QUOTE(ornehx @ Aug 28 2025, 05:10 PM)

Anyone with experience with Kaotim product, specifically Kaotim Medikad and Kaotim Legasi?

Looking for standalone, agentless, online type. I check Fi-Life but seems Legasi is much cheaper. Kaotim is by myTakaful, should be ok?

Kaotim is underwritten by Syarikat Takaful Malaysia Berhad, a license takaful company. if not mistaken, STMB is owned by Bank Islam.

Long story short, it's a legit company, running a legit business. do choose a higher deductible if you can when you buy. i recall they have deductible option of 2k or 3k.

QUOTE(Jason @ Aug 27 2025, 01:51 AM)

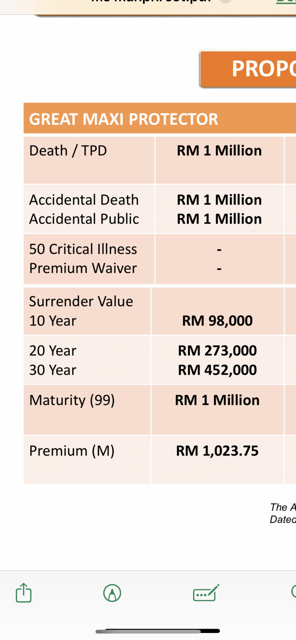

ayam very confused, I think these ILP stuff is hiding a lot of things behind the scenes and agents misrepresenting stuff to sell.

tolong advise

1. I got existing life+ci with medical rider with GE. If I ONLY want to drop the medical rider do I need to cancel the whole policy? or just drop the rider and maintain the existing policy. And if I drop the medical rider, premium logically should go down right? why my agent quote me a new policy.. I just want to remove the medical rider and buy a new medical policy. Or insurance so stupid must cancel my existing policy just because I wanna remove a rider. If my old policy remove and start from 0 again.. fk this insurance I just go other company lah

2. how come same insurance (GE) same policy, same waiver, same deductible, same rider.. 1 agent quote Rm300/month another agent RM200/month... coverage same, benefits same.. everything same but such huge discrepancy..

1st agent.. show as age progress..premium increase..but the rm200 show same monthly premium up to age 100..not possible kan..

1. i am 99.99% confident, you can just drop your medical rider, maintain the whole policy. and rightfully, you will receive a premium reduction.

2. there are other "factors" that are at play which are quite technical to explain. Usually, it will be the sustainability age of the policy, fund selection as well. of course, obviously we are referring to the exact same product. but however, what you are explaining sounds like their mechanism works differently, so it's not the exact same thing.

Aug 27 2025, 04:01 PM

Aug 27 2025, 04:01 PM

Quote

Quote

0.0204sec

0.0204sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled