QUOTE(devilmaycry9 @ Jan 17 2024, 01:40 PM)

for new medical plan introduce, is it having new pool of fund? i'm curious...

if like that, isn't it advantageous for healthy older people to join new plan? while young and latecomer participant will bear higher cost when they get older due to the plan no longer in the market and early participant may already 6 feet under or end their policy already...

QUOTE(Ramjade @ Jan 17 2024, 02:17 PM)

Yes that is right. That's why my agent said if you can hop to new plan, hop. But not hop every year. Hop once every 10y

Please keep in mind to plan hop wisely. Especially to people who said dont want to benefit agents.

Buying a new plan is usually giving commission from year 1 to agents. For most plans commission are generally highest in year 1, gradually reduce over the years.

if you have an Investment-Linked Plan, please reach out to the insurance company if you have the option to delete current medical rider and add new medical rider. from what i know, my brother's policy, about 20 years old, can attach a new medical plan. most likely additional premium is required, but instead of changing the entire plan, he continue to keep his current plan, and the overall charges incurred will be lesser. Caveat: Not all insurance companies will have this option for all their investment-linked plan. so, i hope you are lucky.

please read the product disclosure sheet where possible. BNM will always say insurance is a long-term plan (when long means almost life time long), so dont surrender buy new due to high initial charges.

QUOTE(qhw @ Jan 19 2024, 11:21 AM)

May i know if there are avenues to voice out my anger on this

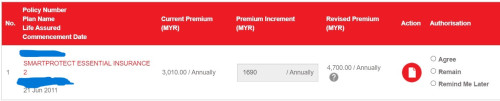

steep premium increase of 56% from GE !!!????

any specific BNM email ?

It seems to me that this business is a sure win, any mispricing then they pass on via premium increase, and if over-price they sit happy with the bumper profit, this makes no sense....

insurance company is not a charity, it's for profit. However, BNM will be there to watch closely and insurance companies won't submit for reprice if their claims didnt worsen. let's just say hospitalisation claim has only worsen and has not improved over the years.

the only exception and anomaly was/is COVID where people just stop going to hospital...

Also to add on, BNM is coming up with guidelines to steer the industry to control these repricing situation as shared by BNM paper (the one shared by contestchris). BNM wants it to be sustainable and bla bla bla... it's not perfect but it's a work in progress.

search for post #4770This post has been edited by adele123: Jan 22 2024, 10:57 PM

Jan 19 2024, 11:19 PM

Jan 19 2024, 11:19 PM

Quote

Quote

0.0276sec

0.0276sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled