QUOTE(KingArthurVI @ Oct 10 2023, 02:43 PM)

Bro can you explain what you mean by the 70% limit? I have a PBB housing loan (Islamic) and I’m planning to put a big bunch of cash from FD in there. Are you saying they only accept max of 70% outstanding loan amount paid in advance?

This is what I know about full flexi PBB and HLB loans based on my experience.

Full flexi loans have loan account and another current account opened to facilitate payment.

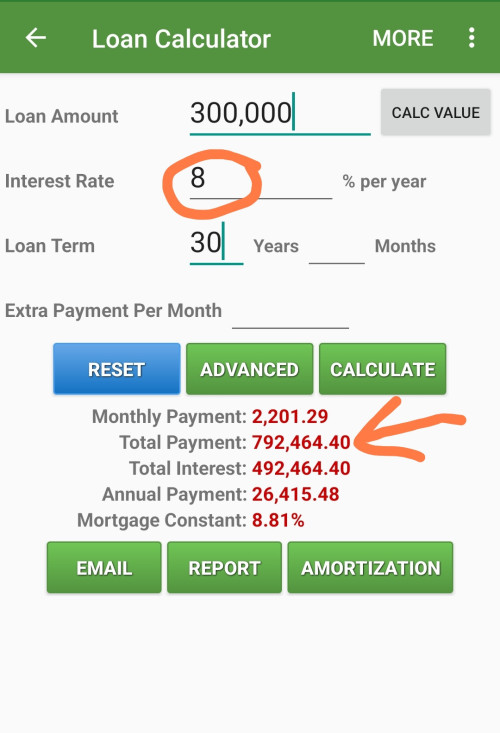

HLB: let's say loan balance is RM100k. If you put in RM80k in this current acc, only RM70k will be used to offset the interest in the loan.

PBB: loan balance is RM100k. If you put RM80k in the current account, only RM80k*70% will be used to offset the interest in the loan.

For semi-flexi conventional loan, PBB allows 100% offset if you pay a lump sump (but not sure how to do it, either at counter or online), the catch is you cannot or it's very difficult if at all to draw out this extra payment.

For Islamic loan, I have no idea bro.

Oct 10 2023, 09:52 AM

Oct 10 2023, 09:52 AM

Quote

Quote

0.0249sec

0.0249sec

0.67

0.67

7 queries

7 queries

GZIP Disabled

GZIP Disabled