QUOTE(bogletails @ Jun 16 2022, 07:44 PM)

Fsmone RSP is actually very cheap with 1usd fee only. Ibkr real cost is actually high because got a lot of minimum amount. (For example, convert money to sgd cost maybe Rm5-15) (convert SGD to USD cost 2usd minimum ), then broker fee 0.35usd. this is very expensive way if you want to DCA monthly. Or your dca amount is small.

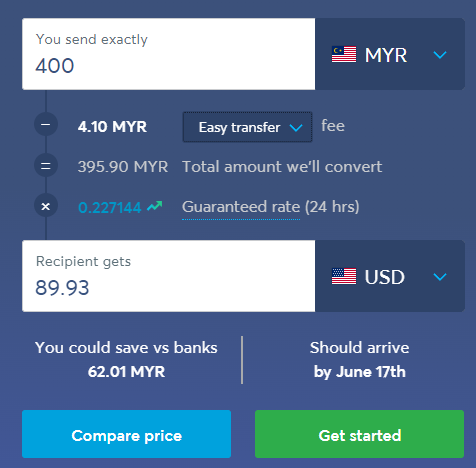

If use ACH wise direct myr to USD also cost quite a lot fee in wise.

Fsmone is cheap because it use fixed percentage for the currency conversion part. And 1++ USD fee for broker only.

I don't know why Rayleigh keep saying rsp is expensive.. I have done the cost calculation for everything. If you DCA monthly. RSP is the cheapest way.

QUOTE(bogletails @ Jun 16 2022, 07:46 PM)

Maybe u should calculate the real cost for Ibkr path first. You conveniently ignored all those currency exchange fee from wise and use 0.35usd to compare it with 1usd fsmone. Very unfair lol.

Please don't take me wrongly. I am not here to diss or promote one platform over the other. I am not saying that FSM RSP is a lot more expensive than IBKR. Initially that may be my impression of FSM RSP, but after doing further calculation, my opinion is that it is only slightly more expensive than IBKR's, but it is still a decent choice if your goal is to set up a monthly RSP. I may still be wrong for all I know. So if you have the numbers and don't mind sharing the calculations, it may do good to everyone. Who knows, maybe you would have shed some light to everyone and this FSM RSP may prove to be a competitive platform to the existing options. Again, I am not trying to be sarcastic here, in case my typing come across as that.

Even through IBKR, I do not do monthly transactions since I am trying to minimize my cost. Therefore, I only do a transaction every few months after pooling sufficient money to reduce the commission to an acceptable amount personally. This is what I was comparing to when I mentioned that FSM fees are more expensive that IBKR, especially if you conduct transactions outside of the your RSP (USD8.80 per transaction).

To be fair, in making my previous statements and assessments I should have also mentioned that I do not invest in USD denominated ETF. I mainly invest in GBP denominated ETF. The cost here is only the minimal fee at Wise and the brokerage commission. Therefore, I am may not have been aware of the costs involved for ACH wise direct from MYR to USD. Are there additional fees or is the rate as shown as when we check on Wise front page? Perhaps you can share your knowledge with me.

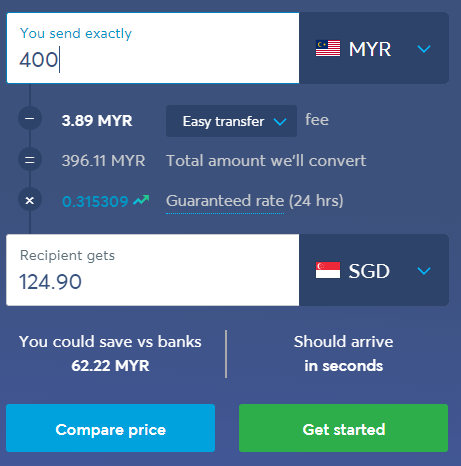

On a side note, Wise fees for RM400 to SDG only costs ~RM4. Why do you quote up to RM15. Is that the cost for a different platform?

This post has been edited by RayleighH: Jun 16 2022, 08:43 PM

This post has been edited by RayleighH: Jun 16 2022, 08:43 PM

Jun 16 2022, 07:46 PM

Jun 16 2022, 07:46 PM

Quote

Quote

0.0311sec

0.0311sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled