can FSMOne's ETF RSP buy fractional share of VT ? If yes gonna pay RM 10 to activate CDS account.

Bogleheads Local Chapter [Malaysia Edisi]

Bogleheads Local Chapter [Malaysia Edisi]

|

|

Jun 4 2022, 03:58 PM Jun 4 2022, 03:58 PM

|

Probation

37 posts Joined: May 2019 |

can FSMOne's ETF RSP buy fractional share of VT ? If yes gonna pay RM 10 to activate CDS account.

|

|

|

|

|

|

Jun 4 2022, 04:05 PM Jun 4 2022, 04:05 PM

Show posts by this member only | IPv6 | Post

#422

|

All Stars

14,866 posts Joined: Mar 2015 |

QUOTE(nguminhuang @ Jun 4 2022, 03:58 PM) maybe can try check this out? while waiting for value added responseshttps://www.fsmone.com.my/etfs/tools/stocks-calculator |

|

|

Jun 4 2022, 04:55 PM Jun 4 2022, 04:55 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Jun 4 2022, 06:05 PM Jun 4 2022, 06:05 PM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

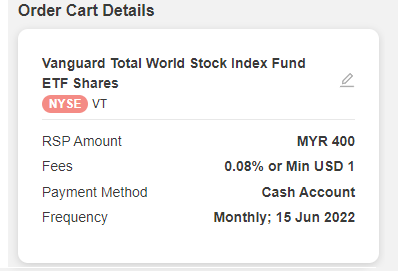

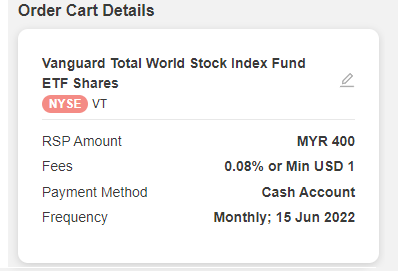

QUOTE(nguminhuang @ Jun 4 2022, 03:58 PM) i think the answer is yes, can! see screenshot. and yea, VT is part of the first 50 US ETFs with the RSP plan.or you could always call up FSM during office hours to confirm. customer service quite good. Attached thumbnail(s)

Ramjade liked this post

|

|

|

Jun 4 2022, 06:21 PM Jun 4 2022, 06:21 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Jun 4 2022, 06:59 PM Jun 4 2022, 06:59 PM

Show posts by this member only | IPv6 | Post

#426

|

All Stars

14,866 posts Joined: Mar 2015 |

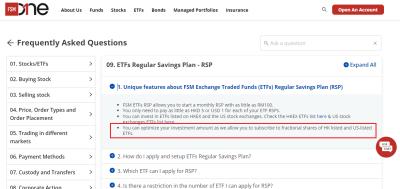

QUOTE(Ramjade @ Jun 4 2022, 06:21 PM) while waiting for his confirmation,...i think it is the FSM MY version https://www.fsmone.com.my/support/frequentl...tUniqueKey=2892 Attached thumbnail(s)

|

|

|

|

|

|

Jun 4 2022, 07:10 PM Jun 4 2022, 07:10 PM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Jun 7 2022, 05:41 PM Jun 7 2022, 05:41 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Hoshiyuu @ May 5 2022, 12:02 AM) A great add-on to my previous post. "If you’re excited about an investment, it’s probably not a good investment." https://open.spotify.com/episode/0ijwnRMl39Pxhpy80rCiyC |

|

|

Jun 7 2022, 06:36 PM Jun 7 2022, 06:36 PM

|

Probation

37 posts Joined: May 2019 |

i just applied for RSP FSM one for VT. the fees is only 0.08% or 1USD min fee. can't wait to see the conversion rate  encikbuta liked this post

|

|

|

Jun 7 2022, 09:00 PM Jun 7 2022, 09:00 PM

|

Junior Member

171 posts Joined: Nov 2015 |

QUOTE(nguminhuang @ Jun 7 2022, 06:36 PM) i just applied for RSP FSM one for VT. the fees is only 0.08% or 1USD min fee. can't wait to see the conversion rate Your RSP value is only RM400, so your fees will be roughly 1.1% for every transaction. Kinda missing out of the purpose of Vanguard funds with their low fees of 0.08%. Perhaps it might be possible to adjust the RSP to a longer frequency so that your transaction is at least RM5500 to keep your fees to the minimum? In FSM's VT webpage, there is a calculator tab. The fees quoted there seems to be quite expensive. Not sure if these are extra fees inclusive of the 0.08% or USD1 min.  This post has been edited by RayleighH: Jun 7 2022, 09:38 PM |

|

|

Jun 7 2022, 11:53 PM Jun 7 2022, 11:53 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(RayleighH @ Jun 7 2022, 09:00 PM) Your RSP value is only RM400, so your fees will be roughly 1.1% for every transaction. Kinda missing out of the purpose of Vanguard funds with their low fees of 0.08%. Perhaps it might be possible to adjust the RSP to a longer frequency so that your transaction is at least RM5500 to keep your fees to the minimum? I have flagged before FSM RSP for US listed ETF not cheap. HKEX ETF ok cheap. But sometimes investors prefer local broker with a presence in own country so then FSM RSP look good encikbuta liked this post

|

|

|

Jun 8 2022, 02:43 PM Jun 8 2022, 02:43 PM

|

Junior Member

171 posts Joined: Nov 2015 |

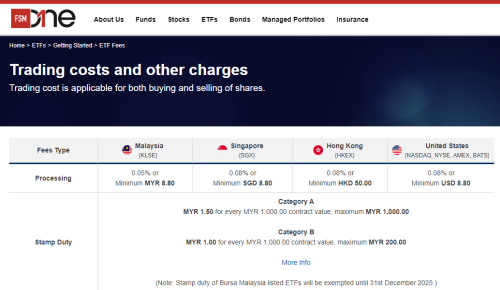

QUOTE(sgh @ Jun 7 2022, 11:53 PM) I have flagged before FSM RSP for US listed ETF not cheap. HKEX ETF ok cheap. But sometimes investors prefer local broker with a presence in own country so then FSM RSP look good After some digging, I found out that the the minimum fee of 0.08% or USD1.00 is for monthly RSP. I could only find this information published in FSM Singapore's website (Link). Not sure where this information is on FSM Malaysia's website. To enjoy the low rate of 0.08%, one will have to be able to contribute, monthly, at least USD1,250 or MYR5,500.  If you can't afford to fork out this much per month and decide to only do a lump sump purchase after saving up for a few months, the minimum fee is at an exorbitant rate of 0.08% or USD8.80 (Link). In order to enjoy the low rate of 0.08% fees, one will have to make a lump sum purchase of USD11,000 or MYR48,300. That is freaking expensive.  I don't think it is wise to invest in ETFs through FSM unless if you are able to fork out the amount mentioned above. Otherwise, FSM fees basically defeat the whole purpose of ETF investing which is their extremely low total expense ratios. You're better off going through a different brokerage like IBKR. Perhaps their exorbitant fees is to protect the other UT funds available through their FSM website. Otherwise, probably many people will withdraw money from other UT funds to ETFs. This post has been edited by RayleighH: Jun 8 2022, 02:47 PM Hoshiyuu liked this post

|

|

|

Jun 8 2022, 03:42 PM Jun 8 2022, 03:42 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(RayleighH @ Jun 8 2022, 02:43 PM) After some digging, I found out that the the minimum fee of 0.08% or USD1.00 is for monthly RSP. I could only find this information published in FSM Singapore's website (Link). Not sure where this information is on FSM Malaysia's website. To enjoy the low rate of 0.08%, one will have to be able to contribute, monthly, at least USD1,250 or MYR5,500. I think above is wrong. The whole idea of FSM RSP ETF is to allow investors to put in small amount every month. When you say MYR5,500 you calculate based on ? Can give e.g ?My understanding is say MYR 100 then pay 0.08% is 0.08 cents or minimum USD 1. Due to the minimum of USD 1 the monthly amount if put small yes rugi. Which is why I never go for FSM RSP ETF for US listed ETF. I use it for HKEX, SGX listed ETF instead. For ppl want to RSP US listed ETF, my current suggestion would be IBKR and Webull which unfortunately is not operating in Msia so it is considered overseas broker and some Msian investors have doubts which is ok. Then FSM MY is your next closest I guess. |

|

|

|

|

|

Jun 8 2022, 05:45 PM Jun 8 2022, 05:45 PM

|

Junior Member

171 posts Joined: Nov 2015 |

QUOTE(sgh @ Jun 8 2022, 03:42 PM) I think above is wrong. The whole idea of FSM RSP ETF is to allow investors to put in small amount every month. When you say MYR5,500 you calculate based on ? Can give e.g ? The USD1,250 is based on the assumption that one will want to minimize the brokerage fee. In this case with FSM, one can minimize to the point where the fees are only 0.08% of your purchase cost.My understanding is say MYR 100 then pay 0.08% is 0.08 cents or minimum USD 1. Due to the minimum of USD 1 the monthly amount if put small yes rugi. Which is why I never go for FSM RSP ETF for US listed ETF. I use it for HKEX, SGX listed ETF instead. For ppl want to RSP US listed ETF, my current suggestion would be IBKR and Webull which unfortunately is not operating in Msia so it is considered overseas broker and some Msian investors have doubts which is ok. Then FSM MY is your next closest I guess. The calculation is as follow: 0.08/100 x Z = USD1.00 Z = USD1,250 or MYR5,500 (1USD = MYR4.40) Any purchase above this amount will entitle you to enjoy the low fees of 0.08%. Any purchase below this amount and a higher portion of your RSP will go to fees. |

|

|

Jun 8 2022, 05:57 PM Jun 8 2022, 05:57 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(RayleighH @ Jun 8 2022, 05:45 PM) The USD1,250 is based on the assumption that one will want to minimize the brokerage fee. In this case with FSM, one can minimize to the point where the fees are only 0.08% of your purchase cost. Thank you for your clear e.g You see FSM RSP ETF I think was created for ppl with low capital but still want to participate in the ETF shares buy. So yes your illustration is coming from want to minimize brokerage fees that is how you get that big number. But if one has that big number will not consider this RSP ETF anymore.The calculation is as follow: 0.08/100 x Z = USD1.00 Z = USD1,250 or MYR5,500 (1USD = MYR4.40) Any purchase above this amount will entitle you to enjoy the low fees of 0.08%. Any purchase below this amount and a higher portion of your RSP will go to fees. Now say Msian want a local broker to buy US ETF shares at affordable cost (aka low capital) what would you recommend? You need to know some ppl can only consider local broker and that will narrow down the choices isn't it? |

|

|

Jun 8 2022, 06:08 PM Jun 8 2022, 06:08 PM

|

Junior Member

171 posts Joined: Nov 2015 |

QUOTE(sgh @ Jun 8 2022, 05:57 PM) Thank you for your clear e.g You see FSM RSP ETF I think was created for ppl with low capital but still want to participate in the ETF shares buy. So yes your illustration is coming from want to minimize brokerage fees that is how you get that big number. But if one has that big number will not consider this RSP ETF anymore. If your uncompromisable criteria is "local broker", then I don't think you have any other choice. If I am not mistaken, IBKR started becaming popular among Malaysians a few years back also because there were no other affordable option to purchase US ETFs. In fact, if one does not mind foreign broker, IBKR fees are much cheaper than FSM ETF even for people with low capital. USD0.35 per transaction.Now say Msian want a local broker to buy US ETF shares at affordable cost (aka low capital) what would you recommend? You need to know some ppl can only consider local broker and that will narrow down the choices isn't it?  |

|

|

Jun 8 2022, 06:14 PM Jun 8 2022, 06:14 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(RayleighH @ Jun 8 2022, 06:08 PM) If your uncompromisable criteria is "local broker", then I don't think you have any other choice. If I am not mistaken, IBKR started becaming popular among Malaysians a few years back also because there were no other affordable option to purchase US ETFs. In fact, if one does not mind foreign broker, IBKR fees are much cheaper than FSM ETF even for people with low capital. USD0.35 per transaction. That has been 'broken' recently by Webull Spore which is 0 per transaction. Since both are overseas broker, one may want to consider Webull Spore over IBKR but of cuz in terms of strength and size IBKR is bigger so pay 35 cents per transaction if you want that. But it seems the Webull Spore app is somehow blocked for install for Msian so yes stick to IBKR. |

|

|

Jun 8 2022, 06:19 PM Jun 8 2022, 06:19 PM

Show posts by this member only | IPv6 | Post

#438

|

Junior Member

171 posts Joined: Nov 2015 |

QUOTE(sgh @ Jun 8 2022, 06:14 PM) That has been 'broken' recently by Webull Spore which is 0 per transaction. Since both are overseas broker, one may want to consider Webull Spore over IBKR but of cuz in terms of strength and size IBKR is bigger so pay 35 cents per transaction if you want that. But it seems the Webull Spore app is somehow blocked for install for Msian so yes stick to IBKR. I remember before IBKR, the discussion around here was about TD. Unfortunately Malaysians do not have easy access to TD. Therefore, the discussion progress got stalled for a while till IBKR became an option through Tradestation. Perhaps in the future Malaysians will also have access to brokerage which charges zero commission for ETFs, hopefully.This post has been edited by RayleighH: Jun 8 2022, 06:20 PM |

|

|

Jun 13 2022, 01:17 PM Jun 13 2022, 01:17 PM

Show posts by this member only | IPv6 | Post

#439

|

Probation

12 posts Joined: Jun 2022 |

QUOTE(sgh @ Jun 8 2022, 03:42 PM) I think above is wrong. The whole idea of FSM RSP ETF is to allow investors to put in small amount every month. When you say MYR5,500 you calculate based on ? Can give e.g ? Hello everyone, My understanding is say MYR 100 then pay 0.08% is 0.08 cents or minimum USD 1. Due to the minimum of USD 1 the monthly amount if put small yes rugi. Which is why I never go for FSM RSP ETF for US listed ETF. I use it for HKEX, SGX listed ETF instead. For ppl want to RSP US listed ETF, my current suggestion would be IBKR and Webull which unfortunately is not operating in Msia so it is considered overseas broker and some Msian investors have doubts which is ok. Then FSM MY is your next closest I guess. I find the conversation about FSM RSP ETF fascinating as it'll be good to automate my investments. However, I'm super confused about the fee structure due to the discussion. As far as I understand, let's say your RSP is RM2000 a month. The transaction fee should then be 0.08% of the RSP or min US1. So in this case, it'll be US$1 - RM4.50 which, for local brokers, is considered quite affordable compared to Rakuten's RM8 per trade or MIDF's freaking RM36 per trade. This is, of course, for those who prefer local brokers like me. (I have been told to death that IBKR is cheaper, I totally get it lol) Am I correct on the math here here or off base? |

|

|

Jun 13 2022, 02:24 PM Jun 13 2022, 02:24 PM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(CoastFireSoon @ Jun 13 2022, 01:17 PM) Hello everyone, yea correct! and to further strengthen your case, if you invest RM2000 in Rakuten, the brokerage charge goes to the next tier which is RM9 per trade, lol. and on top of that, there's the stamp duty (RM1 charge for every RM1000 invested). but that (stamp duty) applies anyway on top of the brokerage charge for any local platform. if you prefer local platform (like me), looks like FSM ETF RSP plan is the way to go.I find the conversation about FSM RSP ETF fascinating as it'll be good to automate my investments. However, I'm super confused about the fee structure due to the discussion. As far as I understand, let's say your RSP is RM2000 a month. The transaction fee should then be 0.08% of the RSP or min US1. So in this case, it'll be US$1 - RM4.50 which, for local brokers, is considered quite affordable compared to Rakuten's RM8 per trade or MIDF's freaking RM36 per trade. This is, of course, for those who prefer local brokers like me. (I have been told to death that IBKR is cheaper, I totally get it lol) Am I correct on the math here here or off base? i have already dumped RM150k into Rakuten (all in VT), a month before FSM introduced the damn ETF RSP plan! so by my own accord, i'm currently 'stuck' in Rakuten because of three reasons: i) the market situation is damn volatile now so i sked i might miss the recovery window while I'm transferring my VT purchases from Rakuten to FSM. I mean, it could work the other way round (i.e. i benefit from evading further drops in the market during the transfer) but i'm not a gambling man. ii) the fees involved to do the transfer is rather high especially for my amount of money. iii) compulsive me cannot tahan having two separate brokerages for the same ETF/holding. This post has been edited by encikbuta: Jun 13 2022, 06:10 PM |

| Change to: |  0.0292sec 0.0292sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 10:49 PM |