QUOTE(Aghi @ Jun 24 2021, 01:38 AM)

What amount of deductible you're looking at?Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jun 24 2021, 01:41 AM Jun 24 2021, 01:41 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

|

|

|

Jun 24 2021, 01:49 AM Jun 24 2021, 01:49 AM

Show posts by this member only | IPv6 | Post

#702

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(lifebalance @ Jun 24 2021, 01:41 AM) Maybe around 20k because I have company insurance. So can I can use my company insurance for the deductible and then use my own plan? I'm so new to this things. Just start looking around wongmunkeong liked this post

|

|

|

Jun 24 2021, 08:00 AM Jun 24 2021, 08:00 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Aghi @ Jun 24 2021, 01:49 AM) Maybe around 20k because I have company insurance. So can I can use my company insurance for the deductible and then use my own plan? $20K is exactly my deductible for my children's & my medical insurance with Pru. For my age 49, i'm paying $2.6k pa, my 15yo girl's $1.27K pa & my boy's $1.88K paI'm so new to this things. Just start looking around just sharing to give U an idea of cost --- Additional post/edit: Wow - some forumers either parkinson's disease coz accidentally clicked REPORT POST twice OR some agents trying to be funny. I'm a buyer, not even in the insurance industry, baka... This post has been edited by wongmunkeong: Jun 24 2021, 12:00 PM Jason, roystevenung, and 1 other liked this post

|

|

|

Jun 24 2021, 01:05 PM Jun 24 2021, 01:05 PM

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(wongmunkeong @ Jun 24 2021, 08:00 AM) $20K is exactly my deductible for my children's & my medical insurance with Pru. For my age 49, i'm paying $2.6k pa, my 15yo girl's $1.27K pa & my boy's $1.88K pa I hope your girls and boys plan are not just purely medical. Else 1.2k and 1.9k is very expensive for 20k deductible.just sharing to give U an idea of cost --- Additional post/edit: Wow - some forumers either parkinson's disease coz accidentally clicked REPORT POST twice OR some agents trying to be funny. I'm a buyer, not even in the insurance industry, baka... wongmunkeong liked this post

|

|

|

Jun 24 2021, 10:48 PM Jun 24 2021, 10:48 PM

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(wongmunkeong @ Jun 24 2021, 08:00 AM) $20K is exactly my deductible for my children's & my medical insurance with Pru. For my age 49, i'm paying $2.6k pa, my 15yo girl's $1.27K pa & my boy's $1.88K pa You taking ilp? it seen quite priceyjust sharing to give U an idea of cost --- Additional post/edit: Wow - some forumers either parkinson's disease coz accidentally clicked REPORT POST twice OR some agents trying to be funny. I'm a buyer, not even in the insurance industry, baka... haha why would they wan report wongmunkeong liked this post

|

|

|

Jun 24 2021, 11:05 PM Jun 24 2021, 11:05 PM

Show posts by this member only | IPv6 | Post

#706

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(Aghi @ Jun 24 2021, 01:49 AM) Maybe around 20k because I have company insurance. So can I can use my company insurance for the deductible and then use my own plan? I am not sure how an insured can claim for a single admission from two different insurer.I'm so new to this things. Just start looking around I know is possible if is from the same insurer. |

|

|

|

|

|

Jun 24 2021, 11:08 PM Jun 24 2021, 11:08 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jun 24 2021, 11:37 PM Jun 24 2021, 11:37 PM

Show posts by this member only | IPv6 | Post

#708

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(lifebalance @ Jun 24 2021, 11:08 PM) Is deductible deducted from total billing or approved claimed ? For eg, if total billing is RM50k and approved claimed is RM42k, so the 20k deductible from 50k or 42k ?Is the insured required to submit the approved claim from the 1st to the 2nd insurer for the additional claim ? |

|

|

Jun 25 2021, 12:16 AM Jun 25 2021, 12:16 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(mini orchard @ Jun 24 2021, 11:37 PM) Is deductible deducted from total billing or approved claimed ? For eg, if total billing is RM50k and approved claimed is RM42k, so the 20k deductible from 50k or 42k ? Deductible is applied in a sense as long as any bill comes in, you'll have to fork out the first 20k as the deductible (or the amount that you've selected on your plan) before the balance is covered by the insurance company. Is the insured required to submit the approved claim from the 1st to the 2nd insurer for the additional claim ? Yes, you'll have to pay first then submit the claim with the 2nd insurer. |

|

|

Jun 25 2021, 10:06 AM Jun 25 2021, 10:06 AM

Show posts by this member only | IPv6 | Post

#710

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(lifebalance @ Jun 25 2021, 12:16 AM) Deductible is applied in a sense as long as any bill comes in, you'll have to fork out the first 20k as the deductible (or the amount that you've selected on your plan) before the balance is covered by the insurance company. Is the deductible include those unapproved/not covered billing or is a separate payment?Yes, you'll have to pay first then submit the claim with the 2nd insurer. |

|

|

Jun 25 2021, 10:13 AM Jun 25 2021, 10:13 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jun 25 2021, 11:45 AM Jun 25 2021, 11:45 AM

|

Senior Member

1,315 posts Joined: Aug 2007 |

|

|

|

Jun 25 2021, 11:49 AM Jun 25 2021, 11:49 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

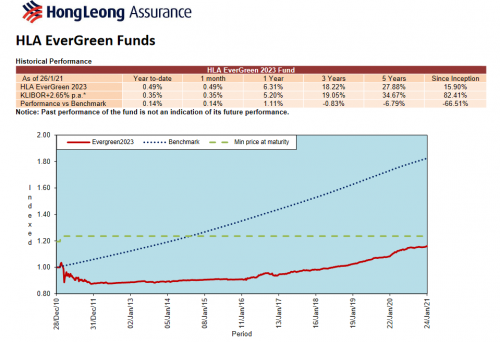

QUOTE(onthefly @ Jun 25 2021, 11:45 AM)  Not really sure how to see this but seem like this fund is severely under perform. -66% different since inception. how to address this. |

|

|

|

|

|

Jun 25 2021, 11:57 AM Jun 25 2021, 11:57 AM

Show posts by this member only | IPv6 | Post

#714

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(wongmunkeong @ Jun 24 2021, 08:00 AM) » Click to show Spoiler - click again to hide... « QUOTE(mini orchard @ Jun 24 2021, 11:05 PM) » Click to show Spoiler - click again to hide... « QUOTE(mini orchard @ Jun 24 2021, 11:37 PM) » Click to show Spoiler - click again to hide... « QUOTE(mini orchard @ Jun 25 2021, 10:06 AM) » Click to show Spoiler - click again to hide... « wongmunkeong liked this post

|

|

|

Jun 25 2021, 12:35 PM Jun 25 2021, 12:35 PM

Show posts by this member only | IPv6 | Post

#715

|

Senior Member

2,429 posts Joined: Jul 2007 |

Seeking opinion on the need for early CI given the Premium is much higher than normal CI.

How often in real life that claims come from diseases apart from the main 36 diseases? |

|

|

Jun 25 2021, 12:52 PM Jun 25 2021, 12:52 PM

Show posts by this member only | IPv6 | Post

#716

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(jutamind @ Jun 25 2021, 12:35 PM) Seeking opinion on the need for early CI given the Premium is much higher than normal CI. hi jutamind, in my opinion its really subjective, by looking at the terms of what is covered under the critical illness early stages part, most early stages there is no long term treatment needed and might not need long term recuperation. likely just an operation, rest a few days then can go back to work. for example, one kidney failure but another one which is still fully functional, even after claiming intermediate CI, there is no dialysis needed to be done. you can go back to work as usual after moving that one failed kidney. unless both fully failed then dialysis is needed then that will be under advanced kidney failure stage where you can claim the normal CI already.How often in real life that claims come from diseases apart from the main 36 diseases? The above is sth very general statement. perhaps you can bring up some specific illness to discuss about it. or you can buy some small amount to cover early CI and more on the normal CI. just a backup in case you need to take a short break from work due to early CI. |

|

|

Jun 25 2021, 01:18 PM Jun 25 2021, 01:18 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(jutamind @ Jun 25 2021, 12:35 PM) Seeking opinion on the need for early CI given the Premium is much higher than normal CI. Unless your parents or brother sister had or has ongoing illnesses then you'll likely have a higher chance to have similar issues.How often in real life that claims come from diseases apart from the main 36 diseases? Then again no one can tell you when you'll die or fall sick, if you think it's a potential risk you'd like to cover then get the Early CI coverage. |

|

|

Jun 25 2021, 04:34 PM Jun 25 2021, 04:34 PM

Show posts by this member only | IPv6 | Post

#718

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(ckdenion @ Jun 25 2021, 11:57 AM) yes can claim from different insurer. for example you can admit using 1 medical card, if there is any excess that still can be claimed and not enough to be covered by the 1st card, then can file and submit the claim to the 2nd card (same/different insurer also can). did this many times already Let's say my company insurance 70k. Hospital fees 80k.If I wan use my company card just for deductible 20k only then remaining use my private insurance, is it possible? Or have to use up my company card fully then only can claim remaining 10k from my private card? |

|

|

Jun 25 2021, 05:08 PM Jun 25 2021, 05:08 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Aghi @ Jun 25 2021, 04:34 PM) Let's say my company insurance 70k. Hospital fees 80k. No, that will complicate the matter, the hospital may not divide the bill as well.If I wan use my company card just for deductible 20k only then remaining use my private insurance, is it possible? Or have to use up my company card fully then only can claim remaining 10k from my private card? However, assuming another scenario. Company Card covers 50k Personal Card covers 50k with 20k deductible. Claim is 80k You can claim the first 50k from the Company Card and subsequently the remaining 30k on the personal card (the 20k deductible is already borne by the Company Card). This post has been edited by lifebalance: Jun 25 2021, 07:58 PM |

|

|

Jun 25 2021, 05:55 PM Jun 25 2021, 05:55 PM

Show posts by this member only | IPv6 | Post

#720

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(Aghi @ Jun 25 2021, 04:34 PM) Let's say my company insurance 70k. Hospital fees 80k. for this case. lets say you have:If I wan use my company card just for deductible 20k only then remaining use my private insurance, is it possible? Or have to use up my company card fully then only can claim remaining 10k from my private card? company medical insurance 70k annual limit with no deductible own medical insurance with 20k deductible Note: Assuming 80k is the claimable portion you can either: Option A: use company insurance to claim the 70k, then the balance 10k claim from your own medical insurance (20k deductible already borne by company medical insurance) Option B: you pay the hospital bill of 80k, then claim from own medical insurance 60k, the balance 20k claim from company insurance. in this case, Option A is a better option to go for. Scenario 2: Hospital Bill: 30k (claimable) company medical insurance 70k annual limit with no deductible own medical insurance with 20k deductible you can claim this 30k bill fully from your company medical insurance. then on that policy year of your own medical insurance, the deductible of 20k is already exceeded (have to submit the 30k claim details to your own medical insurer), so whatever subsequent bill you can claim from your own medical insurance (for that policy year only). on the next policy year then the deductible will reset again. |

| Change to: |  0.0214sec 0.0214sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 09:33 PM |