QUOTE(Ramjade @ Jan 11 2024, 06:46 AM)

Won't help much. It just help to lower the premium paid but will still be hit with deductible.

QUOTE(MUM @ Jan 10 2024, 07:07 PM)

There are always will be someone going against any topic.

Just because of some "certified" people says it is good...do you fall for it that that things really suits you?

Just bcos some actuaries or doctors says it is good...

QUOTE(Ramjade @ Jan 10 2024, 06:49 PM)

I have shared even actuarist avoid ILP. People who design ILP literally avoid ILP. You know something is wrong

so actuary or actuaries depending on singular or plural typically works in an insurance company.

if bank staff get better interest rate for home loan, telco companies get telco benefits, and F&B staff get probably some F&B benefit, what do insurance company staff get? you guessed it staff discount or any form of staff privilege when they self-buy insurance plan (well most companies who care about their staff anyway).

i dont want to go down the route of ILP vs standalone yet... it's a lesson by itself, but i want to rebutt what actuaries will buy? whatever most value for money. if they say can buy, then should be ok la. if they really buy, then you better follow la...

But i want to highlight, actuaries do buy ILP. they just happily use their staff privilege to buy.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

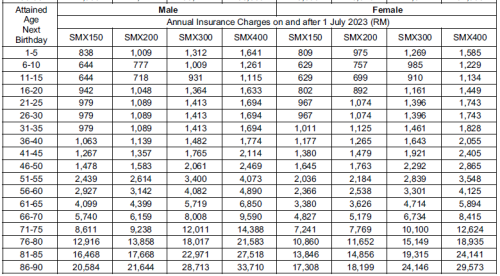

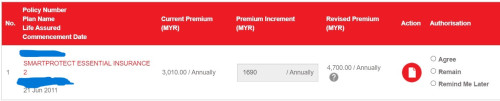

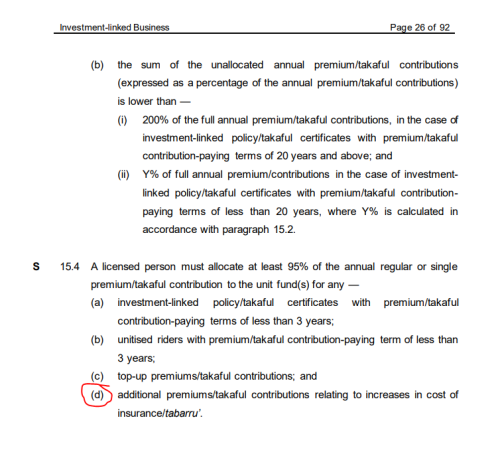

Lesson #2: Buy Medical Insurance with Deductible and Co-insurance

I can loosely tell you what most actuaries will recommend you to buy.

1) Buy simple, cheapest of whatever you can get. if life insurance, buy term life or the simplest form of whatever life insurance you can get, AND DONT EXPECT any return.

2) if medical, buy with deductible or co-insurance.

So, why Buy Medical Insurance with Deductible and Co-insurance?

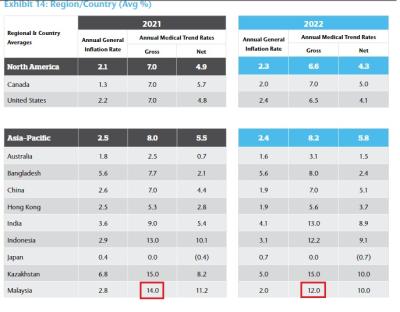

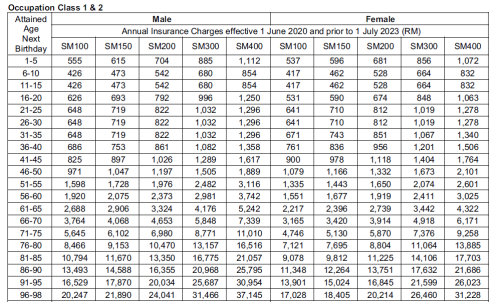

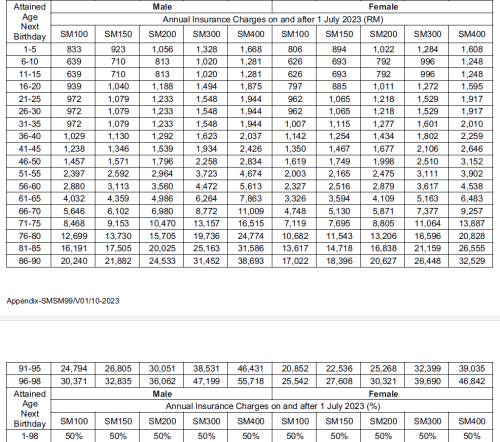

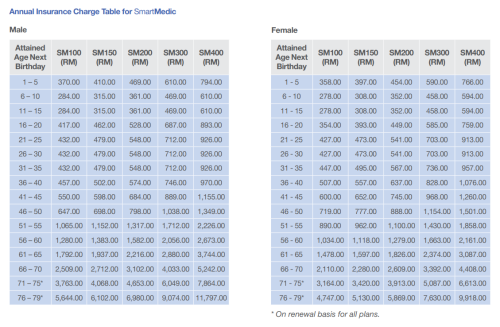

Mainly, it is to lower the premium or insurance charge that you pay to the insurance company. Medical insurance with 0 deductible is being on purposed priced in a very expensive manner. So buy one with deductible. With Co-insurance of 10% and 20%, even better. the premium for these are typically cheaper. in the past there were instances i heard that the medical insurance with co-insurance get repriced less because they do claim less. THIS however, i cannot guarantee will continue to hold true. but if you do get some savings from the premium you pay.

How much deductible is enough though? Not sure, honestly at the end of the day, it's up to you. i digress abit BUT i have talked to some people who know some people who is saying RM300 deductible also can't afford to pay. i'm sorry, but life is such. you want to masuk hospital, you gotta pay. if you can't, i am proud to say, you wont die in Malaysia because you are sick and poor. our government hospital, our KKM, really try our best to treat the patients. This one i genuinely believe so.

i have mentioned this in different post, my own deductible is 15k. i just have to stomach the 1st 15k on my own, after that it's paid by the insurance company. i do save alot since i was a fresh grad. having said that, i do work for an MNC, hence my employer coverage is sufficient. even if i dont have employer coverage and i can afford to pay RM15k on my own.

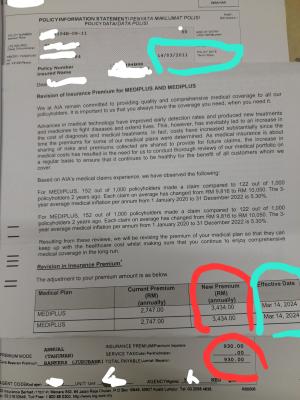

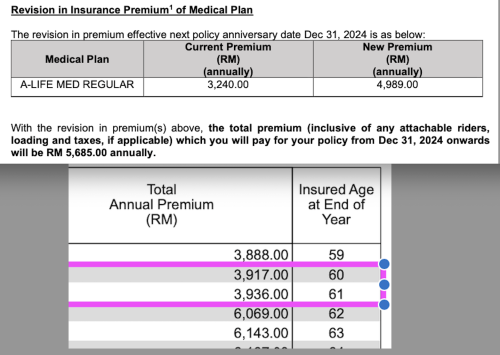

what if 15k is too high for you? you can look for around 1k, 3k, 5k. or recently AIA has one 20% co insurance up to RM3k. which is like having a 3k deductible, sort of. would this mean you wont get repriced? No, but HOPEFULLY it should impact you less. IN my case, the 15k deductible also get repriced. i'm NOT sure and i dont know if the % of increase is lesser compare to someone without deductible. i hope so...? the quantum of the increase is definitely very acceptable.

Do i have any proof my word is to be trusted? Nope. Am i an actuary? Nope.

Do i think you can trust me? Yes, most of the time, if I dont mistype cause i worked 9 to 6 everyday or if im tired from gym.

This post has been edited by adele123: Jan 11 2024, 06:27 PM

Jan 10 2024, 04:09 PM, updated 2y ago

Jan 10 2024, 04:09 PM, updated 2y ago

Quote

Quote

0.1080sec

0.1080sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled