Attached thumbnail(s)

How to deal with medical insurance repricing?

|

|

Jan 15 2024, 11:49 PM Jan 15 2024, 11:49 PM

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

|

|

|

Jan 15 2024, 11:56 PM Jan 15 2024, 11:56 PM

Show posts by this member only | IPv6 | Post

#142

|

Senior Member

5,562 posts Joined: Aug 2011 |

|

|

|

Jan 16 2024, 12:02 AM Jan 16 2024, 12:02 AM

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(bcombat @ Jan 15 2024, 11:49 PM) Yikes. Aia med regular. The standalone plan I have. Haven't received such letter yet. Maybe time to have gathercare as standby. At least gathercare no such nonsense.Surprised they didn't mentioned anything about depreciation of ringgit. Please share and see if increase is more or less than ILP. QUOTE(contestchris @ Jan 15 2024, 11:56 PM) Stated AIA med life regular.This post has been edited by Ramjade: Jan 16 2024, 12:04 AM |

|

|

Jan 16 2024, 12:32 AM Jan 16 2024, 12:32 AM

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jan 16 2024, 12:40 AM Jan 16 2024, 12:40 AM

|

All Stars

14,931 posts Joined: Mar 2015 |

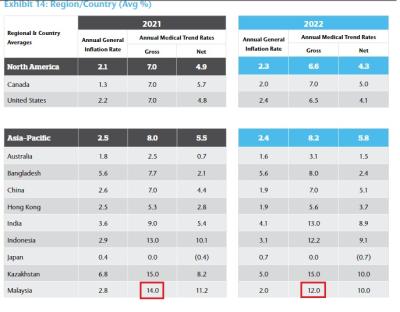

QUOTE(bcombat @ Jan 16 2024, 12:32 AM) this time increase just 7.8%. that is low i think, as it had been published that the medical inflation rate in malaysia had been around 10% ~ 15% per annum.do you still remember when was the last increase for your plan? hope it is not just last year This post has been edited by MUM: Jan 16 2024, 01:14 AM Attached thumbnail(s)

|

|

|

Jan 16 2024, 07:47 AM Jan 16 2024, 07:47 AM

Show posts by this member only | IPv6 | Post

#146

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(MUM @ Jan 15 2024, 08:37 PM) Yeah, if they suggest the ratios of split, options, where too etc. that supposedly match one risk profile, thats fine.... but than again, who would know one risk profile better than own self.... hmmmm, frankly at my age, I know what I'm looking at given all facts considered....risk appetites, age, commitment, liabilities,.... Crunched all my numbers, from worst to best case I possibly could...even if these folks planner can help me making extra 10-20%, not going to make any differences.... but a discourse of diversification would be productive....as long as my interpretation of risk threshold is met etc.. Sorr6 digress off topic....Heck its part of COLA inflation discourse.... 😄 This post has been edited by gamenoob: Jan 16 2024, 07:48 AM MUM liked this post

|

|

|

|

|

|

Jan 16 2024, 08:00 AM Jan 16 2024, 08:00 AM

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(gamenoob @ Jan 16 2024, 07:47 AM) Yeah, if they suggest the ratios of split, options, where too etc. that supposedly match one risk profile, thats fine.... but than again, who would know one risk profile better than own self.... hmmmm, frankly at my age, I know what I'm looking at given all facts considered....risk appetites, age, commitment, liabilities,.... I think that is more applicable to following the soc media investment gurus. I hv not been to a real wealth planner or financial adviser, but I think they will ask you to provides your full financial assessment in details ( sort of kyc) before they do the review, assessment or recommendation Crunched all my numbers, from worst to best case I possibly could...even if these folks planner can help me making extra 10-20%, not going to make any differences.... but a discourse of diversification would be productive....as long as my interpretation of risk threshold is met etc.. Sorr6 digress off topic....Heck its part of COLA inflation discourse.... 😄 |

|

|

Jan 16 2024, 08:02 AM Jan 16 2024, 08:02 AM

|

All Stars

14,931 posts Joined: Mar 2015 |

Sometimes just for fun, I wonder about the numbers, ...

BTW, just some fact I encountered, ....eventhough medical inflation is yearly, the premium of my child insurance did drops drastically (I think -40%) after ( I think) 6 yrs old, then stayed flat for some years, then starts to rise after ( I think) 10 yrs old. This post has been edited by MUM: Jan 16 2024, 08:10 AM Attached thumbnail(s)

|

|

|

Jan 16 2024, 02:43 PM Jan 16 2024, 02:43 PM

Show posts by this member only | IPv6 | Post

#149

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(MUM @ Jan 16 2024, 12:40 AM) this time increase just 7.8%. that is low i think, as it had been published that the medical inflation rate in malaysia had been around 10% ~ 15% per annum. No worry. Insurance companies sure make money one.do you still remember when was the last increase for your plan? hope it is not just last year MUM liked this post

|

|

|

Jan 16 2024, 06:07 PM Jan 16 2024, 06:07 PM

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(bcombat @ Jan 16 2024, 02:43 PM) Unless they increase the premium by just 7.8% per year, while the stated known medical inflation is 8.70% per year..Yes, insurance companies sure makes money, if not Ramjade won't not suggest buying insurance companies stocks. gamenoob liked this post

|

|

|

Jan 16 2024, 07:47 PM Jan 16 2024, 07:47 PM

Show posts by this member only | IPv6 | Post

#151

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(MUM @ Jan 16 2024, 12:40 AM) this time increase just 7.8%. that is low i think, as it had been published that the medical inflation rate in malaysia had been around 10% ~ 15% per annum. Damn.. I need to download and check my previous year statement to see the annual creep...do you still remember when was the last increase for your plan? hope it is not just last year I don't think its gone that much higher ie 7-8%... hmmm,.... makes me worry a bit pulak...... |

|

|

Jan 16 2024, 07:52 PM Jan 16 2024, 07:52 PM

Show posts by this member only | IPv6 | Post

#152

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(gamenoob @ Jan 16 2024, 07:47 PM) Damn.. I need to download and check my previous year statement to see the annual creep... Mine had gone up abt 270% in 13 yrs...I don't think its gone that much higher ie 7-8%... hmmm,.... makes me worry a bit pulak...... Just for fun numbers, ... Contestchris had just posted this in insurance tread. Entry age and price variance of 2 online products This post has been edited by MUM: Jan 16 2024, 07:58 PM Attached thumbnail(s)

|

|

|

Jan 17 2024, 11:21 AM Jan 17 2024, 11:21 AM

Show posts by this member only | IPv6 | Post

#153

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(MUM @ Jan 16 2024, 07:52 PM) Mine had gone up abt 270% in 13 yrs... Looking back, my current policy started 15yrs ago. Midway, I have 2 supplementary policies whenever insurer offer them at discount with extra coverage with low premium and no medical check requirements to provide the additional coverage.Just for fun numbers, ... Contestchris had just posted this in insurance tread. Entry age and price variance of 2 online products Then 2 years ago, it was consolidated when insurer offer an upsell without medical check, allow me to upgrade my original plan that in total match all 3 policies combined. Nett Premium is actually lowered as part of their upsell consolidation. I let my 2 supplementary policies run for another 6 months as there was waiting period on the upsell. Now with only 1 policy and the other 2 is cancelled. Overall, the premium remain about the same last 5 yrs with small creep about 3-4% annually. |

|

|

|

|

|

Jan 17 2024, 11:29 AM Jan 17 2024, 11:29 AM

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(gamenoob @ Jan 17 2024, 11:21 AM) Looking back, my current policy started 15yrs ago. Midway, I have 2 supplementary policies whenever insurer offer them at discount with extra coverage with low premium and no medical check requirements to provide the additional coverage. You upgraded policy, ..thus added total premium or changed premium value to higher just 2 yrs ago...Then 2 years ago, it was consolidated when insurer offer an upsell without medical check, allow me to upgrade my original plan that in total match all 3 policies combined. Nett Premium is actually lowered as part of their upsell consolidation. I let my 2 supplementary policies run for another 6 months as there was waiting period on the upsell. Now with only 1 policy and the other 2 is cancelled. Overall, the premium remain about the same last 5 yrs with small creep about 3-4% annually. Would be good to see if the 3-4% pa medical inflation rate increase remained after 5 yrs. This post has been edited by MUM: Jan 17 2024, 11:31 AM |

|

|

Jan 17 2024, 11:49 AM Jan 17 2024, 11:49 AM

Show posts by this member only | IPv6 | Post

#155

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(MUM @ Jan 17 2024, 11:29 AM) You upgraded policy, ..thus added total premium or changed premium value to higher just 2 yrs ago... Ya that the million bucks question.... Would be good to see if the 3-4% pa medical inflation rate increase remained after 5 yrs. Finger crossed.... but then again, I'm already at high state cost group at 55... so it will be an upward trajectory premium... pretty sure. |

|

|

Jan 17 2024, 12:28 PM Jan 17 2024, 12:28 PM

|

Senior Member

3,665 posts Joined: Apr 2019 |

I am curious...

this thread is "How to deal with medical insurance repricing?". So how? agents recommend ILP... DIY gurus recommend DIY with medical cards only and invest outside... any other solutions beside be healthy? |

|

|

Jan 17 2024, 12:34 PM Jan 17 2024, 12:34 PM

|

All Stars

14,931 posts Joined: Mar 2015 |

Regarding this,...just for discussion, no right or wrong issues

QUOTE(gamenoob @ Jan 17 2024, 11:21 AM) Looking back, my current policy started 15yrs ago. Midway, I have 2 supplementary policies whenever insurer offer them at discount with extra coverage with low premium and no medical check requirements to provide the additional coverage. if let's say. ...1 policy covers 335k with bed at 150 for 90 days. 3 policies would covers 1 million with bed 150 for 90 x 3 days (270 days) if claimed separately. The chances of claiming 150 x 90 days would be rare. Thus those extra 180 bed days will be highly not claimed. Thus even though it was discounted in premium value for that 2 policies .....is it really cheaper?? Then 2 years ago, it was consolidated when insurer offer an upsell without medical check, allow me to upgrade my original plan that in total match all 3 policies combined. Nett Premium is actually lowered as part of their upsell consolidation. I let my 2 supplementary policies run for another 6 months as there was waiting period on the upsell. if 1 policy that covers 335k with bed150 x 90 days, 3 policies would covers 1 millions with bed 150 x 270 days if claimed separately Consolidating that 3 individually into 1 that covers 1 million with bed150 x 90 days. After Consolidating the 3 policies into 1, the consolidated premium will be lower than the total premium of the 3 combined. Is that more worthy? you buy 2 new extra policies = agent untung. You cancelled that 2 policies later, agent no rugi. You upgrade the old existing policy with increased premium value, .... agent got untung?? Now with only 1 policy and the other 2 is cancelled. Overall, the premium remain about the same last 5 yrs with small creep about 3-4% annually. |

|

|

Jan 17 2024, 12:42 PM Jan 17 2024, 12:42 PM

Show posts by this member only | IPv6 | Post

#158

|

All Stars

21,457 posts Joined: Jul 2012 |

Older people are more likely to make insurance claim and medical inflation is higher than cpi; it is unavoidable for premium to rise.

If average Joe could beat actuarial scientists, insurance companies won't pay them high celery. This post has been edited by icemanfx: Jan 17 2024, 12:44 PM |

|

|

Jan 17 2024, 12:57 PM Jan 17 2024, 12:57 PM

Show posts by this member only | IPv6 | Post

#159

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(Wedchar2912 @ Jan 17 2024, 12:28 PM) I am curious... I think very unlikely can prevent medical inflation. We can try to reduce the quantumof rate of increase...Some insurance sifus in insurance thread had suggested co-insurance or deductible plansthis thread is "How to deal with medical insurance repricing?". So how? agents recommend ILP... DIY gurus recommend DIY with medical cards only and invest outside... any other solutions beside be healthy? Wedchar2912 liked this post

|

|

|

Jan 17 2024, 01:10 PM Jan 17 2024, 01:10 PM

Show posts by this member only | IPv6 | Post

#160

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(MUM @ Jan 17 2024, 12:34 PM) You are absolutely correct on the agent gain. However it was an open eye on my part as I requested the agent to check for it. That period, health wise was having some issues and felt my policy limit is not adequate, hence when the offer came, I pick it up while waiting for upsell. Lo and behold, few months right after consolidation just past the waiting period, I had a complications which recoup whatever I have paid last 8yrs ish of insurance premium. Let's just say it's not an lottery/ROI that one should aim for when it come to insurance. Be it the 3 separate policies or one consolidated it would have cover it. But having a single one now that technically cheaper ie higher coverage for same dollar, it's easier to manage. This post has been edited by gamenoob: Jan 17 2024, 01:12 PM |

| Change to: |  0.0239sec 0.0239sec

0.59 0.59

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 05:44 AM |