QUOTE(contestchris @ Jan 10 2024, 04:09 PM)

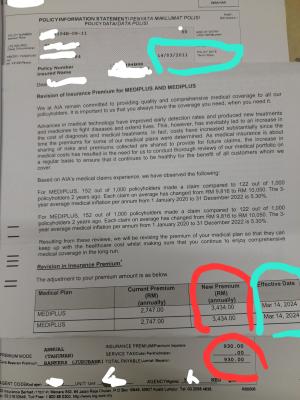

For the second time in 3 years, I’ve received a letter on the increase in cost of insurance for my ILP’s medical plan. The quantum of increase is rather steep at 35%! This has resulted in increases to my monthly premium.

From what I gather, this will likely continue happening every 3 years or so. The future quantum of increase might well be higher than 35% as the good risks depart the medical plan and the bad risks (with substandard health resulting in high claims) remain.

What’s the best way to deal with this issue? It seems like the sustainability projections at the start of the policy are a joke and wholly useless as in just a few short years, there have been multiple repricing exercises and the premiums have been increasing.

Honest answer. Not trolling

1. Switch funds. Ideally choose one with US exposure, minimal china and Malaysia exposure.

2. Go standalone route (that way you get rid of the baggage of lousy underperforming funds), you only get the repricing for medical inflation part. I don't hear standalone people complaining. Only ILP

3. Use gathercare if you are stil eligible (this one no repricing as not insurance and not for profit I think)

4. Switch to more expensive room plan. I already showed you the higher tier insurance usually kena less repricing Vs lower and mid tier.

5. Self insure. Set aside a fund, every month put in money into that investment. Money used for insurance premium divert it there. Can be very simple. Say your investment fund consist of public bank and Maybank stock As long as you never draw down the fund it will keep increasing vs insurance. Unlikely you will use insurance now. Likely going to use it in your 60s or 70s. That time substantial amount unless you are in 50s. If you are able to get 6 digit of passive income a year, what medical insurance do you need?

6. Govt hospital. But need to wait your turn, cramp with people and lower down service to B40 lifestyle.

7. Do a top-up lump-sum into your ILP say RM50-100k and it will stop the hike for a while. Not a route I want to take. This was advise to me by my agent when I asked about ILP. She said ILP will always increase in price and buy topping up lump-sum l, it will increase sustainability. Your money, your call.

QUOTE(zero5177 @ Jan 10 2024, 05:02 PM)

And they always say, buy early to prevent price hike

In reality when during entry they already fully calculated everything be it u come in early or late all cost factored.

I also kena conned. After doing research found out buy early or late more or less the same. Lol. But I buy now cause I know will use it in the future. Cause if you get illness already, too late to buy insurance already.

This post has been edited by Ramjade: Jan 10 2024, 06:38 PM

Jan 10 2024, 04:09 PM, updated 2y ago

Jan 10 2024, 04:09 PM, updated 2y ago

Quote

Quote

0.1476sec

0.1476sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled