB SG, able to transfer MYR to SGD using duitnow overseas transfer? QUOTE(Medufsaid @ Mar 1 2024, 12:04 PM) Use ocbc or mbb Singapore, cimb sg not part of duitnow If you need to send S$850 and above just use moneymatch as it'll be cheaper Duitnow only worth it for sub$850 QUOTE(jas029 @ Mar 1 2024, 02:44 PM) i see.. how about mobile number used? can register in our m'sian mobile number to say, our OCBC SG account, and received SGD through duitnow transfer? QUOTE(moonsatelite @ Mar 1 2024, 03:19 PM) yes, i can confirm that you can use a Malaysian phone number for OCBC Singapore and to receive money via DuitNow This is interesting. Does it mean i have SG Bank, i can send directly to a Malaysia bank using Paynow and it'll convert the rates? What about if you have an MCA account with SGD. Can you use Paynow=>Duit Now directly in MCA without conversion?? |

|

|

Mar 8 2024, 08:39 AM Mar 8 2024, 08:39 AM

|

Senior Member

3,501 posts Joined: Jan 2003 |

CommodoreAmiga

This post has been edited by Medufsaid: Jul 12 2024, 09:07 AM CommodoreAmiga liked this post

|

|

|

Mar 8 2024, 08:00 PM Mar 8 2024, 08:00 PM

|

Junior Member

844 posts Joined: Sep 2011 |

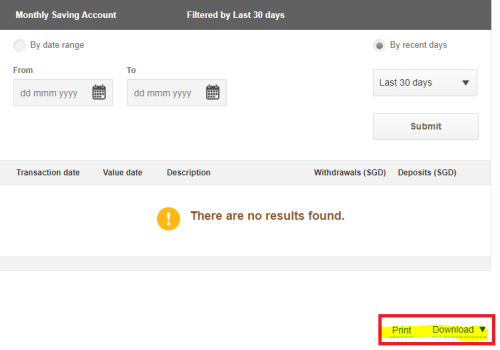

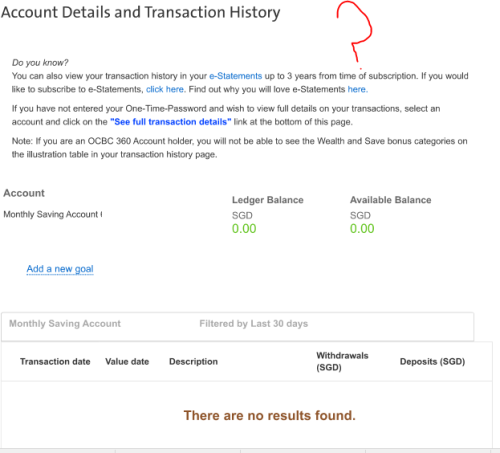

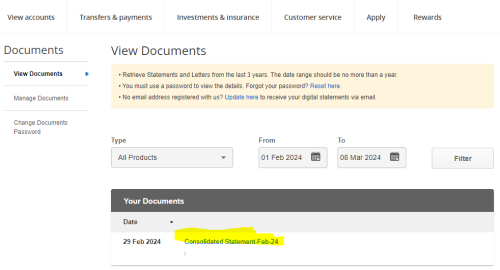

QUOTE(Mr Gray @ Jan 5 2024, 08:04 AM) Here u go. Referral code deleted already. Hahahaha Hey Mr Gray, is it possible to generate a bank statement from the OCBC SG portal that includes both the account holder name and address? There doesn't seem to be any way to do this per my attempts.Happy to share that I have successfully opened my OCBC Singapore account with just my IC and Passport. The process of applying through the app is a bit a pain in the ass, as needs to do several times for the app to accept my IC. Tips, the ic can be slightly outside the rectangle. Took about 3 working days for the account to be approved. Was given Global Savings Account and Statement Savings Account. Initial deposit required is just SGD1000, it can be from your Singaporean bank account or Malaysian bank account. I already have Maybank SG account. So this is very seamless. Despite the T&C showing initial deposit for non-resident Statement Savings Account is SGD20k. I just needed to deposit SGD1k. Not sure if this only applies for Malaysians or what. Regardless, even if the fall below fee for non-resident Statement Savings Account which is 20k is imposed as per T&C (no fee for first year), don't worry, we can go around this. cool2.gif Once you have access to the OCBC SG online banking, you can immediately apply for other accounts like OCBC 360 (minimum balance 3k) or OCBC Frank (minimum balance 1k), Monthly Savings account (minimum balance 500) or other OCBC SG accounts. I prefer OCBC 360. I will close Statement Savings Account after this. So for all Malaysians residing in Malaysia, with no SG pass whatsoever. Right now we have 3 easy options for SG bank accounts (Maybank, CIMB and OCBC), everything done online, super easy. The Print and Download buttons from the View Accounts page is only able to generate statements without account holder name nor address. Not useful when trying to prove that I'm the account holder. Screenshot: View Accounts > Print / Download  Screenshot: Generated statement, but no name nor address..  On the other hand, the View Documents page only displays the Statement of Account with name and address, but this one is auto-generated at the end of the month. No way to generate on-demand from beginning of month to current date, meaning that I will need to wait until the end of the month in order to get a statement with my name and address on it? Screenshot: View Documents  This post has been edited by poooky: Mar 8 2024, 08:05 PM |

|

|

Mar 8 2024, 10:13 PM Mar 8 2024, 10:13 PM

|

Junior Member

51 posts Joined: May 2008 |

Hi - how can I transfer money from my Wise to Maybank SG account? Thanks.

|

| Change to: |  0.0493sec 0.0493sec

0.30 0.30

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 06:17 AM |