QUOTE(qhw @ Jan 19 2024, 11:41 AM)

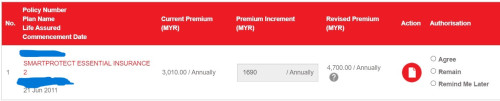

Hi, i see my plan has Smart Medic, Smart Medic 99, Smart early payout critical care, Critical illness benefit rider, IL Waiver of premium plus rider.

Based on the breakdown of my premium paid statement, about 80% of the premium is related to medical.

I am just wondering how come the increase can be so ridiculous, 56% is no joke at all....

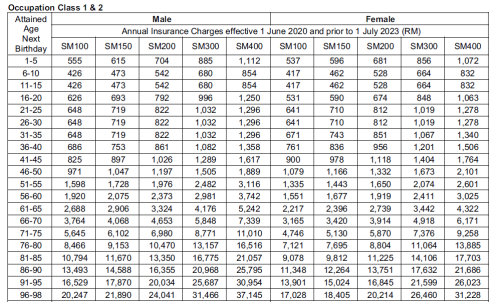

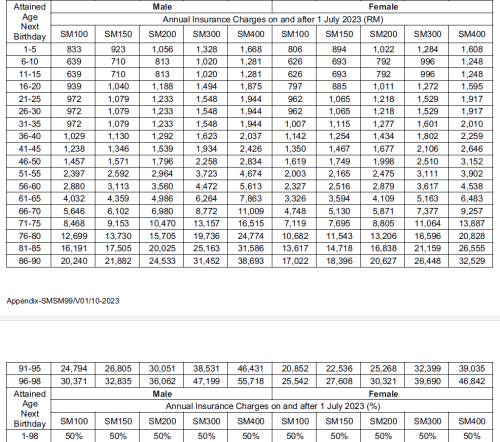

From what I know, the quantum of increase for SmartMedic is 50% this time. In comparison, the quantum of increase for SmartMedic Xtra (which was launched after SmartMedic) is around 30%.

As to why the discrepancy, refer to the diagram in my first post. Your plan is older, hence it has more "bad risk". The average age would also be higher since it had closed to business earlier, and the healthier ones would've moved on to the newer (i.e. cheaper) plans.

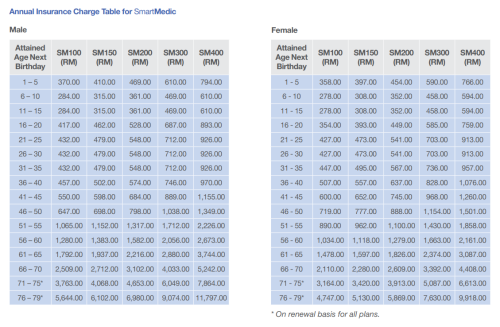

Generally, if you are healthy and have nothing wrong with your health, you should move to the newest plan, SmartMedic Shield. The medical plan's cost of insurance will be significantly lower and the benefits will be significantly better. Plus, with a deductible of RM300, the expectation is medical claims experience will be somewhat better contained.

Can you share the quantum of increase from the PDF? At the bottom, they also share the % value in increase.

Jan 17 2024, 01:40 PM

Jan 17 2024, 01:40 PM

Quote

Quote

0.0267sec

0.0267sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled