Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

mavistan89

|

Feb 20 2021, 01:01 AM Feb 20 2021, 01:01 AM

|

|

QUOTE(corad @ Feb 15 2021, 08:19 PM) just wondering what everyone is doing with their "parked" $$ in SG bank account ? FD rates are nothing compared to M'sia ... so considering if I should remit the funds back (and get a slight gain on current exchange rates) or if there are better things that can be done. For me, not FD purpose, just to keep my $$ in sg in case myr depreciate more. Hedging purpose |

|

|

|

|

|

mavistan89

|

Feb 5 2024, 11:23 AM Feb 5 2024, 11:23 AM

|

|

Is there any way to transfer from myr to sgd cheaper? I use cimb click to transfer to cimb sg, exchange rate at 3.5878

|

|

|

|

|

|

mavistan89

|

Feb 5 2024, 01:34 PM Feb 5 2024, 01:34 PM

|

|

QUOTE(Medufsaid @ Feb 5 2024, 11:41 AM) mavistan89 moneymatch, or DuitNow Overseas Transfer (CIMB SG doesn't support duitnow yet) Is there a limit how much to transfer? Safe to transfer huge amount like 100k sgd? Can enlighten me what is the rate |

|

|

|

|

|

mavistan89

|

Feb 5 2024, 01:35 PM Feb 5 2024, 01:35 PM

|

|

QUOTE(Ramjade @ Feb 5 2024, 01:11 PM) Do not use cimb Malaysia to transfer. Use what Medufsaid suggested. Yes, they mark up the rate so overly high, currently finding a way to transfer huge amount without hassle |

|

|

|

|

|

mavistan89

|

Feb 5 2024, 04:34 PM Feb 5 2024, 04:34 PM

|

|

QUOTE(Medufsaid @ Feb 5 2024, 02:11 PM) daily transfer limits for the remittance agents

- DuitNow - RM3k

- BigPay - RM20k

- MoneyMatch - RM30k

- Sunway Money - RM30k (e-KYC) / RM50k (KYC via face-to-face

just transfer day by day to reach your 100k sgd limit. even if you bring physical cash in sg, you need to declare if the amt exceeds S$20k rates changes daily but duitnow is good for small amounts, MoneyMatch good during day time, BigPay good during night time (would recommend to just remit during day time for quick turnaround) Never use moneymatch, checked and found that it is under bnm and regulated by Brunei rules and regulations? Is it considered a platform under bnm? |

|

|

|

|

|

mavistan89

|

Feb 6 2024, 12:33 AM Feb 6 2024, 12:33 AM

|

|

QUOTE(Medufsaid @ Feb 5 2024, 04:42 PM) he got confused by the footer of the moneymatch page kot Haha yeah. I saw moneymatch rate is 3.5544 for myr/sgd, is this the rate usually we use to remit fund? Because money changer midvalley only 3.50 |

|

|

|

|

|

mavistan89

|

Feb 6 2024, 01:19 PM Feb 6 2024, 01:19 PM

|

|

QUOTE(Medufsaid @ Feb 6 2024, 09:18 AM) yea need to know the optimal time for transferring Thank you si fu |

|

|

|

|

|

mavistan89

|

Feb 6 2024, 01:22 PM Feb 6 2024, 01:22 PM

|

|

I checked wise rm3.54 , money match rm3.55/sgd, as of 1:20pm, midvalley physical money changer rm3.50, just curious, is it online remit other currency cannot compare with local physical money changer?

|

|

|

|

|

|

mavistan89

|

Feb 6 2024, 10:12 PM Feb 6 2024, 10:12 PM

|

|

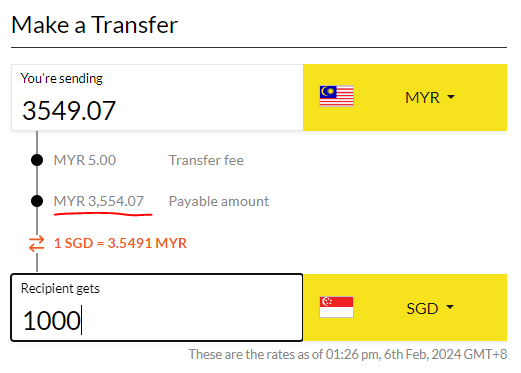

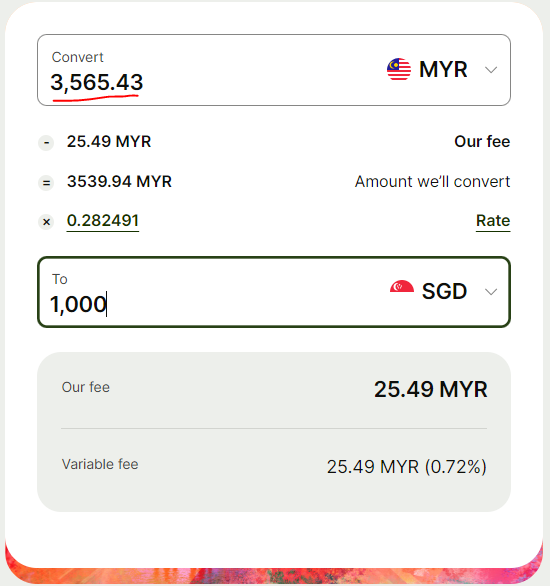

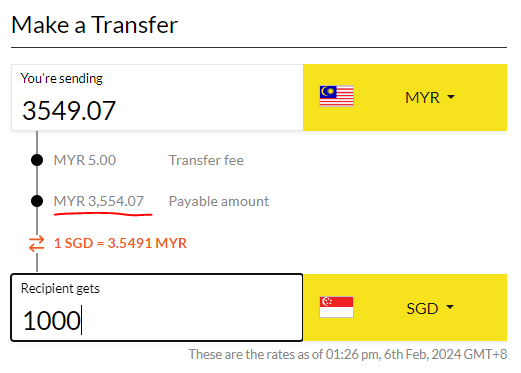

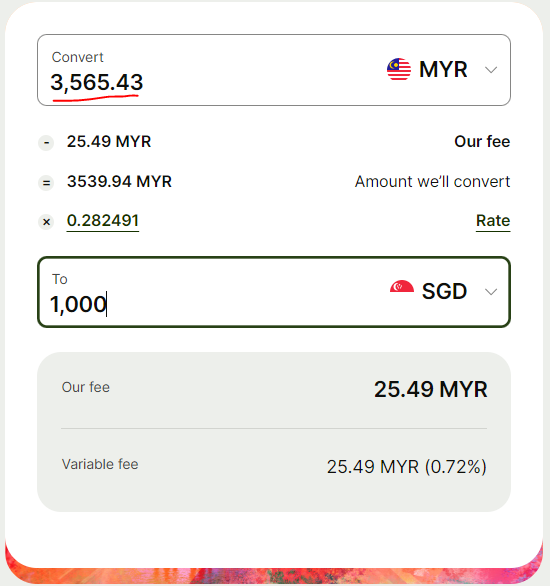

QUOTE(Medufsaid @ Feb 6 2024, 01:30 PM) changing money in midvalley is always the cheapest. problem is how to bank it into SG. come let me show you the rates | MoneyMatch | Wise |  |  |

Yes that is the rate I checked. If I want to transfer 300k to 500k sgd (rm1 to 1.5mil) , is this the best way to transfer? I mean we cannot compare to the rate offered by money changer/ Google rate? We should use the rate stated in wise/moneymatch/bank tt correct? |

|

|

|

|

|

mavistan89

|

Feb 6 2024, 11:05 PM Feb 6 2024, 11:05 PM

|

|

QUOTE(Ramjade @ Feb 6 2024, 10:18 PM) Use Google rate for references. You can check with banks. Sometimes large amount can have discount from banks. Yes bank offered me 3.56, first time doing big transfer, I thought it cost me only 3.50 or 3.51, got shocked 😲 |

|

|

|

|

|

mavistan89

|

Feb 13 2024, 04:45 PM Feb 13 2024, 04:45 PM

|

|

QUOTE(Afterburner1.0 @ Feb 13 2024, 09:51 AM) why would normal malaysians open SG bank acc??? unless u stay in JB or u go SG very often lar.... got business dealings etc.... if not for normal folks.... why wanna open a SG bank acc ah??? FD rate also super low...... To be honest, I just wan to keep it there. 0% is ok, hold too much ringgit is not a good sign |

|

|

|

|

|

mavistan89

|

Feb 14 2024, 09:32 AM Feb 14 2024, 09:32 AM

|

|

QUOTE(Ramjade @ Feb 14 2024, 09:09 AM) I am one of those people. Lol. Last time it was 3.0 only. Forget sg bank FD. Just open tiger and park your money into their MMF. Tiger MMF basically invest into their FD. Only sg banks which let Malaysian open account without you needing to step foot there is cimb, maybank and ocbc. Rest maybe can be done if you are willing to park SGD250-300k for priority banking purpose. What benefit for priority banking? |

|

|

|

|

|

mavistan89

|

Mar 8 2024, 01:01 AM Mar 8 2024, 01:01 AM

|

|

QUOTE(Ramjade @ Mar 6 2024, 11:33 AM) FD interest won't stay high. If you have been around long enough you will know before COVID, the rates are only 1.x%p a. What then? Singapore FD rarely on par with Malaysian rates in the olden days. Last time fixed deposit rate normally at what rate? Like from year 2010 to 2019 precovid? All the while 1.2 to1.5%? |

|

|

|

|

Feb 20 2021, 01:01 AM

Feb 20 2021, 01:01 AM

Quote

Quote

0.0248sec

0.0248sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled