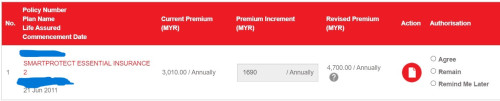

From what I gather, this will likely continue happening every 3 years or so. The future quantum of increase might well be higher than 35% as the good risks depart the medical plan and the bad risks (with substandard health resulting in high claims) remain.

What’s the best way to deal with this issue? It seems like the sustainability projections at the start of the policy are a joke and wholly useless as in just a few short years, there have been multiple repricing exercises and the premiums have been increasing.

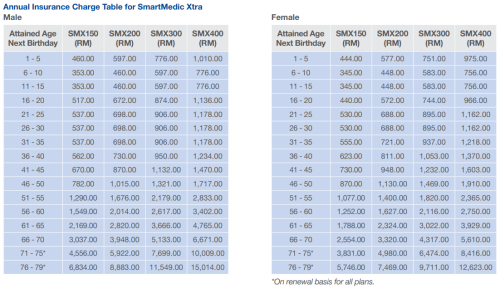

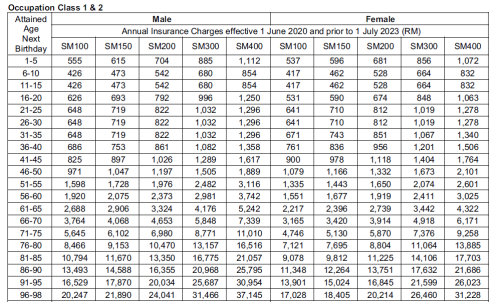

1. Launch insurance charges for SmartMedic Xtra in 2014:

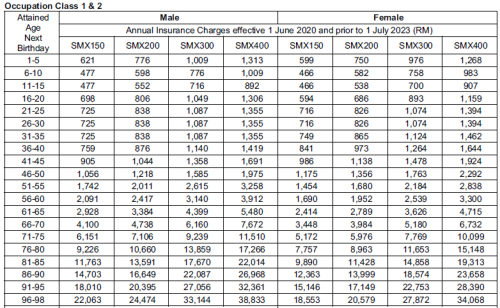

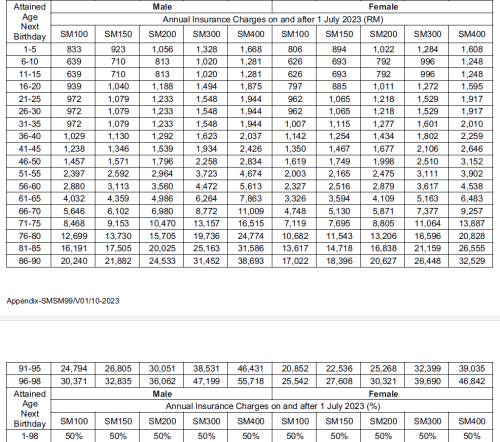

2. After 1st repricing in June 2020:

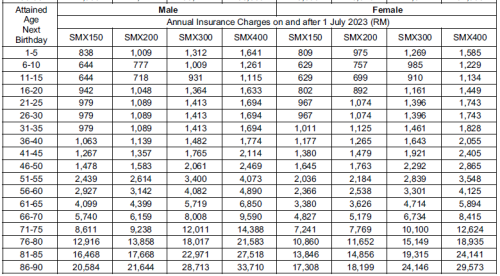

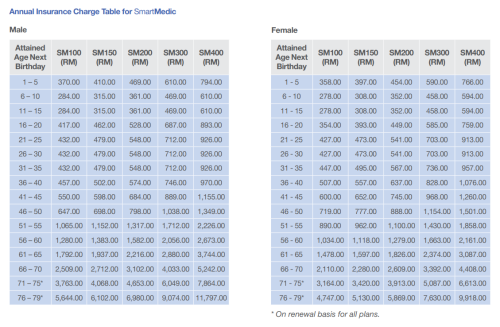

3. After 2nd repricing in July 2023:

This post has been edited by contestchris: Jan 15 2024, 06:42 PM

Jan 10 2024, 04:09 PM, updated 2y ago

Jan 10 2024, 04:09 PM, updated 2y ago

Quote

Quote

0.0334sec

0.0334sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled