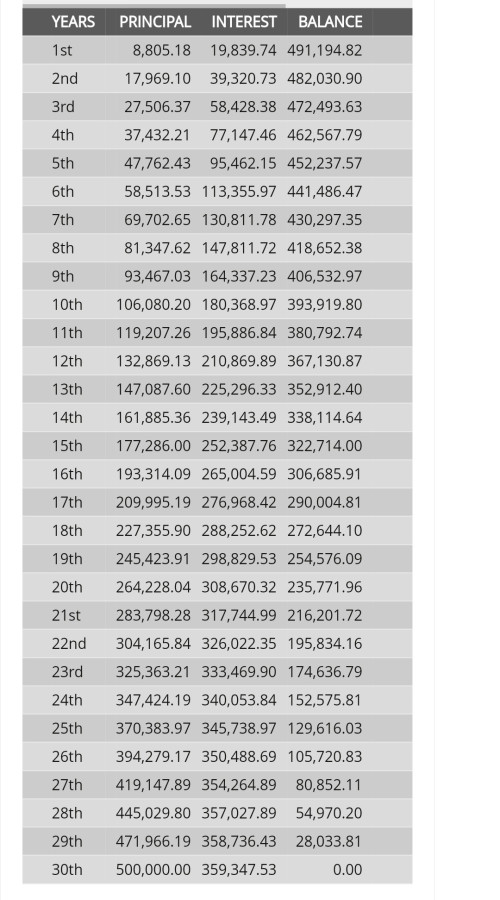

lets say u borrow 500k for 30 year 4%, at the end u have to pay 359k interest on top of the 500k.

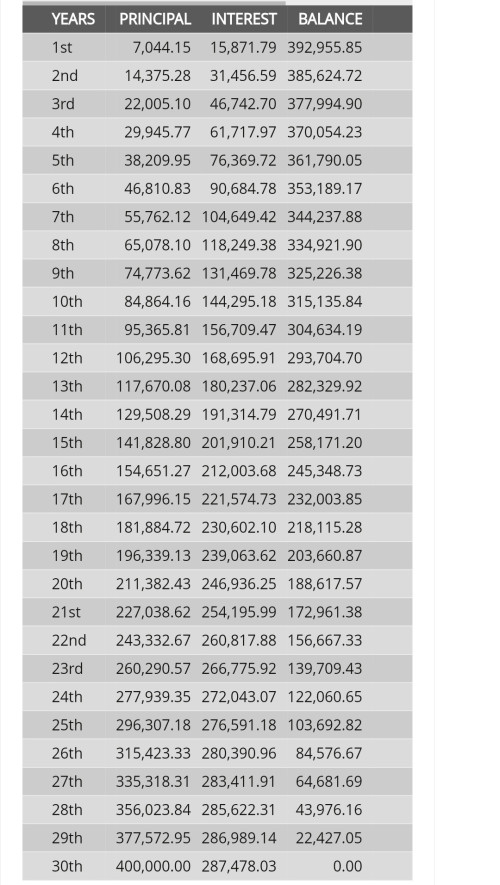

but if u pay 100k downpayment and borrow 400k for 30 years at 4%, at the end u have to pay 287k interest on top of 500k.

difference is u save rm 72k on interest

but, if u take that 100k and dump into epf lets say 5.5% for 30 years, u will have 498k after 30 years.

minus the 72k due to house loan interest difference, u still have 426k extra.

so for me, is really no brainer la, i sure whack highest loan tenure as possible and save the money elsewhere with higher return than house loan.

but will get in trouble if use it to leverage and borrow more to goreng house. once opr hike more than epf rate then gg

Housing loan is scary

Oct 10 2023, 04:15 PM

Oct 10 2023, 04:15 PM

Quote

Quote

0.0132sec

0.0132sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled