QUOTE(owllo @ Jun 18 2021, 04:23 PM)

any general insurance ppl here? Need help to pass the PCEIA exam... failed 3 times already.. anyone can send me past year questions?

hi owllo. you want PCE AB or PCE A only? most candidates i know study only the sample questions or only understand the sample questions to pass the exam. perhaps you can try that. best is to understand the whole context of the text book. familiarizing the questions is good so you know roughly how the question is like.

if you only want the PCE A, i can send it to you. just PM me your email address.

QUOTE(coldbasecamp @ Jun 18 2021, 10:13 PM)

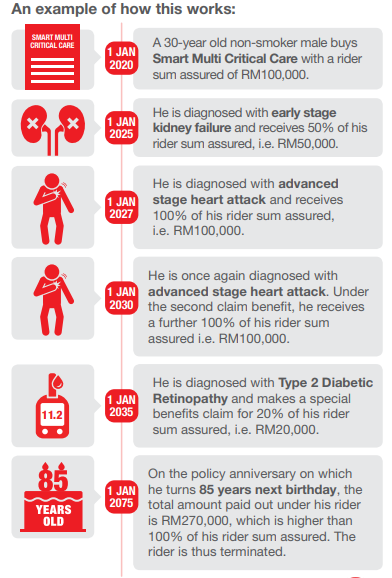

My friend recently sold me a CI plan by GE.

according to him, there is an unlimited claim for the illness.

like I got heart attack on 2021, 2023, 2027, 2035 will be eligible to claim 4 times of the insured amount.

was wondering is that true? thinking it is too good to be true.

hi coldbasecamp, not to say "unlimited". there is a maximum of only up to 800% sum assured claims. but of course this 800% is not from 1 critical illness only, that is if you managed to claim all the category. also take note on the recurring claim criteria, i think this is more crucial and easier to get mislead for example cancer, heart attack and stroke multiple claim criteria. make sure agent explained this to you clearly so you know what you are paying for.

Jun 18 2021, 10:13 PM

Jun 18 2021, 10:13 PM

Quote

Quote

0.0217sec

0.0217sec

0.26

0.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled