Hi All,

Is there a good high amount deductible and no claim reward ilp insurance plan?

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jun 24 2021, 01:38 AM Jun 24 2021, 01:38 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

75 posts Joined: May 2019 |

Hi All,

Is there a good high amount deductible and no claim reward ilp insurance plan? |

|

|

|

|

|

Jun 24 2021, 01:49 AM Jun 24 2021, 01:49 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(lifebalance @ Jun 24 2021, 01:41 AM) Maybe around 20k because I have company insurance. So can I can use my company insurance for the deductible and then use my own plan? I'm so new to this things. Just start looking around wongmunkeong liked this post

|

|

|

Jun 24 2021, 10:48 PM Jun 24 2021, 10:48 PM

Return to original view | Post

#3

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(wongmunkeong @ Jun 24 2021, 08:00 AM) $20K is exactly my deductible for my children's & my medical insurance with Pru. For my age 49, i'm paying $2.6k pa, my 15yo girl's $1.27K pa & my boy's $1.88K pa You taking ilp? it seen quite priceyjust sharing to give U an idea of cost --- Additional post/edit: Wow - some forumers either parkinson's disease coz accidentally clicked REPORT POST twice OR some agents trying to be funny. I'm a buyer, not even in the insurance industry, baka... haha why would they wan report wongmunkeong liked this post

|

|

|

Jun 25 2021, 04:34 PM Jun 25 2021, 04:34 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(ckdenion @ Jun 25 2021, 11:57 AM) yes can claim from different insurer. for example you can admit using 1 medical card, if there is any excess that still can be claimed and not enough to be covered by the 1st card, then can file and submit the claim to the 2nd card (same/different insurer also can). did this many times already Let's say my company insurance 70k. Hospital fees 80k.If I wan use my company card just for deductible 20k only then remaining use my private insurance, is it possible? Or have to use up my company card fully then only can claim remaining 10k from my private card? |

|

|

Aug 29 2021, 09:12 PM Aug 29 2021, 09:12 PM

Return to original view | Post

#5

|

Junior Member

75 posts Joined: May 2019 |

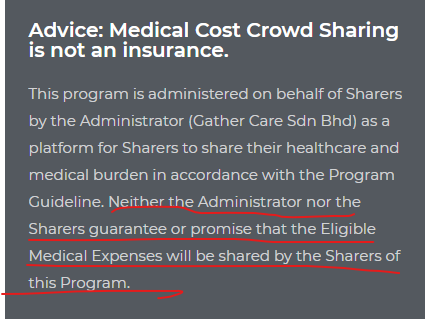

Hi, is anyone here have insurance from Gathercare.

Monthly less than 50, RM 1,000,000 Medical Protection Increase by RM 200,000 yearly |

|

|

Aug 29 2021, 11:18 PM Aug 29 2021, 11:18 PM

Return to original view | Post

#6

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(MUM @ Aug 29 2021, 10:18 PM) from its website Thanks. I see that you have made some comparison.https://gathercare.com/ GatherCare is not an insurance or takaful, but an alternative solution to medical costs by providing a platform for people to come together to form a community and share their medical bill through program. name changed from previously Life Engineering. there is a active thread on it too,... Life Engineering Health pooling scheme, Anyone got participate? https://forum.lowyat.net/topic/4636224/all Its not a complete package but still good enough for someone who really cant really affford normal ilp insurance. Maybe can supplement it with some other insurance since their monthly also only around RM10-15 monthly average QUOTE(lifebalance @ Aug 29 2021, 10:31 PM) Apply at your own risk since it's non-regulated. Yup its not regulated maybe cause its a first of its kind i think To me, it makes no sense as peeps are just contributing RM50, while the claim is quite high in their sharing. Unless someone behind them is giving free money to pay claims / charity + assuming they are earning nothing out of this (which I highly doubt so). Anyways, enter at your own risk. Their claim not high as you can check they will share every month total cost divide with all sharer. Till date their average per month less than 10 They have a annual fee of 360. Hope so in future they have many other coverage. This post has been edited by Aghi: Aug 29 2021, 11:19 PM |

|

|

|

|

|

Sep 2 2021, 08:16 PM Sep 2 2021, 08:16 PM

Return to original view | Post

#7

|

Junior Member

75 posts Joined: May 2019 |

Hi guys,

Just to clarify. Allianz have no claim refund upto 20% of COI. Does it mean the 20% is from only the medical (medisafe infinite+) coi or its including overall COI (life,medical,critical) ? I see that after 10-20 years the coi is very high and can save some good amount of money. This post has been edited by Aghi: Sep 2 2021, 08:17 PM |

|

|

Sep 4 2021, 03:13 AM Sep 4 2021, 03:13 AM

Return to original view | Post

#8

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(MUM @ Sep 3 2021, 01:40 AM) I was wondering, in the next 20 yrs, how much will the buying power be for the current value of That's why I prefer to take life/tpd on online website like FWD, takaful Malaysia, etiqa..It's cheap, can go up to 500k and also flexible to choose fixed term like for 30 years same premium. CI 50k, R&B 300, TPD 10k. The hospitalizations cost maybe enough,... What abt life after hospitalization ? They also have have CI coverage with cheaper price...so I think can reduce our medical ILP premium by minimising life/tpd, CI and take them from online. Most agent quote me ILP with life coverage 50k. Yes I got no dependant but dude incase of tpd for young men, 50k is nothing. Need a million dollar 🤑 |

|

|

Oct 9 2021, 09:00 PM Oct 9 2021, 09:00 PM

Return to original view | Post

#9

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(steventyy @ Oct 9 2021, 10:54 AM) Hi all, For now i find that got 2 company with deductible and have no claim discount. About the deductible card, if I choose high deductible amount due to company provide medical benefit, then what if the benefit no longer available due to policy change/change company. What can I do? Let say I choose a card with 20-30K deductible now, I don't think I can cover the amount if 1st card not available. Please advise. Both of this will be useful to reduce the premium since we wont use it much cause have company card Holocene liked this post

|

|

|

Oct 9 2021, 09:44 PM Oct 9 2021, 09:44 PM

Return to original view | Post

#10

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(Ewa Wa @ Oct 7 2021, 02:32 PM) Then why not add in SE so ur annual limit 1.32mil. Yes fall back to old card due to waiting period. No didn't hold 2 cards, covert the SMX to SMM in the existing SPE2 like what u are doing now. Some how still have this waiting period involved especially for chronic illness like cancer, kidney failure which take longer time to develop and not happen in these 4 months. Which u would like to take note on. Hi, a agent from HLA tell me the same thing some critical illness will take long time to develop so better after 2 years then no problem to claim. Call the number I have given you just now, they can explain better. Cross finger these 4 months u r healthy so ur conversion is successful. To be frank holding 2 cards not economically la if u r healthy now. If after 4 month which is the waiting period then company will investigate. Lets say a person very healthy and no any symptom during the 4 month period then on the 5th month suddenly got pain and see doctor and he said cancer So will have problem when wan claim for medical and CI coverage? |

|

|

Oct 9 2021, 10:13 PM Oct 9 2021, 10:13 PM

Return to original view | Post

#11

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(lifebalance @ Oct 9 2021, 09:57 PM) You consent the insurance company to investigate on any claims that is filed. Tq lifebalance. As long we declare everything honestly then no problem right.If you have done all declaration and have nothing to hide. There is no need to be concerned about after the 4th month waiting period. It doesn't matter if the policy is 5 or 10 years later, if you did not disclose your information truthfully. Your claims can still be rejected. But what will the company investigation based on? Lets say the doctor said this cancer already must have for the past 1 year (which would be before i take this insurance), but just now only giving symptom. Can this affect? Or is it better i do a full medical check up and keep it as prove. Sorry asking so detail because as we all know cancer is a complicated b**ch. This thing may not be detect during health screening and might only give effect after second stage like that. |

|

|

Jul 29 2022, 01:52 AM Jul 29 2022, 01:52 AM

Return to original view | IPv6 | Post

#12

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(denion @ Jun 20 2022, 08:29 PM) hi perfect10, there is a form that you can fill up to waive premium loading and submit. then company will then issue letter of request for you to do the require medical check-up to review. Hi so if 1 million limit can cover the whole treatment for cancer until cure including consultation, examination fees and take home drug?. Or it's only until the post hospitalisation 60/90 days only?hi wawasan2200, for medical card, it is good to have at least a million prepared. that big sum is to prepare for very critical illnesses say cancer. cancer claims can come out to very high amount. the latest claim that i dealt with back in february till now, the total bill will come to a near 500k (chemo sessions + surgery). these are the big bills that we want our medical card to cover for. Also I think now only pru and allinz promoting they provide all this advance cancer treatment, which will be nice if they can support us till end |

|

|

Aug 14 2022, 02:29 PM Aug 14 2022, 02:29 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

75 posts Joined: May 2019 |

Hi, can know which insurance company can cover for platelet rich plasma (prp) treatment for joint/muscle pain (not cosmetic purpose ya).

Cos i heard many company dont include it under their coverage |

|

|

Dec 11 2022, 04:09 PM Dec 11 2022, 04:09 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

75 posts Joined: May 2019 |

QUOTE(Ramjade @ Dec 1 2022, 12:47 AM) Don't worry. I found my answer already. There are some insurance that you can buy yourself without agent. Just go to branch and fill up the form. No need to go thought agent. 1. Gathercare, cost sharing platform. Annual limit 1 million and renewable until 100yo.Just need some Google and reading. I already found the insurance I am looking for thanks to blog of an IFP. Will go to their office and seek more answer. Can save alot for long term, can share your opinion on this 2. Critical illness - AXA cover 50 critical illness. I think the most comprehensive for online product. 3. Life - FWD or any other. Just google n compare 4. ILP insurance but pay less to agent - Buy through FSMONE Insurance. Got HLB, manulife, tokio, prudential and so on. Last i check you also get back 30% of agent commission. Can know the insurance that you found, might be helpful for me too since for sure you had done your research before choosing it. |

| Change to: |  0.0299sec 0.0299sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 07:08 PM |