QUOTE(cuddlybubblyteddy @ Oct 10 2023, 03:59 PM)

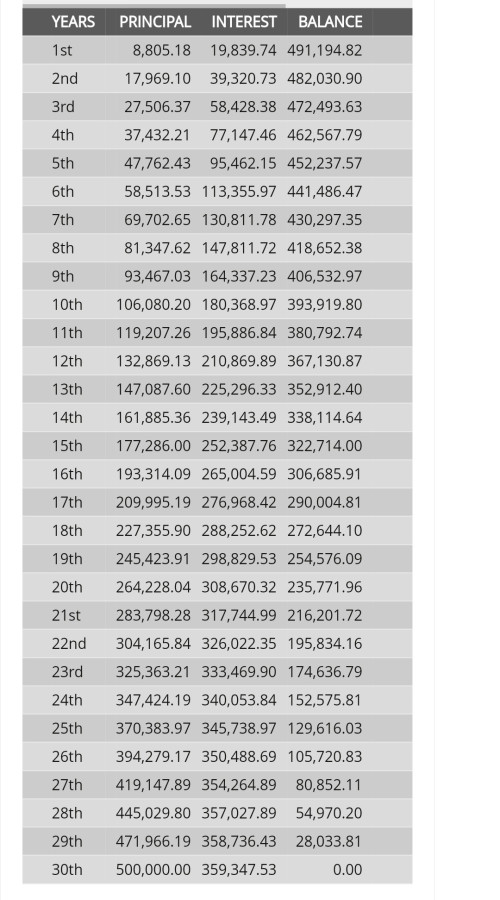

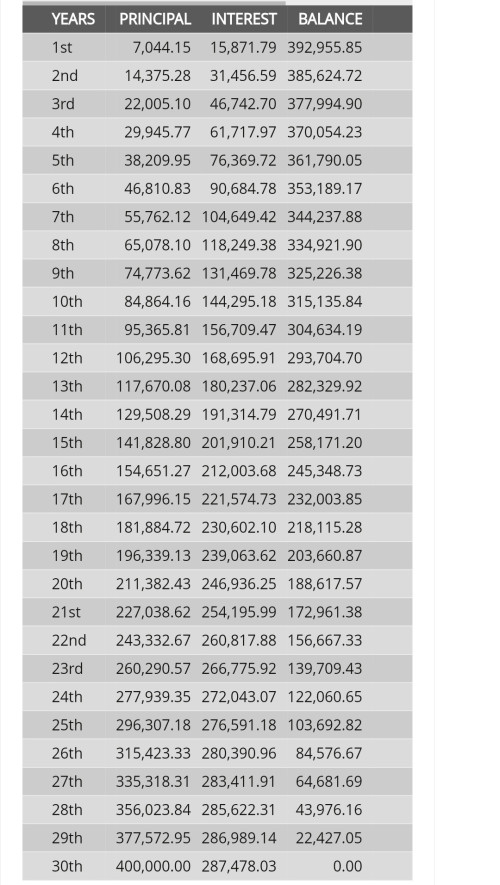

Let say I want to buy an apartment cost about rm600k, should I take 90% loan? Or 50% loan instead?

Throw cash 300k as deposit, then 300k with 10 years loan

However on 3rd year of loan I can settle the loan, anyone can help calculate how much interest I could save?

Tak bagi interest rate how to calculate? Throw cash 300k as deposit, then 300k with 10 years loan

However on 3rd year of loan I can settle the loan, anyone can help calculate how much interest I could save?

Also some loan got 5 years lock in period which need to pay penalty for early settlement.

Oct 10 2023, 04:13 PM

Oct 10 2023, 04:13 PM

Quote

Quote

0.0156sec

0.0156sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled