Loan 350k

Today outstanding: 320k

Already served 6 years plus, 1500 monthly

6 x 12 x 1500 = 108k

108k - 30k = 78k

Bank already earned 78k interest from me, bloody hell

Gov should do sthg, how can house loan be so expensive...

Housing loan is scary

Housing loan is scary

|

|

Oct 10 2023, 09:28 AM, updated 3y ago Oct 10 2023, 09:28 AM, updated 3y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

2 posts Joined: Feb 2023 |

Loan 350k

Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... |

|

|

|

|

|

Oct 10 2023, 09:28 AM Oct 10 2023, 09:28 AM

Show posts by this member only | IPv6 | Post

#2

|

Junior Member

148 posts Joined: Aug 2013 From: Uranus |

U x sukak u bayar cash Lonelybird, YamiBear, and 47 others liked this post

|

|

|

Oct 10 2023, 09:29 AM Oct 10 2023, 09:29 AM

Show posts by this member only | IPv6 | Post

#3

|

Junior Member

693 posts Joined: Dec 2009 From: Italy |

Then stay in jungle build own hut

|

|

|

Oct 10 2023, 09:29 AM Oct 10 2023, 09:29 AM

Show posts by this member only | Post

#4

|

Senior Member

2,220 posts Joined: Apr 2006 |

compound interest is the 8th greatest wonder of the world wawasan2200, fullmetalneko, and 15 others liked this post

|

|

|

Oct 10 2023, 09:30 AM Oct 10 2023, 09:30 AM

Show posts by this member only | Post

#5

|

Junior Member

13 posts Joined: Apr 2022 |

That's how bank earn your money. If u got extra, just proceed with principal reduction. Lonelybird, Lee767, and 3 others liked this post

|

|

|

Oct 10 2023, 09:31 AM Oct 10 2023, 09:31 AM

Show posts by this member only | Post

#6

|

Senior Member

2,263 posts Joined: Sep 2006 From: i-city |

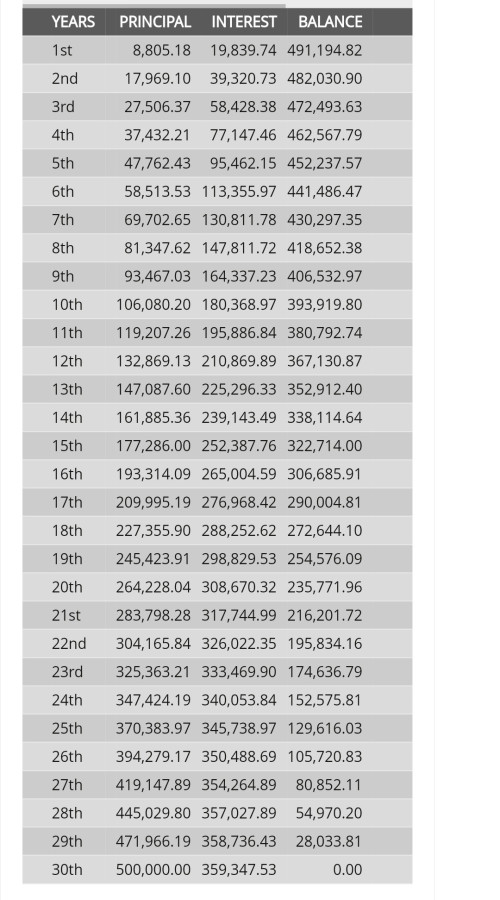

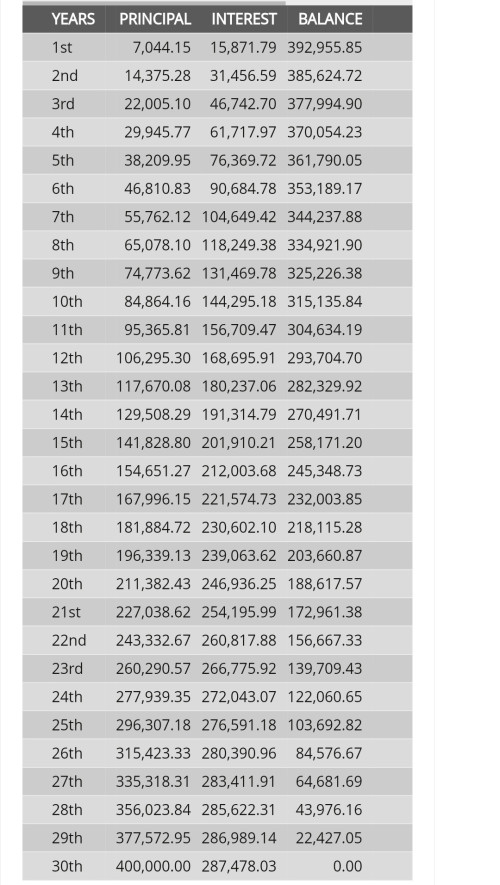

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k if flexi loan. park all ur extra money insideToday outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... btw assuming you loan 350k at 4.15% with tenure 35 years. thats come about 1.6k a month. total interest paid to serve 35 years is 314k. if u pay extra 1k a month, your tenure is cut off by 20 years roughly . you will settle your loan around 15 years with total interest paid roughly 120k. This post has been edited by sheahann: Oct 10 2023, 09:34 AM |

|

|

|

|

|

Oct 10 2023, 09:31 AM Oct 10 2023, 09:31 AM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

QUOTE(robotking123 @ Oct 10 2023, 10:28 AM) Loan 350k Unker ppr in 2013 buy only rm218k.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... Monthly supposed to be rm1100 wonly. But pay rm2k monthly now. Currenlt principle left rm66k wonly. Hope can fully settle within the next 2-3 years. kidmad liked this post

|

|

|

Oct 10 2023, 09:31 AM Oct 10 2023, 09:31 AM

Show posts by this member only | Post

#8

|

Senior Member

1,420 posts Joined: Nov 2013 |

Just grow pubic hair ah TS?

|

|

|

Oct 10 2023, 09:31 AM Oct 10 2023, 09:31 AM

Show posts by this member only | IPv6 | Post

#9

|

Junior Member

907 posts Joined: Jun 2005 |

|

|

|

Oct 10 2023, 09:31 AM Oct 10 2023, 09:31 AM

|

Senior Member

9,796 posts Joined: Jun 2008 From: Rubber Duck Pond |

|

|

|

Oct 10 2023, 09:32 AM Oct 10 2023, 09:32 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Friend...Bank also need to make money, to pay their staff and everyday expenses. Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... Nobody would give you loan if no profit. I think the formula should be if you take a 350k loan, expect to be paying double the amount Loan + interest = 700k or more until your loan period ends. alfiejr, max_cavalera, and 1 other liked this post

|

|

|

Oct 10 2023, 09:32 AM Oct 10 2023, 09:32 AM

|

Senior Member

9,048 posts Joined: Jan 2003 |

First, banks are NOT your friends. Whether is GF, wife, or FWB, they will suck u dry like a vampire. Second, banks are answerable to their shareholders. Profits are the only word they want to hear. Third, don't ever commit to a loan if you're not prepared. Either save more or work 3 or more jobs to earn more income. JimbeamofNRT and DupeIkan liked this post

|

|

|

Oct 10 2023, 09:32 AM Oct 10 2023, 09:32 AM

|

Junior Member

535 posts Joined: Jan 2016 |

if maybank how to pay principal ?

|

|

|

|

|

|

Oct 10 2023, 09:33 AM Oct 10 2023, 09:33 AM

Show posts by this member only | IPv6 | Post

#14

|

Junior Member

907 posts Joined: Jun 2005 |

QUOTE(Duckies @ Oct 10 2023, 09:31 AM) Want to ask ya if I put more money inside...it only reduces the loan duration right? Not the loan amount monthly right? it reduce the interest you need to pay for each month. in other word, your instalment contribute more toward principal amount |

|

|

Oct 10 2023, 09:33 AM Oct 10 2023, 09:33 AM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

3,510 posts Joined: Feb 2005 |

Siapa suruh miskin? Bank got point gun to your head to sign agreement? max_cavalera liked this post

|

|

|

Oct 10 2023, 09:33 AM Oct 10 2023, 09:33 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

|

|

|

Oct 10 2023, 09:33 AM Oct 10 2023, 09:33 AM

Show posts by this member only | IPv6 | Post

#17

|

Senior Member

2,992 posts Joined: Feb 2015 |

Aiyo.

Add in principal payment la... |

|

|

Oct 10 2023, 09:34 AM Oct 10 2023, 09:34 AM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

1,075 posts Joined: Oct 2022 |

I made the same mistake earlier

Please dump in more money until you unable to eat to settle loan first |

|

|

Oct 10 2023, 09:34 AM Oct 10 2023, 09:34 AM

|

Junior Member

933 posts Joined: Jul 2005 |

x sukak... jadi slave to debt... sewa rumah jer la... topkekk... pepolz nowadays during recession buy house, 90% downpayment... 10% loan... you go the other way for what?? Sihambodoh, bobowyc, and 1 other liked this post

|

|

|

Oct 10 2023, 09:34 AM Oct 10 2023, 09:34 AM

|

Senior Member

1,818 posts Joined: Jan 2005 From: Kuala Lumpur |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Actually, there's nothing scary, if you dont plan to do early settlement.. whatever numbers shown, your installment numbers remain fixed (25/30 years or whatever duration you had chosen).Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... This post has been edited by zeese: Oct 10 2023, 09:34 AM |

|

|

Oct 10 2023, 09:34 AM Oct 10 2023, 09:34 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

|

|

|

Oct 10 2023, 09:34 AM Oct 10 2023, 09:34 AM

|

Senior Member

1,231 posts Joined: Jan 2003 |

first time..?

|

|

|

Oct 10 2023, 09:35 AM Oct 10 2023, 09:35 AM

|

Senior Member

1,176 posts Joined: May 2006 From: Memesia |

bank: terima kasih

|

|

|

Oct 10 2023, 09:35 AM Oct 10 2023, 09:35 AM

Show posts by this member only | IPv6 | Post

#24

|

Junior Member

291 posts Joined: Aug 2019 |

if have extra cash pay extra lor

|

|

|

Oct 10 2023, 09:35 AM Oct 10 2023, 09:35 AM

|

|

Elite

7,826 posts Joined: Jan 2003 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k That is why there is a movement where people prefer to just rent then own a property. Gives them a lot more freedom.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... |

|

|

Oct 10 2023, 09:36 AM Oct 10 2023, 09:36 AM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Same if you ask anyone else to loan you a lump sum 350K. Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... Of course your interest is levied to your principal sum owing 350k from day 1. That's how it works because you bought a sum owing. Principal reduction is the math here. All the best. This post has been edited by jojolicia: Oct 10 2023, 09:49 AM |

|

|

Oct 10 2023, 09:36 AM Oct 10 2023, 09:36 AM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k TS bodo ke buat bodo.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... dah la miskin lagi mau buy rumah. sewa kan ade owai bigduck liked this post

|

|

|

Oct 10 2023, 09:36 AM Oct 10 2023, 09:36 AM

|

Senior Member

9,796 posts Joined: Jun 2008 From: Rubber Duck Pond |

|

|

|

Oct 10 2023, 09:37 AM Oct 10 2023, 09:37 AM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

907 posts Joined: Jun 2005 |

|

|

|

Oct 10 2023, 09:37 AM Oct 10 2023, 09:37 AM

|

Newbie

27 posts Joined: May 2017 |

Redeem the loan kalau you tak suka bank untung banyak

|

|

|

Oct 10 2023, 09:40 AM Oct 10 2023, 09:40 AM

Show posts by this member only | IPv6 | Post

#31

|

Junior Member

2 posts Joined: Feb 2023 |

House loan should follow car loan, max 9 years and fixed interest. Today bought Benz 300k loan 9 years also not this expensive. How come house loan interest so high than car?

|

|

|

Oct 10 2023, 09:41 AM Oct 10 2023, 09:41 AM

|

Junior Member

106 posts Joined: Dec 2021 |

kesian

|

|

|

Oct 10 2023, 09:42 AM Oct 10 2023, 09:42 AM

|

Senior Member

6,249 posts Joined: Jul 2006 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k gov have a vested interest with banksToday outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... they tax the transactions and they tax the income of banks buy something less than 100k pay cash |

|

|

Oct 10 2023, 09:44 AM Oct 10 2023, 09:44 AM

|

Senior Member

1,154 posts Joined: Oct 2021 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k borrow 100k, fully paid add 200k thats normal.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... unless you convert into 4 year loan not scary, just your income small |

|

|

Oct 10 2023, 09:45 AM Oct 10 2023, 09:45 AM

|

Senior Member

995 posts Joined: May 2005 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k das why unker service first 5 year double paymentToday outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... interest will be cut by alot by then |

|

|

Oct 10 2023, 09:45 AM Oct 10 2023, 09:45 AM

|

Junior Member

368 posts Joined: Jan 2006 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Rather than gomen do something, you can do something immediately.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... Pay more than then minimum RM1500 that's required. Try RM2000 or RM2500. It will make a big difference on interest. Lonelybird and max_cavalera liked this post

|

|

|

Oct 10 2023, 09:45 AM Oct 10 2023, 09:45 AM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(desmond2020 @ Oct 10 2023, 09:33 AM) it reduce the interest you need to pay for each month. in other word, your instalment contribute more toward principal amount This. Sorry bro, do excuse my itchy hand for clarity to your statement. <it reduce the interest you need to pay for each month. in other word, your instalment contribute more toward principal reduction> This post has been edited by jojolicia: Oct 10 2023, 09:46 AM |

|

|

Oct 10 2023, 09:46 AM Oct 10 2023, 09:46 AM

Show posts by this member only | IPv6 | Post

#38

|

Senior Member

3,130 posts Joined: Feb 2014 |

B40 don’t buy house. Just rent.

|

|

|

Oct 10 2023, 09:46 AM Oct 10 2023, 09:46 AM

|

Senior Member

4,232 posts Joined: Jan 2003 From: Selangor |

just wait till interest rate naik kaw2

|

|

|

Oct 10 2023, 09:48 AM Oct 10 2023, 09:48 AM

Show posts by this member only | IPv6 | Post

#40

|

Junior Member

341 posts Joined: Dec 2006 |

Thats why unker buy 4 acres of land with pertanian status.........when cheap only cost 360k.....build house with 5 rooms 20X25 02 halls 30X25..02 parking garage....3 porch..... all without the hassle of approval from local counsil because of the status of the land..........and best of all it only cost me 160k..... DupeIkan and max_cavalera liked this post

|

|

|

Oct 10 2023, 09:48 AM Oct 10 2023, 09:48 AM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

867 posts Joined: Feb 2017 |

Be like me.. every 100k disbursement during building. Pay up 90k. Let bank earn only the 10k principal interest. Then after collect key interest very low only jojolicia liked this post

|

|

|

Oct 10 2023, 09:49 AM Oct 10 2023, 09:49 AM

Show posts by this member only | IPv6 | Post

#42

|

Junior Member

327 posts Joined: Nov 2008 |

QUOTE(robotking123 @ Oct 10 2023, 09:40 AM) House loan should follow car loan, max 9 years and fixed interest. Today bought Benz 300k loan 9 years also not this expensive. How come house loan interest so high than car? Kebodohan TS terselar Angry Clerk, cabbagepotato, and 2 others liked this post

|

|

|

Oct 10 2023, 09:50 AM Oct 10 2023, 09:50 AM

Show posts by this member only | IPv6 | Post

#43

|

Senior Member

2,209 posts Joined: Nov 2010 |

QUOTE(jojolicia @ Oct 10 2023, 09:45 AM) This. it just means you can settle loan faster if you keep that money park there. Sorry bro, do excuse my itchy hand for clarity to your statement. <it reduce the interest you need to pay for each month. in other word, your instalment contribute more toward principal reduction> I baru angkat a 530K loan, same deal RM2.5K/month. I plan to park lots of cash inside to reduce it. I think after few years i sekaligus settle. max_cavalera and jojolicia liked this post

|

|

|

Oct 10 2023, 09:50 AM Oct 10 2023, 09:50 AM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

1,404 posts Joined: Jun 2009 |

the first half tenure of loan is mainly to pay the interest. after that only you'll start to see the principal amount reducing fast

|

|

|

Oct 10 2023, 09:52 AM Oct 10 2023, 09:52 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(robotking123 @ Oct 10 2023, 09:40 AM) House loan should follow car loan, max 9 years and fixed interest. Today bought Benz 300k loan 9 years also not this expensive. How come house loan interest so high than car? High? Try taking a 30-year car loan for that 300k Merc and see how much interest you will pay. You are the one who is sohigh. Angry Clerk and kiasunkiasi liked this post

|

|

|

Oct 10 2023, 09:53 AM Oct 10 2023, 09:53 AM

|

Junior Member

7 posts Joined: Jul 2019 |

Based on TS numbers, it seems like 36 year loan @ ~3.9% interest. Interest is always highest at earliest point of loan. At full repayment, one would have paid $306k in interest.

In order to reduce interest payable, consider take up shorter loan duration (max 15 years), higher repayment amount and/or lower loan quantum. Otherwise, bank say thank you for working for bank. |

|

|

Oct 10 2023, 09:57 AM Oct 10 2023, 09:57 AM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

125 posts Joined: Mar 2018 |

QUOTE(robotking123 @ Oct 10 2023, 09:40 AM) House loan should follow car loan, max 9 years and fixed interest. Today bought Benz 300k loan 9 years also not this expensive. How come house loan interest so high than car? This guy really dunno how to use brain and see the calculation.Dun tell ang mo you are asian mempersiasuikan |

|

|

Oct 10 2023, 09:58 AM Oct 10 2023, 09:58 AM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(Boldnut @ Oct 10 2023, 09:50 AM) it just means you can settle loan faster if you keep that money park there. Correct. Many don't buy my suggestion in playing the 'zeroried' game specially if you are buying U/C. More so in highrise, one has 48 months to strategies and pan this out. Some said its a no brainer opportunity cost lost wor. I baru angkat a 530K loan, same deal RM2.5K/month. I plan to park lots of cash inside to reduce it. I think after few years i sekaligus settle. Even you don't get the net 0 by VP, it will be a milestone to achieve, say 30-50% total principal sum owing is good enough to collect your new keys Believe me, the 'zeroried' leveraging game is very addictive (if you tasted the drug). In no time, you will be on your next leverage. This post has been edited by jojolicia: Oct 10 2023, 10:09 AM |

|

|

Oct 10 2023, 09:59 AM Oct 10 2023, 09:59 AM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

459 posts Joined: Mar 2005 From: home |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... TS like my friend, said paid more than 10 years for housing loan, last few year go check principle only reduce less than 50k. Then kpkb. Ask him pay more monthly, he keep quiet. The best part is monthly TNB bill more than the housing loan Got kids, 1 breeding dog, outside eat dont really care the price. YOLO more important Angry Clerk, Boldnut, and 1 other liked this post

|

|

|

Oct 10 2023, 10:06 AM Oct 10 2023, 10:06 AM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

1,132 posts Joined: Jun 2015 |

QUOTE(buffa @ Oct 10 2023, 09:59 AM) TS like my friend, said paid more than 10 years for housing loan, last few year go check principle only reduce less than 50k. Then kpkb. Ask him pay more monthly, he keep quiet. The best part is monthly TNB bill more than the housing loan Got kids, 1 breeding dog, outside eat dont really care the price. YOLO more important |

|

|

Oct 10 2023, 10:07 AM Oct 10 2023, 10:07 AM

|

All Stars

13,477 posts Joined: Jan 2012 |

|

|

|

Oct 10 2023, 10:09 AM Oct 10 2023, 10:09 AM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

3,217 posts Joined: Dec 2006 From: City of Neko~~Nyaa~ |

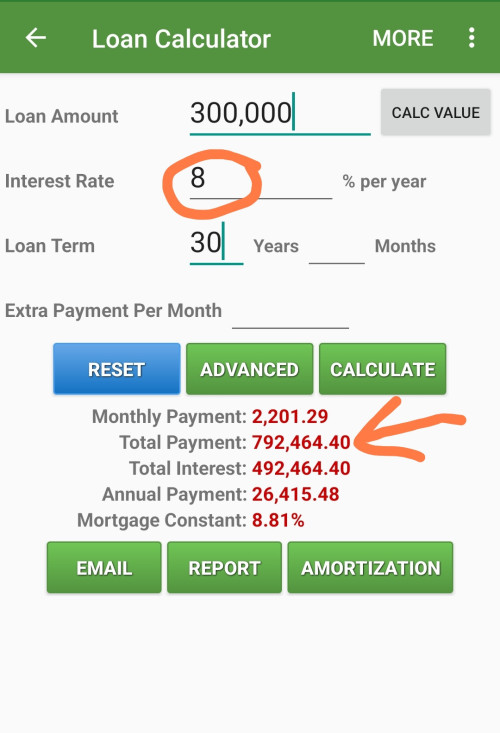

Unker also count unker House loan...

Loan 300, after finish 30 year... Pay around 1 million.... Don't know how... |

|

|

Oct 10 2023, 10:09 AM Oct 10 2023, 10:09 AM

Show posts by this member only | IPv6 | Post

#53

|

Senior Member

3,217 posts Joined: Dec 2006 From: City of Neko~~Nyaa~ |

Duplicate...

This post has been edited by moiskyrie: Oct 10 2023, 10:09 AM |

|

|

Oct 10 2023, 10:10 AM Oct 10 2023, 10:10 AM

|

Senior Member

1,037 posts Joined: Jul 2009 |

if the loan interest is less than epf interest, better park in epf.

QUOTE(sheahann @ Oct 10 2023, 09:31 AM) if flexi loan. park all ur extra money inside btw assuming you loan 350k at 4.15% with tenure 35 years. thats come about 1.6k a month. total interest paid to serve 35 years is 314k. if u pay extra 1k a month, your tenure is cut off by 20 years roughly . you will settle your loan around 15 years with total interest paid roughly 120k. |

|

|

Oct 10 2023, 10:11 AM Oct 10 2023, 10:11 AM

|

Junior Member

51 posts Joined: Mar 2013 |

kena cekik darah ke or kena forced signature?

walaupun hidup berpuluh tahun kalo ... |

|

|

Oct 10 2023, 10:12 AM Oct 10 2023, 10:12 AM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

3,969 posts Joined: Nov 2007 |

press X

|

|

|

Oct 10 2023, 10:13 AM Oct 10 2023, 10:13 AM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

3,969 posts Joined: Nov 2007 |

|

|

|

Oct 10 2023, 10:14 AM Oct 10 2023, 10:14 AM

|

Junior Member

370 posts Joined: Jul 2010 |

The banks are very sneaky. You pay more interest than principal the first 1/3 of the loan duration and then slowly reduce. That's why first 10 years your principal don't reduce much.

They know majority investors will sell off property within this period so they already earn enough from your interest. That's how banks are legal loan sharks. |

|

|

Oct 10 2023, 10:14 AM Oct 10 2023, 10:14 AM

|

Senior Member

1,053 posts Joined: Jan 2008 |

Do you know how long bank need to wait to complete for yours to pay your loan?

|

|

|

Oct 10 2023, 10:15 AM Oct 10 2023, 10:15 AM

|

Junior Member

36 posts Joined: Nov 2021 |

|

|

|

Oct 10 2023, 10:17 AM Oct 10 2023, 10:17 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 10:17 AM Oct 10 2023, 10:17 AM

|

Junior Member

661 posts Joined: Jan 2005 From: Legio Titanicus |

Rent for life then.

Nobody owes you a living. |

|

|

Oct 10 2023, 10:19 AM Oct 10 2023, 10:19 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(ameliorate @ Oct 10 2023, 10:14 AM) The banks are very sneaky. You pay more interest than principal the first 1/3 of the loan duration and then slowly reduce. That's why first 10 years your principal don't reduce much. Takkan you expect them to cough up hundreds of thousands at risk of you not paying, only to earn peanuts when you sell?They know majority investors will sell off property within this period so they already earn enough from your interest. That's how banks are legal loan sharks. |

|

|

Oct 10 2023, 10:19 AM Oct 10 2023, 10:19 AM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

218 posts Joined: Sep 2015 |

QUOTE(froggyx @ Oct 10 2023, 10:48 AM) Thats why unker buy 4 acres of land with pertanian status.........when cheap only cost 360k.....build house with 5 rooms 20X25 02 halls 30X25..02 parking garage....3 porch..... But tanah status pertanian right all without the hassle of approval from local counsil because of the status of the land..........and best of all it only cost me 160k..... If you sell the house also under status pertanian? Not legit for residential development |

|

|

Oct 10 2023, 10:25 AM Oct 10 2023, 10:25 AM

|

Junior Member

483 posts Joined: Jan 2010 |

lucky you... so little loan.

my loan last time 300k, now like multiple the loan amount, refinance and refinance.... |

|

|

Oct 10 2023, 10:31 AM Oct 10 2023, 10:31 AM

Show posts by this member only | IPv6 | Post

#66

|

Senior Member

1,187 posts Joined: Nov 2006 |

so u flush before shit is it

sudah sign agreement baru nak check bingai |

|

|

Oct 10 2023, 10:33 AM Oct 10 2023, 10:33 AM

Show posts by this member only | IPv6 | Post

#67

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

If got extra buy bank shares.

|

|

|

Oct 10 2023, 10:35 AM Oct 10 2023, 10:35 AM

|

Junior Member

194 posts Joined: Sep 2010 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k This I agree. Gov should do something. Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... This will free up a huge sum for people's spending and in many ways will spur the economy also in the end. |

|

|

Oct 10 2023, 10:36 AM Oct 10 2023, 10:36 AM

|

Senior Member

2,096 posts Joined: Oct 2007 |

Sometimes i don't understand those "buy properties for investment".

mostly making lost anyways. Property appreciation is practically none now. |

|

|

Oct 10 2023, 10:38 AM Oct 10 2023, 10:38 AM

|

Junior Member

140 posts Joined: Jul 2007 From: Puchong |

Bank is legal ah long

|

|

|

Oct 10 2023, 10:39 AM Oct 10 2023, 10:39 AM

|

Junior Member

101 posts Joined: May 2008 |

TS speaking like only today he discovered gravity

|

|

|

Oct 10 2023, 10:40 AM Oct 10 2023, 10:40 AM

|

Junior Member

101 posts Joined: May 2008 |

QUOTE(cmk96 @ Oct 10 2023, 10:36 AM) Sometimes i don't understand those "buy properties for investment". alot of them are banging for capital gainmostly making lost anyways. Property appreciation is practically none now. for example, a house priced at rm 300k, so they are "hoping" can sell it at 500k or higher in future time |

|

|

Oct 10 2023, 10:40 AM Oct 10 2023, 10:40 AM

|

Junior Member

87 posts Joined: Aug 2009 |

suka suka apply and sign document without doing enough homework

padan muka ts |

|

|

Oct 10 2023, 10:41 AM Oct 10 2023, 10:41 AM

|

Junior Member

54 posts Joined: Nov 2021 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Bank also give high interest for FD. If not bank makan apa?Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... OPR still very low. Lucky already |

|

|

Oct 10 2023, 10:43 AM Oct 10 2023, 10:43 AM

|

Senior Member

1,119 posts Joined: Jun 2007 |

im pretty sure there are some extra park in advance payment...did you check your statement to confirm that?

|

|

|

Oct 10 2023, 10:44 AM Oct 10 2023, 10:44 AM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

3,217 posts Joined: Dec 2006 From: City of Neko~~Nyaa~ |

QUOTE(pisces88 @ Oct 10 2023, 10:13 AM) Don't know,See dashboard show still own bank almost 1.1 million... Already pay for 7 years.... QUOTE(SixteenNine @ Oct 10 2023, 10:15 AM) BNM is play safe. US already stop interest hike and aiming for reduce interest rate next year. While Malaysia remains as pre-covid era at 3% OPR. Interest pre covid, but the amount need to pay more that pre covid......If interest naik also maybe max to 4% QUOTE(mushigen @ Oct 10 2023, 10:17 AM) Impossible unless got prawn behind rock. Don't know...Even average 8% interest rate for this loan pun won't need to pay so much.  Bank dashboard show I still own 1.1 million.... Borrow 300k... Pay 7 years already..... |

|

|

Oct 10 2023, 10:44 AM Oct 10 2023, 10:44 AM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

265 posts Joined: Jan 2013 |

well...someone's gotta earn...

and the idea is ...not you. |

|

|

Oct 10 2023, 10:45 AM Oct 10 2023, 10:45 AM

|

Junior Member

752 posts Joined: Jun 2012 |

U no money buy house, who borrow you money..??

|

|

|

Oct 10 2023, 10:45 AM Oct 10 2023, 10:45 AM

|

|

Moderator

6,181 posts Joined: Oct 2004 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k for house loan, banks will always use your installment for interest first.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... my mbb house loan pay for 10 years, principal also reduce little bit only. |

|

|

Oct 10 2023, 10:51 AM Oct 10 2023, 10:51 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(moiskyrie @ Oct 10 2023, 10:44 AM) Don't know, Islamic loan? I was told Islamic loan displays different amount of balance compared to conventional but not sure how much difference.See dashboard show still own bank almost 1.1 million... Already pay for 7 years.... Interest pre covid, but the amount need to pay more that pre covid...... Don't know... Bank dashboard show I still own 1.1 million.... Borrow 300k... Pay 7 years already..... |

|

|

Oct 10 2023, 10:59 AM Oct 10 2023, 10:59 AM

Show posts by this member only | IPv6 | Post

#81

|

Junior Member

181 posts Joined: Dec 2010 |

cash is king problem solved

|

|

|

Oct 10 2023, 10:59 AM Oct 10 2023, 10:59 AM

|

Junior Member

483 posts Joined: Jan 2010 |

QUOTE(cmk96 @ Oct 10 2023, 10:36 AM) Sometimes i don't understand those "buy properties for investment". as long as you can rent out and your rental can cover loan you are not really losing in the long runmostly making lost anyways. Property appreciation is practically none now. you buy off the plan brand new, then you going to take the depreciation hit la |

|

|

Oct 10 2023, 11:01 AM Oct 10 2023, 11:01 AM

Show posts by this member only | IPv6 | Post

#83

|

Junior Member

2 posts Joined: Feb 2023 |

Now Bang Nuar gonna remove the subsidy, then at least help us to reduce our house loan. Just set bank max can only charge 50% interest of the house loan amount. Problem solved, all happy

|

|

|

Oct 10 2023, 11:01 AM Oct 10 2023, 11:01 AM

|

Senior Member

1,037 posts Joined: Jul 2009 |

that's the standard mortgage calculation for fixed installments.

unless bank allowed you to have reducing installment, you can't have same fixed portion for interest and principal. QUOTE(ameliorate @ Oct 10 2023, 10:14 AM) The banks are very sneaky. You pay more interest than principal the first 1/3 of the loan duration and then slowly reduce. That's why first 10 years your principal don't reduce much. They know majority investors will sell off property within this period so they already earn enough from your interest. That's how banks are legal loan sharks. |

|

|

Oct 10 2023, 11:02 AM Oct 10 2023, 11:02 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

QUOTE(a_dot_el @ Oct 10 2023, 10:35 AM) This I agree. Gov should do something. like how?This will free up a huge sum for people's spending and in many ways will spur the economy also in the end. u can't exactly fix the interest rate otherwise those Rating agencies like Standard & Poor will be after our ass, and downgrade us? |

|

|

Oct 10 2023, 11:05 AM Oct 10 2023, 11:05 AM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

|

|

|

Oct 10 2023, 11:07 AM Oct 10 2023, 11:07 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(robotking123 @ Oct 10 2023, 11:01 AM) Now Bang Nuar gonna remove the subsidy, then at least help us to reduce our house loan. Just set bank max can only charge 50% interest of the house loan amount. Problem solved, all happy While we're at it, why not ask to increase our employer EPF contribution to 50% too? |

|

|

Oct 10 2023, 11:07 AM Oct 10 2023, 11:07 AM

Show posts by this member only | IPv6 | Post

#88

|

Senior Member

1,173 posts Joined: Dec 2012 |

|

|

|

Oct 10 2023, 11:08 AM Oct 10 2023, 11:08 AM

|

Senior Member

1,895 posts Joined: Apr 2010 From: Keep Walking ... Tomorrowland |

kan ade rent . owai

|

|

|

Oct 10 2023, 11:08 AM Oct 10 2023, 11:08 AM

|

Junior Member

219 posts Joined: Nov 2021 |

QUOTE(taitianhin @ Oct 10 2023, 11:05 AM) if your loan type is not Flexi or Semi-flexi then you cant... If apply semi flexi loan 300k and put cash 300k park into that flexi loan acc then still will kena interest?? If your loan are those flexi. you will see extra amt paid in online Maybank, loan screen Emergency time still can cash out from that acc jz charge abit only . |

|

|

Oct 10 2023, 11:10 AM Oct 10 2023, 11:10 AM

Show posts by this member only | IPv6 | Post

#91

|

Senior Member

2,256 posts Joined: Feb 2012 |

math failed.

totally failed |

|

|

Oct 10 2023, 11:11 AM Oct 10 2023, 11:11 AM

Show posts by this member only | IPv6 | Post

#92

|

Junior Member

28 posts Joined: Jul 2022 |

|

|

|

Oct 10 2023, 11:12 AM Oct 10 2023, 11:12 AM

|

Junior Member

370 posts Joined: Jul 2010 |

QUOTE(mroys@lyn @ Oct 10 2023, 11:01 AM) that's the standard mortgage calculation for fixed installments. The standards are fixed by the banks. If they want to change it they can but they won't.unless bank allowed you to have reducing installment, you can't have same fixed portion for interest and principal. I'm saying they skew too much in the banks favor. You're paying around 90:10 interest vs principal during the first few years of the loan. Many people have impression that housing loan is similar to hire purchase. The banks want profit but this is too greedy. If ah long do this everyone condemns but if banks then it is ok. |

|

|

Oct 10 2023, 11:13 AM Oct 10 2023, 11:13 AM

|

Junior Member

219 posts Joined: Nov 2021 |

|

|

|

Oct 10 2023, 11:14 AM Oct 10 2023, 11:14 AM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Oct 10 2023, 11:14 AM Oct 10 2023, 11:14 AM

Show posts by this member only | IPv6 | Post

#96

|

Junior Member

996 posts Joined: Mar 2019 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Now only u know.. u got take mco moratorium also?Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... |

|

|

Oct 10 2023, 11:16 AM Oct 10 2023, 11:16 AM

Show posts by this member only | IPv6 | Post

#97

|

Junior Member

996 posts Joined: Mar 2019 |

QUOTE(max_cavalera @ Oct 10 2023, 09:31 AM) Unker ppr in 2013 buy only rm218k. This unker is smart. Not bad unker..Monthly supposed to be rm1100 wonly. But pay rm2k monthly now. Currenlt principle left rm66k wonly. Hope can fully settle within the next 2-3 years. Buy those 500k above.. bank has the last laugh |

|

|

Oct 10 2023, 11:18 AM Oct 10 2023, 11:18 AM

|

|

Elite

5,784 posts Joined: Jan 2003 From: Shah Alam |

take revenge..buy back the loan's bank share..

|

|

|

Oct 10 2023, 11:18 AM Oct 10 2023, 11:18 AM

|

Junior Member

110 posts Joined: Jan 2009 |

QUOTE(mroys@lyn @ Oct 10 2023, 11:01 AM) that's the standard mortgage calculation for fixed installments. surely all banks allow capital prepayment. the procedure for each bank is different though.unless bank allowed you to have reducing installment, you can't have same fixed portion for interest and principal. |

|

|

Oct 10 2023, 11:20 AM Oct 10 2023, 11:20 AM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

QUOTE(prdkancil @ Oct 10 2023, 11:08 AM) If apply semi flexi loan 300k and put cash 300k park into that flexi loan acc then still will kena interest?? The idea is there...Emergency time still can cash out from that acc jz charge abit only . But I remember there is a clause in Loan agreement that We cant put 100%. The max is around 70% or 75%...cant remember... mroys@lyn liked this post

|

|

|

Oct 10 2023, 11:21 AM Oct 10 2023, 11:21 AM

Show posts by this member only | IPv6 | Post

#101

|

Junior Member

907 posts Joined: Jun 2005 |

|

|

|

Oct 10 2023, 11:21 AM Oct 10 2023, 11:21 AM

Show posts by this member only | IPv6 | Post

#102

|

Junior Member

38 posts Joined: Apr 2022 |

Increase your earning ability lor.

|

|

|

Oct 10 2023, 11:22 AM Oct 10 2023, 11:22 AM

|

Senior Member

1,037 posts Joined: Jul 2009 |

it's not bank standard calculation but it's a universal formula for mortgage calculation. if you not agree, can you show your correct calculation?

of course you are paying the most interest in the beginning because the interest is based on the principal which is at the max compare to at the ending of your loan period. QUOTE(ameliorate @ Oct 10 2023, 11:12 AM) The standards are fixed by the banks. If they want to change it they can but they won't. I'm saying they skew too much in the banks favor. You're paying around 90:10 interest vs principal during the first few years of the loan. Many people have impression that housing loan is similar to hire purchase. The banks want profit but this is too greedy. If ah long do this everyone condemns but if banks then it is ok. |

|

|

Oct 10 2023, 11:24 AM Oct 10 2023, 11:24 AM

|

Junior Member

55 posts Joined: Mar 2017 |

That's why housing should always be socialised.

Leased/let out by the government. Singapore did it right. |

|

|

Oct 10 2023, 11:25 AM Oct 10 2023, 11:25 AM

|

Senior Member

2,294 posts Joined: Sep 2011 |

Apa house only 350k ?

|

|

|

Oct 10 2023, 11:28 AM Oct 10 2023, 11:28 AM

Show posts by this member only | IPv6 | Post

#106

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

|

|

|

Oct 10 2023, 11:29 AM Oct 10 2023, 11:29 AM

|

Junior Member

113 posts Joined: Apr 2019 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k i think u got it wrong,.. 78k is paying back the capital,.. not interest,.. 30k is the interest,.. Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... if u fully settle your loan today,.. then flat rate interest = (30k/108k) / 6 years = 4.6% very near current market what ?? |

|

|

Oct 10 2023, 11:30 AM Oct 10 2023, 11:30 AM

|

Junior Member

370 posts Joined: Jul 2010 |

QUOTE(mroys@lyn @ Oct 10 2023, 11:22 AM) it's not bank standard calculation but it's a universal formula for mortgage calculation. if you not agree, can you show your correct calculation? You mabuk ketum ke? Again, if they want to change it they can but they won't. No such thing as 'universal'. of course you are paying the most interest in the beginning because the interest is based on the principal which is at the max compare to at the ending of your loan period. I can't do shit because I don't have money to buy house in cash. You pandering to the banks like you own them. |

|

|

Oct 10 2023, 11:32 AM Oct 10 2023, 11:32 AM

Show posts by this member only | IPv6 | Post

#109

|

Junior Member

72 posts Joined: Jul 2012 From: Eastern Kingdom |

We actually been brainwashed to loan a house for 25-30 years. Actually, if we settle it like a car loan (i.e 5 to 9 years), the bank wont benefit that much.

|

|

|

Oct 10 2023, 11:36 AM Oct 10 2023, 11:36 AM

Show posts by this member only | IPv6 | Post

#110

|

Senior Member

4,482 posts Joined: Jul 2005 |

QUOTE(max_cavalera @ Oct 10 2023, 09:31 AM) Unker ppr in 2013 buy only rm218k. This is important.. to those taking >25 years loan the first few years is critical.. if monthly you can double up the repayment you actually need around 12 years only to completely pay the property.Monthly supposed to be rm1100 wonly. But pay rm2k monthly now. Currenlt principle left rm66k wonly. Hope can fully settle within the next 2-3 years. |

|

|

Oct 10 2023, 11:36 AM Oct 10 2023, 11:36 AM

Show posts by this member only | IPv6 | Post

#111

|

Junior Member

172 posts Joined: Jan 2017 |

QUOTE(Duckies @ Oct 10 2023, 09:31 AM) Want to ask ya if I put more money inside...it only reduces the loan duration right? Not the loan amount monthly right? Technically it doesn't reduce the duration, it reduces the outstanding amountSay you have a outstanding balance of 100k, and monthly repayment is 1000, 700 goes to interest and 300 goes to reduction You put extra 50k into the account, now your outstanding is reduced to 50k, you still pay althea same amount of 1000 monthly, but due to reduced outstanding, you pay less interest and more of your 1000, say 700 can goes to principal reduction. Then up until a point where the advance payment = outstanding, you can opt for full settlement. That's where people say advance payment can reduce loan tenure |

|

|

Oct 10 2023, 11:38 AM Oct 10 2023, 11:38 AM

Show posts by this member only | IPv6 | Post

#112

|

Senior Member

3,217 posts Joined: Dec 2006 From: City of Neko~~Nyaa~ |

QUOTE(mushigen @ Oct 10 2023, 10:51 AM) Islamic loan? I was told Islamic loan displays different amount of balance compared to conventional but not sure how much difference. yup, i think is islamic....i ask the banker, the banker say no need to see the amount, just pay nia... it will reduce at the end..... but pay 7 years already, the amount still same.... |

|

|

Oct 10 2023, 11:38 AM Oct 10 2023, 11:38 AM

Show posts by this member only | IPv6 | Post

#113

|

Junior Member

2 posts Joined: Feb 2023 |

QUOTE(kidmad @ Oct 10 2023, 11:36 AM) This is important.. to those taking >25 years loan the first few years is critical.. if monthly you can double up the repayment you actually need around 12 years only to completely pay the property. Talk like so easy all can afford pay 2x instalment, money fall from sky Lonelybird, augusta23, and 1 other liked this post

|

|

|

Oct 10 2023, 11:39 AM Oct 10 2023, 11:39 AM

Show posts by this member only | IPv6 | Post

#114

|

Senior Member

4,482 posts Joined: Jul 2005 |

QUOTE(Cincai lar @ Oct 10 2023, 11:29 AM) i think u got it wrong,.. 78k is paying back the capital,.. not interest,.. 30k is the interest,.. Nop his right first few year it will always going to be a large portion to interest and if you follow the schedule most likely on the 10th years onwards more will be going into principal. That's how loans work.if u fully settle your loan today,.. then flat rate interest = (30k/108k) / 6 years = 4.6% very near current market what ?? |

|

|

Oct 10 2023, 11:40 AM Oct 10 2023, 11:40 AM

Show posts by this member only | IPv6 | Post

#115

|

All Stars

11,667 posts Joined: Jan 2003 From: Klang/Subang |

QUOTE(robotking123 @ Oct 10 2023, 11:38 AM) Buy property that the installment is 1/5 1/6 of your income then can laBuy 1/3 one is memang cannot Lonelybird liked this post

|

|

|

Oct 10 2023, 11:40 AM Oct 10 2023, 11:40 AM

Show posts by this member only | IPv6 | Post

#116

|

Senior Member

4,482 posts Joined: Jul 2005 |

|

|

|

Oct 10 2023, 11:41 AM Oct 10 2023, 11:41 AM

|

Senior Member

1,123 posts Joined: Sep 2013 |

you think bank doing charity work keh ? They need to pay employee, pay rental fee, pay electric and water bill, pay system and best of all pay their boss and investor .... that what they say....bank is a certified along approve by gov and bank negara.....

This post has been edited by doppatroll: Oct 10 2023, 11:43 AM |

|

|

Oct 10 2023, 11:42 AM Oct 10 2023, 11:42 AM

|

Senior Member

2,115 posts Joined: Apr 2013 |

baru tau ke? pay more to reduce the principal :X

|

|

|

Oct 10 2023, 11:44 AM Oct 10 2023, 11:44 AM

|

Senior Member

1,037 posts Joined: Jul 2009 |

looks like you don't have anything to substantiate your claim, okay thanks.

QUOTE(ameliorate @ Oct 10 2023, 11:30 AM) |

|

|

Oct 10 2023, 11:44 AM Oct 10 2023, 11:44 AM

|

Newbie

8 posts Joined: Jun 2015 |

QUOTE(moiskyrie @ Oct 10 2023, 11:38 AM) yup, i think is islamic.... Haha ......very funny. First few years is something like paying the bank interest from the money you borrowed. Then after that the principal will only go down slowly.i ask the banker, the banker say no need to see the amount, just pay nia... it will reduce at the end..... but pay 7 years already, the amount still same.... |

|

|

Oct 10 2023, 11:46 AM Oct 10 2023, 11:46 AM

|

Senior Member

1,495 posts Joined: Dec 2012 |

Thank you TS for helping to pay for my juicy bank bonus every year. Banks like people like TS….😂😂 smallcrab and 0168257061 liked this post

|

|

|

Oct 10 2023, 11:48 AM Oct 10 2023, 11:48 AM

|

Junior Member

336 posts Joined: Mar 2017 |

Motobodo is real in this world max_cavalera liked this post

|

|

|

Oct 10 2023, 11:50 AM Oct 10 2023, 11:50 AM

Show posts by this member only | IPv6 | Post

#123

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(max_cavalera @ Oct 10 2023, 09:31 AM) Unker ppr in 2013 buy only rm218k. better pay minimum keep cash kingMonthly supposed to be rm1100 wonly. But pay rm2k monthly now. Currenlt principle left rm66k wonly. Hope can fully settle within the next 2-3 years. house sure alot maintenance upkeep later down the road mortgage is cheapest, u should use it to max |

|

|

Oct 10 2023, 11:51 AM Oct 10 2023, 11:51 AM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

|

|

|

Oct 10 2023, 11:55 AM Oct 10 2023, 11:55 AM

|

Senior Member

1,291 posts Joined: Aug 2014 |

QUOTE(BullshitDetective @ Oct 10 2023, 11:11 AM) QUOTE(prdkancil @ Oct 10 2023, 11:13 AM) mine can offset 100%. Took the loan in year 2012. New rules I dunno ...back then can put 100%PBB didnt make any money from me, just progressive interest lol. |

|

|

Oct 10 2023, 11:57 AM Oct 10 2023, 11:57 AM

|

Junior Member

336 posts Joined: Mar 2017 |

|

|

|

Oct 10 2023, 12:00 PM Oct 10 2023, 12:00 PM

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k thats why i cleared off in 3 years.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... now i have advance cash can withdraw when need it bank is angry, ask me to settle close account asap. but why should i |

|

|

Oct 10 2023, 12:01 PM Oct 10 2023, 12:01 PM

Show posts by this member only | IPv6 | Post

#128

|

Senior Member

1,132 posts Joined: Jun 2015 |

QUOTE(cmk96 @ Oct 10 2023, 10:36 AM) Sometimes i don't understand those "buy properties for investment". It's legit, when you buy before 2016/2017.mostly making lost anyways. Property appreciation is practically none now. My cousin just sold his Semi D, sold price are 2x from his SPA price, bought around 2014. |

|

|

Oct 10 2023, 12:21 PM Oct 10 2023, 12:21 PM

Show posts by this member only | IPv6 | Post

#129

|

Senior Member

2,209 posts Joined: Nov 2010 |

QUOTE(cmk96 @ Oct 10 2023, 10:36 AM) Sometimes i don't understand those "buy properties for investment". depends on places.mostly making lost anyways. Property appreciation is practically none now. condo pretty much non-existance already. but landed house in Klang valley. This one still go up. landed house is like Limited unit already, especially free hold landed. No developer wanna build landed house in near KL or inside KL anymore. This type of house confirm sky high price in future. |

|

|

Oct 10 2023, 12:21 PM Oct 10 2023, 12:21 PM

|

Junior Member

244 posts Joined: Jul 2008 |

|

|

|

Oct 10 2023, 12:24 PM Oct 10 2023, 12:24 PM

Show posts by this member only | IPv6 | Post

#131

|

Junior Member

540 posts Joined: Mar 2006 |

Yala loan 400k, after paid all is 800k liao.

Macam scam lol... |

|

|

Oct 10 2023, 12:28 PM Oct 10 2023, 12:28 PM

|

Junior Member

695 posts Joined: Nov 2010 |

QUOTE(gashout @ Oct 10 2023, 12:00 PM) thats why i cleared off in 3 years. Wow, you played the bank nicely and they don't like being beaten at their own gamenow i have advance cash can withdraw when need it bank is angry, ask me to settle close account asap. but why should i This post has been edited by lopo90: Oct 10 2023, 12:28 PM |

|

|

Oct 10 2023, 12:35 PM Oct 10 2023, 12:35 PM

|

Junior Member

370 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 12:35 PM Oct 10 2023, 12:35 PM

|

Senior Member

1,773 posts Joined: Dec 2013 |

QUOTE(N9484640 @ Oct 10 2023, 07:55 AM) mine can offset 100%. Took the loan in year 2012. New rules I dunno ...back then can put 100% they actually made so much with the moni u parked therePBB didnt make any money from me, just progressive interest lol. moni grow moni for them bank still wins we just dont let them win too much tats it N9484640 liked this post

|

|

|

Oct 10 2023, 12:38 PM Oct 10 2023, 12:38 PM

|

Newbie

4 posts Joined: Jun 2015 |

You remind me my 3rd landed house loan House Price: rm430k Downpayment : Rm130k ( Big hole on my ASB) Loan + MRTT : 311k Tenure :11 years...yess i make 11 years loan!! starting april 2017 Monthy Rm2700-RM29++ (depend on BLR) best year during covid...reject moratorium since iam gov staff gaji tetap jalan Today outstanding: 181k Total bank makan for 11 years loan estimate: RM98k , yeah got pro and cons when high downpayment, shorter time but kill my itik telur emas ASB.. xiaojohn liked this post

|

|

|

Oct 10 2023, 12:41 PM Oct 10 2023, 12:41 PM

|

Junior Member

846 posts Joined: Nov 2010 |

Bbb

|

|

|

Oct 10 2023, 12:42 PM Oct 10 2023, 12:42 PM

Show posts by this member only | IPv6 | Post

#137

|

All Stars

11,667 posts Joined: Jan 2003 From: Klang/Subang |

Uuu

|

|

|

Oct 10 2023, 12:42 PM Oct 10 2023, 12:42 PM

|

Junior Member

140 posts Joined: Jul 2007 From: Puchong |

QUOTE(spider955 @ Oct 10 2023, 12:38 PM) You remind me my 3rd landed house loan Untung keje gomenHouse Price: rm430k Downpayment : Rm130k ( Big hole on my ASB) Loan + MRTT : 311k Tenure :11 years...yess i make 11 years loan!! starting april 2017 Monthy Rm2700-RM29++ (depend on BLR) best year during covid...reject moratorium since iam gov staff gaji tetap jalan Today outstanding: 181k Total bank makan for 11 years loan estimate: RM98k , yeah got pro and cons when high downpayment, shorter time but kill my itik telur emas ASB.. |

|

|

Oct 10 2023, 12:43 PM Oct 10 2023, 12:43 PM

Show posts by this member only | IPv6 | Post

#139

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 12:45 PM Oct 10 2023, 12:45 PM

|

Junior Member

683 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 12:47 PM Oct 10 2023, 12:47 PM

|

Newbie

4 posts Joined: Jun 2015 |

|

|

|

Oct 10 2023, 12:49 PM Oct 10 2023, 12:49 PM

|

Junior Member

422 posts Joined: Jan 2011 |

|

|

|

Oct 10 2023, 01:04 PM Oct 10 2023, 01:04 PM

Show posts by this member only | IPv6 | Post

#143

|

Junior Member

28 posts Joined: Jul 2022 |

QUOTE(Cincai lar @ Oct 10 2023, 11:29 AM) i think u got it wrong,.. 78k is paying back the capital,.. not interest,.. 30k is the interest,.. you're wrong. in the early years your installment paid mostly is just for the interest and very little capital paid.if u fully settle your loan today,.. then flat rate interest = (30k/108k) / 6 years = 4.6% very near current market what ?? |

|

|

Oct 10 2023, 01:38 PM Oct 10 2023, 01:38 PM

Show posts by this member only | IPv6 | Post

#144

|

Junior Member

341 posts Joined: Dec 2006 |

QUOTE(cuddlybubblyteddy @ Oct 10 2023, 10:19 AM) But tanah status pertanian right Nope....under pertanian allowed to built......everything is the same as normal house.......when u want to developed for housing..just change it to kediaman from pertanian.If you sell the house also under status pertanian? Not legit for residential development |

|

|

Oct 10 2023, 01:55 PM Oct 10 2023, 01:55 PM

Show posts by this member only | IPv6 | Post

#145

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Oct 10 2023, 02:01 PM Oct 10 2023, 02:01 PM

|

Junior Member

424 posts Joined: Sep 2015 |

Only 3 reasons to take housing loan:

1. Cannot afford to buy in cash 2. Investment opportunity to invest the cash that would yield greater returns compared to the Housing Loan interest rate. 3. Sked LHDN kacau, where the penalty will be higher than the Loan interest rate. |

|

|

Oct 10 2023, 02:12 PM Oct 10 2023, 02:12 PM

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

QUOTE(BullshitDetective @ Oct 10 2023, 01:04 PM) you're wrong. in the early years your installment paid mostly is just for the interest and very little capital paid. nobody ask you to pay the exact amount every month. if you can afford to hisap rokok , minum starbucks, makan hotpot every month, then that should be part of the principal. i paid off my 250k loan in 6 years. i have another 760k loan left 180k after 10 years of servicing it. probably 3 more years can kaotim. jojolicia liked this post

|

|

|

Oct 10 2023, 02:13 PM Oct 10 2023, 02:13 PM

Show posts by this member only | IPv6 | Post

#148

|

Senior Member

1,767 posts Joined: Jan 2019 |

That’s the price to pay for been poor.

If you’re rich to upfront the whole cost, you would had saved the 78k. This post has been edited by msacras: Oct 10 2023, 02:13 PM |

|

|

Oct 10 2023, 02:24 PM Oct 10 2023, 02:24 PM

|

Junior Member

333 posts Joined: Jun 2013 |

my loan 452k including MLTA (21k, full refund upon early settlement), now condo still under construction, so got progressive interest. already start paying full loan amount since March, the first month of interest. 1.8k principal, 200-250 interest every month. hnggg, still got another 3 years until the construction is done, dont know how much interest will be save till then, but quite a lot. ady repaid 14175.23 of my principal kiasunkiasi and max_cavalera liked this post

|

|

|

Oct 10 2023, 02:27 PM Oct 10 2023, 02:27 PM

|

Junior Member

453 posts Joined: Feb 2014 |

Bayangkan those beli RM2mil rumah.

RM2,000,000 x 0.045 / 365 x 30 = Monthly interesting RM7,400 Sakit ooo |

|

|

Oct 10 2023, 02:33 PM Oct 10 2023, 02:33 PM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(MKCL @ Oct 10 2023, 02:24 PM) my loan 452k including MLTA (21k, full refund upon early settlement), now condo still under construction, so got progressive interest. Kudos. already start paying full loan amount since March, the first month of interest. 1.8k principal, 200-250 interest every month. hnggg, still got another 3 years until the construction is done, dont know how much interest will be save till then, but quite a lot. ady repaid 14175.23 of my principal Try to do the progressive drawdown disbursed prepayment by the bank to developer, bro. Mininum past stage 2b&2c or further if cashflow permitted. You will see the saving and principal reduction over the time horizon come VP 36/48mths later This post has been edited by jojolicia: Oct 10 2023, 02:39 PM |

|

|

Oct 10 2023, 02:33 PM Oct 10 2023, 02:33 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(desmond2020 @ Oct 10 2023, 11:21 AM) Depends... PBB limits to 70% of current account balance - whatever amount you have in the current account, 30% of it will goyang telur. HLB is 70% of outstanding loan balance. QUOTE(moiskyrie @ Oct 10 2023, 11:38 AM) yup, i think is islamic.... I was told by the loan officer that Islamic loan is not the same as conventional... "it may be difficult for laymen to understand". You should call the bank to check your outstanding amount.i ask the banker, the banker say no need to see the amount, just pay nia... it will reduce at the end..... but pay 7 years already, the amount still same.... |

|

|

Oct 10 2023, 02:36 PM Oct 10 2023, 02:36 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(spider955 @ Oct 10 2023, 12:38 PM) You remind me my 3rd landed house loan IMO, you lose money by taking out from ASB to pay more downpayment if ASB gives you higher interest rate compared to home loan - especially for gomen staff kan? You only gain from potentially lower MRTT premium.House Price: rm430k Downpayment : Rm130k ( Big hole on my ASB) Loan + MRTT : 311k Tenure :11 years...yess i make 11 years loan!! starting april 2017 Monthy Rm2700-RM29++ (depend on BLR) best year during covid...reject moratorium since iam gov staff gaji tetap jalan Today outstanding: 181k Total bank makan for 11 years loan estimate: RM98k , yeah got pro and cons when high downpayment, shorter time but kill my itik telur emas ASB.. |

|

|

Oct 10 2023, 02:41 PM Oct 10 2023, 02:41 PM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(a13solut3 @ Oct 10 2023, 02:12 PM) nobody ask you to pay the exact amount every month. if you can afford to hisap rokok , minum starbucks, makan hotpot every month, then that should be part of the principal. Kudos. 👍i paid off my 250k loan in 6 years. i have another 760k loan left 180k after 10 years of servicing it. probably 3 more years can kaotim. This is called, you are in control in the name game of leveraging This post has been edited by jojolicia: Oct 10 2023, 02:43 PM |

|

|

Oct 10 2023, 02:43 PM Oct 10 2023, 02:43 PM

|

Senior Member

1,126 posts Joined: Feb 2011 From: Penang |

QUOTE(mushigen @ Oct 10 2023, 02:33 PM) Depends... PBB limits to 70% of current account balance - whatever amount you have in the current account, 30% of it will goyang telur. Bro can you explain what you mean by the 70% limit? I have a PBB housing loan (Islamic) and I’m planning to put a big bunch of cash from FD in there. Are you saying they only accept max of 70% outstanding loan amount paid in advance?HLB is 70% of outstanding loan balance. |

|

|

Oct 10 2023, 02:44 PM Oct 10 2023, 02:44 PM

|

Junior Member

333 posts Joined: Jun 2013 |

QUOTE(jojolicia @ Oct 10 2023, 02:33 PM) Kudos. what is progressive drawdown disbursed prepayment in layman terms ?Try to do the progressive drawdown disbursed prepayment by the bank to developer, bro. Mininum past stage 2b&2c or further if cashflow permitted. You will see the saving and principal reduction over the time horizon come VP 36/48mths later my loan currently already release 94k, based on progress. outstanding released amount is 79k. I dont have much in flexi loan as I spent most of them in downpayment, have like 6-10k, with additional 10k from bonus every yr |

|

|

Oct 10 2023, 02:45 PM Oct 10 2023, 02:45 PM

|

Junior Member

333 posts Joined: Jun 2013 |

QUOTE(KingArthurVI @ Oct 10 2023, 02:43 PM) Bro can you explain what you mean by the 70% limit? I have a PBB housing loan (Islamic) and I’m planning to put a big bunch of cash from FD in there. Are you saying they only accept max of 70% outstanding loan amount paid in advance? meaning your flexi loan can only offset interest up to 70% of the principal amount, if loan 100k, your flexi acc got 100k. they can still charge interest on 30k of the loan. it will never be 0% KingArthurVI liked this post

|

|

|

Oct 10 2023, 02:45 PM Oct 10 2023, 02:45 PM

|

Junior Member

117 posts Joined: Nov 2021 |

|

|

|

Oct 10 2023, 02:45 PM Oct 10 2023, 02:45 PM

Show posts by this member only | IPv6 | Post

#159

|

Junior Member

996 posts Joined: Mar 2019 |

|

|

|

Oct 10 2023, 02:46 PM Oct 10 2023, 02:46 PM

|

Senior Member

5,559 posts Joined: Aug 2011 |

QUOTE(billyboy @ Oct 10 2023, 09:29 AM) And it's a double-edged sword, that can serve and punish you. Just need to be smart. xiaojohn liked this post

|

|

|

Oct 10 2023, 02:47 PM Oct 10 2023, 02:47 PM

|

Senior Member

5,559 posts Joined: Aug 2011 |

QUOTE(robotking123 @ Oct 10 2023, 09:28 AM) Loan 350k Housing loan interest is simple to understand la, go get a loan without understanding is just dumb.Today outstanding: 320k Already served 6 years plus, 1500 monthly 6 x 12 x 1500 = 108k 108k - 30k = 78k Bank already earned 78k interest from me, bloody hell Gov should do sthg, how can house loan be so expensive... |

|

|

Oct 10 2023, 02:48 PM Oct 10 2023, 02:48 PM

|

Junior Member

246 posts Joined: Jun 2020 |

|

|

|

Oct 10 2023, 02:48 PM Oct 10 2023, 02:48 PM

|

Senior Member

5,559 posts Joined: Aug 2011 |

|

|

|

Oct 10 2023, 02:51 PM Oct 10 2023, 02:51 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(KingArthurVI @ Oct 10 2023, 02:43 PM) Bro can you explain what you mean by the 70% limit? I have a PBB housing loan (Islamic) and I’m planning to put a big bunch of cash from FD in there. Are you saying they only accept max of 70% outstanding loan amount paid in advance? This is what I know about full flexi PBB and HLB loans based on my experience. Full flexi loans have loan account and another current account opened to facilitate payment.HLB: let's say loan balance is RM100k. If you put in RM80k in this current acc, only RM70k will be used to offset the interest in the loan. PBB: loan balance is RM100k. If you put RM80k in the current account, only RM80k*70% will be used to offset the interest in the loan. For semi-flexi conventional loan, PBB allows 100% offset if you pay a lump sump (but not sure how to do it, either at counter or online), the catch is you cannot or it's very difficult if at all to draw out this extra payment. For Islamic loan, I have no idea bro. KingArthurVI liked this post

|

|

|

Oct 10 2023, 02:51 PM Oct 10 2023, 02:51 PM

Show posts by this member only | IPv6 | Post

#165

|

Junior Member

229 posts Joined: Feb 2022 |

QUOTE(MKCL @ Oct 10 2023, 02:24 PM) my loan 452k including MLTA (21k, full refund upon early settlement), now condo still under construction, so got progressive interest. do you know you still need to pay a lot money to maintain your condo?already start paying full loan amount since March, the first month of interest. 1.8k principal, 200-250 interest every month. hnggg, still got another 3 years until the construction is done, dont know how much interest will be save till then, but quite a lot. ady repaid 14175.23 of my principal |

|

|

Oct 10 2023, 02:51 PM Oct 10 2023, 02:51 PM

|

Senior Member

5,559 posts Joined: Aug 2011 |

QUOTE(robotking123 @ Oct 10 2023, 09:40 AM) House loan should follow car loan, max 9 years and fixed interest. Today bought Benz 300k loan 9 years also not this expensive. How come house loan interest so high than car? You are extra bodoh, a car loan's actual Effective Interest rate is nearly double the published simple interest rate. |

|

|

Oct 10 2023, 02:53 PM Oct 10 2023, 02:53 PM

Show posts by this member only | IPv6 | Post

#167

|

Junior Member

229 posts Joined: Feb 2022 |

QUOTE(spider955 @ Oct 10 2023, 12:47 PM) private is worst working conditions...and you need to be capable and competence....also gaji ciput....no bonus....you sure? spider955 liked this post

|

|

|

Oct 10 2023, 02:54 PM Oct 10 2023, 02:54 PM

Show posts by this member only | IPv6 | Post

#168

|

|

Elite

3,249 posts Joined: Oct 2011 |

Ts memang obvious troll since day one

dont bother explaining basic logic to him la |

|

|

Oct 10 2023, 02:54 PM Oct 10 2023, 02:54 PM

Show posts by this member only | IPv6 | Post

#169

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 02:55 PM Oct 10 2023, 02:55 PM

Show posts by this member only | IPv6 | Post

#170

|

Senior Member

848 posts Joined: Feb 2011 |

Inb4 turun padang or not

|

|

|

Oct 10 2023, 02:56 PM Oct 10 2023, 02:56 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 02:57 PM Oct 10 2023, 02:57 PM

|

Junior Member

333 posts Joined: Jun 2013 |

|

|

|

Oct 10 2023, 02:58 PM Oct 10 2023, 02:58 PM

Show posts by this member only | IPv6 | Post

#173

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 02:58 PM Oct 10 2023, 02:58 PM

Show posts by this member only | IPv6 | Post

#174

|

Newbie

10 posts Joined: Feb 2017 |

Thats why these kind of things which Muslims should fight and jihad against, Muslims dont do. Meanwhile only good at kacau dress code.

|

|

|

Oct 10 2023, 02:59 PM Oct 10 2023, 02:59 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 03:00 PM Oct 10 2023, 03:00 PM

Show posts by this member only | IPv6 | Post

#176

|

Junior Member

229 posts Joined: Feb 2022 |

QUOTE(MKCL @ Oct 10 2023, 02:57 PM) yes i know, maintenance fee 200, and reno maintenance fee is just a starting....it will be long terms commitment....but at least reduce quite an amount of interest in long run for the loan. paying 90% of the monthly installment to capital for the 1st yr quite syok not only renovations, furnitures etc....but also to repair the broken things/pipe/water leakage, and cleaning the house also a long terms cost.... don't forget cukai tanah cukai pintu....and MOT |

|

|

Oct 10 2023, 03:00 PM Oct 10 2023, 03:00 PM

|

Senior Member

5,366 posts Joined: Aug 2005 |

i sekaligus taruh 160k into the semi-flexi account for a principal of 430k

|

|

|

Oct 10 2023, 03:00 PM Oct 10 2023, 03:00 PM

|

Junior Member

614 posts Joined: Feb 2018 |

QUOTE(mushigen @ Oct 10 2023, 02:51 PM) This is what I know about full flexi PBB and HLB loans based on my experience. Full flexi loans have loan account and another current account opened to facilitate payment. maybank is the best then, can offset 100% HLB: let's say loan balance is RM100k. If you put in RM80k in this current acc, only RM70k will be used to offset the interest in the loan. PBB: loan balance is RM100k. If you put RM80k in the current account, only RM80k*70% will be used to offset the interest in the loan. For semi-flexi conventional loan, PBB allows 100% offset if you pay a lump sump (but not sure how to do it, either at counter or online), the catch is you cannot or it's very difficult if at all to draw out this extra payment. For Islamic loan, I have no idea bro. |

|

|

Oct 10 2023, 03:00 PM Oct 10 2023, 03:00 PM

Show posts by this member only | IPv6 | Post

#179

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 03:01 PM Oct 10 2023, 03:01 PM

Show posts by this member only | IPv6 | Post

#180

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 03:03 PM Oct 10 2023, 03:03 PM

|

Junior Member

453 posts Joined: Feb 2014 |

|

|

|

Oct 10 2023, 03:04 PM Oct 10 2023, 03:04 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(koja6049 @ Oct 10 2023, 03:00 PM) You cannot offset 100%. Will auto close account wei.The last time I asked, Maybank full flexi comes with compulsory overdraft facility. You don''t use put kena pay some fee (can't remember what it's called). The semi flexi is easier compared to PBB in terms of withdrawing excess payment when you need it iirc. |

|

|

Oct 10 2023, 03:04 PM Oct 10 2023, 03:04 PM

|

Senior Member

572 posts Joined: Nov 2004 |

This is the problem when school don't teach you financial management and loan calculation. xiaojohn liked this post

|

|

|

Oct 10 2023, 03:05 PM Oct 10 2023, 03:05 PM

|

Junior Member

614 posts Joined: Feb 2018 |

QUOTE(mushigen @ Oct 10 2023, 03:04 PM) You cannot offset 100%. Will auto close account wei. my account never closed. put 300k in, 300k interest less. That's 100% The last time I asked, Maybank full flexi comes with compulsory overdraft facility. You don''t use put kena pay some fee (can't remember what it's called). The semi flexi is easier compared to PBB in terms of withdrawing excess payment when you need it iirc. |

|

|

Oct 10 2023, 03:06 PM Oct 10 2023, 03:06 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(xiaojohn @ Oct 10 2023, 03:00 PM) Those doctors and proffessionals, takkan all of them buy using company money? I wonder how you come to the conclusion people don't use own money and name to buy RM2mln properties. It's not that expensive for these people. |

|

|

Oct 10 2023, 03:07 PM Oct 10 2023, 03:07 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 03:11 PM Oct 10 2023, 03:11 PM

|

Junior Member

614 posts Joined: Feb 2018 |

|

|

|

Oct 10 2023, 03:12 PM Oct 10 2023, 03:12 PM

|

Senior Member

992 posts Joined: Jan 2003 From: Malaysia |

If leasehold, after 99 years. Govt can claim land, redevelop and sell bak to your grandchildren.

Happened to some shoplot owners in undisclosed location in Malaysia. |

|

|

Oct 10 2023, 03:12 PM Oct 10 2023, 03:12 PM

|

Senior Member

1,922 posts Joined: Feb 2016 |

QUOTE(MKCL @ Oct 10 2023, 02:44 PM) what is progressive drawdown disbursed prepayment in layman terms ? Progressive drawdown disbursed mean loan released for the stage completion. Example if spa 600k. Completion of stage 2a piling (10%-60k) stage 2b structure (15%-90k) and so on. my loan currently already release 94k, based on progress. outstanding released amount is 79k. I dont have much in flexi loan as I spent most of them in downpayment, have like 6-10k, with additional 10k from bonus every yr For highrise, these 2 stages will incur longest/ most cummulative u/c progressive interest till VP. Therefore work towards to zerorize 2a&2b in the coming 36 months, the sooner the better prior to VP. This post has been edited by jojolicia: Oct 10 2023, 03:41 PM |

|

|

Oct 10 2023, 03:13 PM Oct 10 2023, 03:13 PM

|

Junior Member

219 posts Joined: Nov 2021 |

|

|

|

Oct 10 2023, 03:13 PM Oct 10 2023, 03:13 PM

Show posts by this member only | IPv6 | Post

#191

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 03:13 PM Oct 10 2023, 03:13 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 03:14 PM Oct 10 2023, 03:14 PM

Show posts by this member only | IPv6 | Post

#193

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 03:14 PM Oct 10 2023, 03:14 PM

|

Junior Member

614 posts Joined: Feb 2018 |

|

|

|

Oct 10 2023, 03:15 PM Oct 10 2023, 03:15 PM

|

Junior Member

614 posts Joined: Feb 2018 |

|

|

|

Oct 10 2023, 03:15 PM Oct 10 2023, 03:15 PM

Show posts by this member only | IPv6 | Post

#196

|

Junior Member

229 posts Joined: Feb 2022 |

QUOTE(mushigen @ Oct 10 2023, 03:06 PM) Those doctors and proffessionals, takkan all of them buy using company money? I wonder how you come to the conclusion people don't use own money and name to buy RM2mln properties. It's not that expensive for these people. doctors also got Sdn Bhd geh....don't be surprised....even so, they can lease back or use rental contract to back up... |

|

|

Oct 10 2023, 03:17 PM Oct 10 2023, 03:17 PM

Show posts by this member only | IPv6 | Post

#197

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 03:18 PM Oct 10 2023, 03:18 PM

|

Junior Member

219 posts Joined: Nov 2021 |

|

|

|

Oct 10 2023, 03:19 PM Oct 10 2023, 03:19 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 03:19 PM Oct 10 2023, 03:19 PM

|

Senior Member

719 posts Joined: Jul 2011 |

If u loan me 350k, after 35 years total i pay to you is 700k, will u approve?

|

|

|

Oct 10 2023, 03:20 PM Oct 10 2023, 03:20 PM

Show posts by this member only | IPv6 | Post

#201

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |