QUOTE(Medufsaid @ Feb 18 2024, 10:05 AM)

that's y it's a pure atm card, no debit card functionOpening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Feb 18 2024, 10:14 AM Feb 18 2024, 10:14 AM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

QUOTE(Medufsaid @ Feb 18 2024, 10:05 AM) that's y it's a pure atm card, no debit card function Medufsaid liked this post

|

|

|

|

|

|

Feb 18 2024, 11:59 AM Feb 18 2024, 11:59 AM

Show posts by this member only | IPv6 | Post

#5542

|

Junior Member

844 posts Joined: Sep 2011 |

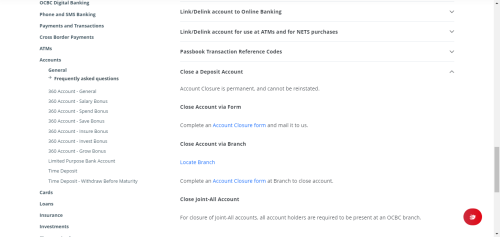

QUOTE(Mr Gray @ Jan 5 2024, 08:04 AM) Here u go. Referral code deleted already. Hahahaha Have you closed your OCBC SG Statement Savings Account yet? I don't see any option to do so online. From the site's FAQ https://www.ocbc.com/personal-banking/help-...ccounts/general, it seems that the only ways to do so are to either:Happy to share that I have successfully opened my OCBC Singapore account with just my IC and Passport. The process of applying through the app is a bit a pain in the ass, as needs to do several times for the app to accept my IC. Tips, the ic can be slightly outside the rectangle. Took about 3 working days for the account to be approved. Was given Global Savings Account and Statement Savings Account. Initial deposit required is just SGD1000, it can be from your Singaporean bank account or Malaysian bank account. I already have Maybank SG account. So this is very seamless. Despite the T&C showing initial deposit for non-resident Statement Savings Account is SGD20k. I just needed to deposit SGD1k. Not sure if this only applies for Malaysians or what. Regardless, even if the fall below fee for non-resident Statement Savings Account which is 20k is imposed as per T&C (no fee for first year), don't worry, we can go around this. cool2.gif Once you have access to the OCBC SG online banking, you can immediately apply for other accounts like OCBC 360 (minimum balance 3k) or OCBC Frank (minimum balance 1k), Monthly Savings account (minimum balance 500) or other OCBC SG accounts. I prefer OCBC 360. I will close Statement Savings Account after this. So for all Malaysians residing in Malaysia, with no SG pass whatsoever. Right now we have 3 easy options for SG bank accounts (Maybank, CIMB and OCBC), everything done online, super easy. 1. Physically mail Accounting Closure Form, 2. Walk into a branch to do so Anyone else have gone through this process? I opened my account around Nov last year so still have some waiver time, but need to start preparing.. lol.  |

|

|

Feb 18 2024, 03:47 PM Feb 18 2024, 03:47 PM

Show posts by this member only | IPv6 | Post

#5543

|

Junior Member

505 posts Joined: Jul 2015 |

QUOTE(poooky @ Feb 18 2024, 11:59 AM) Have you closed your OCBC SG Statement Savings Account yet? I don't see any option to do so online. From the site's FAQ https://www.ocbc.com/personal-banking/help-...ccounts/general, it seems that the only ways to do so are to either: i juz opened via app n its created instantly. why prefer OCBC 360? i have Statement Savings Acc and Global Savings Acc now.1. Physically mail Accounting Closure Form, 2. Walk into a branch to do so Anyone else have gone through this process? I opened my account around Nov last year so still have some waiver time, but need to start preparing.. lol.  |

|

|

Feb 18 2024, 04:04 PM Feb 18 2024, 04:04 PM

|

Senior Member

3,501 posts Joined: Jan 2003 |

privatequity 360 had a promo going on

QUOTE(Medufsaid @ Jul 25 2023, 05:26 PM) (haven't fully read TnC for any catch yet) seems like no fall below fee for the 1st year (deposit, then withdraw), but this means u need to set a calendar to close it 6 months in the future, all to get that S$15 reward This post has been edited by Medufsaid: Feb 18 2024, 04:37 PM |

|

|

Feb 18 2024, 04:06 PM Feb 18 2024, 04:06 PM

Show posts by this member only | IPv6 | Post

#5545

|

Junior Member

505 posts Joined: Jul 2015 |

|

|

|

Feb 18 2024, 04:07 PM Feb 18 2024, 04:07 PM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

|

|

|

Feb 18 2024, 04:08 PM Feb 18 2024, 04:08 PM

Show posts by this member only | IPv6 | Post

#5547

|

Junior Member

505 posts Joined: Jul 2015 |

whats the best way to fund my singapore ocbc acc? convert myr to sgd to Wise. And transfer from Wise to SG OCBC?

|

|

|

Feb 18 2024, 04:14 PM Feb 18 2024, 04:14 PM

|

Senior Member

3,501 posts Joined: Jan 2003 |

Use moneymatch. Remit on weekday 9am and it'll appear in sg bank by lunchtime. If under RM3k, can use duitnow overseas transfer

btw, what are the minimum balance required for both your ocbc acct? This post has been edited by Medufsaid: Feb 18 2024, 04:21 PM |

|

|

Feb 18 2024, 04:21 PM Feb 18 2024, 04:21 PM

Show posts by this member only | IPv6 | Post

#5549

|

Junior Member

505 posts Joined: Jul 2015 |

|

|

|

Feb 18 2024, 06:48 PM Feb 18 2024, 06:48 PM

Show posts by this member only | IPv6 | Post

#5550

|

All Stars

24,427 posts Joined: Feb 2011 |

|

|

|

Feb 18 2024, 07:08 PM Feb 18 2024, 07:08 PM

Show posts by this member only | IPv6 | Post

#5551

|

Junior Member

844 posts Joined: Sep 2011 |

QUOTE(privatequity @ Feb 18 2024, 03:47 PM) i juz opened via app n its created instantly. why prefer OCBC 360? i have Statement Savings Acc and Global Savings Acc now. Did not open 360 as it needs 3k minimum balance. SSA and GSA are given by default on new account creation, but SSA requires 1k min balance waived for first year. Eventually will need to close SSA to open the Monthly Savings Account which only requires SGD500 minimum balance.Question now is whether SSA can be closed online? Or will need to physically mail in / walk into branch. |

|

|

Feb 18 2024, 07:13 PM Feb 18 2024, 07:13 PM

Show posts by this member only | IPv6 | Post

#5552

|

Junior Member

73 posts Joined: Jan 2003 |

QUOTE(poooky @ Feb 18 2024, 07:08 PM) Did not open 360 as it needs 3k minimum balance. SSA and GSA are given by default on new account creation, but SSA requires 1k min balance waived for first year. Eventually will need to close SSA to open the Monthly Savings Account which only requires SGD500 minimum balance. It's SGD 20K minimum balance for SSA if you're non SG resident.Question now is whether SSA can be closed online? Or will need to physically mail in / walk into branch.  |

|

|

Feb 18 2024, 07:28 PM Feb 18 2024, 07:28 PM

Show posts by this member only | IPv6 | Post

#5553

|

Junior Member

505 posts Joined: Jul 2015 |

|

|

|

|

|

|

Feb 18 2024, 07:32 PM Feb 18 2024, 07:32 PM

Show posts by this member only | IPv6 | Post

#5554

|

Junior Member

505 posts Joined: Jul 2015 |

OCBC SSA SG Acc, can i get debit card?

|

|

|

Feb 18 2024, 07:38 PM Feb 18 2024, 07:38 PM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Feb 18 2024, 07:40 PM Feb 18 2024, 07:40 PM

Show posts by this member only | IPv6 | Post

#5556

|

Junior Member

505 posts Joined: Jul 2015 |

|

|

|

Feb 18 2024, 07:56 PM Feb 18 2024, 07:56 PM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Feb 18 2024, 09:56 PM Feb 18 2024, 09:56 PM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(poooky @ Feb 18 2024, 11:59 AM) Have you closed your OCBC SG Statement Savings Account yet? I don't see any option to do so online. From the site's FAQ https://www.ocbc.com/personal-banking/help-...ccounts/general, it seems that the only ways to do so are to either: Not doing anything. Just leave it there. Why bother to close? I'm keeping it for my SGD savings. Every month transfer money from MYR to SGD1. Physically mail Accounting Closure Form, 2. Walk into a branch to do so Anyone else have gone through this process? I opened my account around Nov last year so still have some waiver time, but need to start preparing.. lol.  Lol why u opened, if wanna close barely a few months after that? |

|

|

Feb 19 2024, 01:04 AM Feb 19 2024, 01:04 AM

|

Senior Member

3,501 posts Joined: Jan 2003 |

Mr Gray bcos by default you are given GSA/SSA. Now they want to migrate to MSA with lower amt of locked up funds

|

|

|

Feb 19 2024, 08:20 AM Feb 19 2024, 08:20 AM

|

Senior Member

1,604 posts Joined: Aug 2014 |

QUOTE(moonsatelite @ Feb 18 2024, 10:02 AM) When you applied to open CIMB FastSavers Savings Account via CIMB Singapore internet banking website, what additional steps did you perform in order to get CIMB Singapore ATM card?I did not receive a CIMB Singapore ATM card, so I may have missed out the required steps. I am interested in only CIMB Singapore ATM card, since the card seems to be issued free of charge, as compared to CIMB Singapore debit card with SGD 10 issuance fee. Thank you for your information. |

| Change to: |  0.0204sec 0.0204sec

0.88 0.88

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 12:23 PM |