QUOTE(qhw @ Jan 19 2024, 03:47 PM)

Hi Chris, thanks so much for the suggestion. Any ballpark figure like how much lower the premium will be for like-for-like medical coverage?

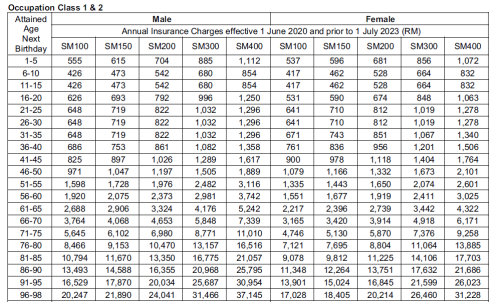

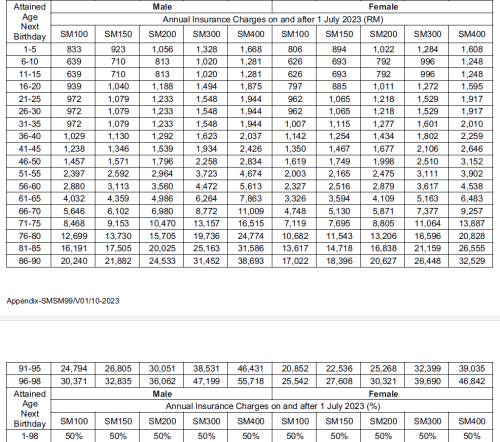

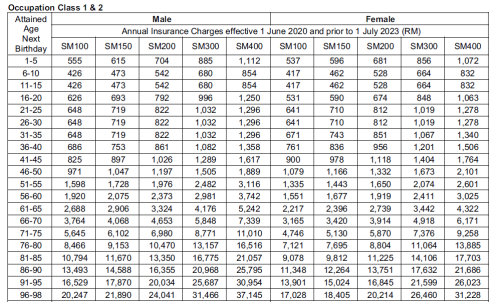

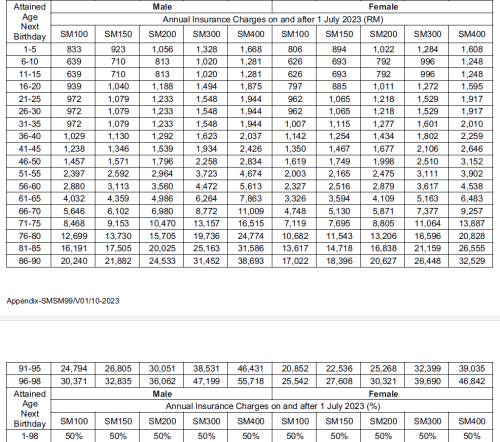

please find below the revised table from the GE document

I am wondering if anyone notice this effect.

Say one is 36 years old, male, healthy: pay around 180rm pm for coverage.

But at age 76, which i dare say really needed the insurance, the cost is at least 2K rm pm for coverage. (lets not kid ourselves, it will most probably be way more than that when the time comes).

Can one afford to continue the coverage just when one is old, most probably not working and needed the coverage the most?

A great way to hook on "loyal" customer for life...

Jan 10 2024, 09:47 PM

Jan 10 2024, 09:47 PM

Quote

Quote

0.0293sec

0.0293sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled