QUOTE(zstan @ Jan 10 2024, 05:40 PM)

is your insurance on its own or investment linked?

if investment linked then not worth anymore as their earnings supposed to contra any increment

Regarding ILP vs STANDALONE.if investment linked then not worth anymore as their earnings supposed to contra any increment

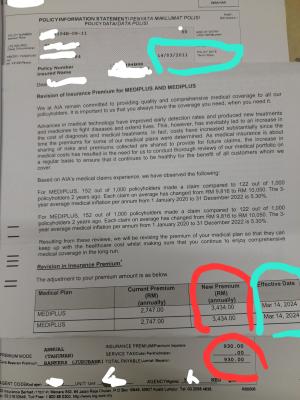

This is a data that I got for standalone plan...just for discussion sake

I don't hv the ILP version,....I only got the data for the standalone plan.

In 2011 age 39, premium was 930

In 2024, age 52, premium is 3430

For a coverage of 300k lifetime.

In 13 years, the quantum of increase is just staggering ....$2500 or 268.8% increases.

( every year about 20% increase??)

Looking at the quantum of rate increases, I believes the premium may reach 5k in another 5 yrs at age 57, then may even reach 10k at 68.

The chances of needing medical claims would be alot higher at age 68....insurance company will be happy I cannot continue to afford paying the premium ...

If one is not wealthy, .... May really "eats" into the budget of the retirement plan.

I always envy those that had bought the 1 mil standalone med coverage at young age....hopefully they can hv the mean to sustain it before they die

Just hopefully someone can provides comparison of the quantum of rate increases of ILP Vs STANDALONE plan .

What is lower cost or cheap to buy now may not be so after the premium increases...

Attached thumbnail(s)

Jan 10 2024, 06:22 PM

Jan 10 2024, 06:22 PM

Quote

Quote

0.0285sec

0.0285sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled