WISE just prompts this message:

"Exchange rates are volatile right now, so you can't add this amount to your USD balance using MYR.."

Tried adding/converting using other currency, same thing

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Nov 15 2022, 12:55 AM Nov 15 2022, 12:55 AM

|

Junior Member

45 posts Joined: Sep 2008 From: Kota Kinabalu |

Anyone else having problem adding money to their WISE account?

WISE just prompts this message: "Exchange rates are volatile right now, so you can't add this amount to your USD balance using MYR.." Tried adding/converting using other currency, same thing |

|

|

|

|

|

Nov 15 2022, 01:56 AM Nov 15 2022, 01:56 AM

|

Junior Member

164 posts Joined: Sep 2015 |

Lol, my account got deactivated more than a month. Email sent one month ago till now no feedback wtf wise. How hard is it for them to get back to me? There are funds inside my account....

|

|

|

Nov 15 2022, 01:59 AM Nov 15 2022, 01:59 AM

Show posts by this member only | IPv6 | Post

#863

|

Senior Member

1,154 posts Joined: Oct 2021 |

Cash out MYR to other currency, very good.

|

|

|

Nov 15 2022, 02:12 AM Nov 15 2022, 02:12 AM

|

Junior Member

13 posts Joined: Jan 2022 |

QUOTE(Sherman Kong @ Nov 15 2022, 01:56 AM) Lol, my account got deactivated more than a month. Email sent one month ago till now no feedback wtf wise. How hard is it for them to get back to me? There are funds inside my account.... how long have you been using wise? wonder is there any alternatives like wiseThis post has been edited by jozyzzz: Nov 15 2022, 02:17 AM |

|

|

Nov 15 2022, 02:22 AM Nov 15 2022, 02:22 AM

|

Junior Member

475 posts Joined: Feb 2010 |

QUOTE(jozyzzz @ Nov 15 2022, 02:12 AM) Currently, I use Wise purely as a foreign exchange broker where funds are transferred from source of origin bank in A denomination, converted via Wise exchange + fees and redirected back to source of origin bank in B denomination. |

|

|

Nov 15 2022, 06:41 AM Nov 15 2022, 06:41 AM

Show posts by this member only | IPv6 | Post

#866

|

All Stars

24,384 posts Joined: Feb 2011 |

|

|

|

|

|

|

Nov 15 2022, 08:51 AM Nov 15 2022, 08:51 AM

Show posts by this member only | IPv6 | Post

#867

|

Junior Member

663 posts Joined: Jul 2008 From: KL |

I suggest apply rhb multi currency card better. Secure and no limit storage. Anything happen jz go back to rhb settle. Some more rate is better . Only con is Rm20 annual fee.

|

|

|

Nov 15 2022, 09:47 AM Nov 15 2022, 09:47 AM

|

Senior Member

1,184 posts Joined: May 2005 |

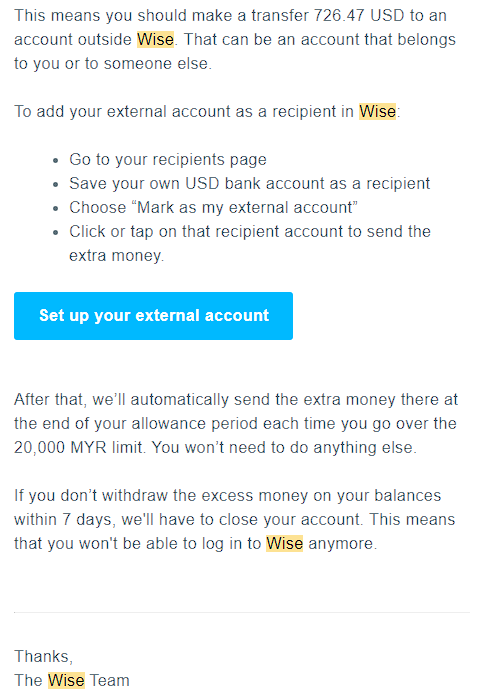

QUOTE(GSCboy @ Nov 14 2022, 01:05 PM) This is wrong, i just checked my email and apparently the exceed limit email was sent but went into my spam, no idea why. but they did quote about closing my account if i dont withdraw the excess. Although they say is seven days but apparently it was only 5 days, came back on the sixth. Happened to me. Just send a support ticket, they will reactivate in few days. |

|

|

Nov 15 2022, 09:55 AM Nov 15 2022, 09:55 AM

Show posts by this member only | IPv6 | Post

#869

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(frankliew @ Nov 15 2022, 08:51 AM) I suggest apply rhb multi currency card better. Secure and no limit storage. Anything happen jz go back to rhb settle. Some more rate is better . Only con is Rm20 annual fee. RHB multicurrency rate is better? Sure boh. Can I send SGD directly to a Bank in Singapore without charges? |

|

|

Nov 15 2022, 11:29 AM Nov 15 2022, 11:29 AM

|

Junior Member

164 posts Joined: Sep 2015 |

|

|

|

Nov 15 2022, 11:30 AM Nov 15 2022, 11:30 AM

|

Junior Member

164 posts Joined: Sep 2015 |

|

|

|

Nov 15 2022, 11:59 AM Nov 15 2022, 11:59 AM

|

Senior Member

1,058 posts Joined: Jun 2011 From: Kuala Lumpur, Malaysia |

QUOTE(Sitting Duck @ Nov 14 2022, 09:35 PM) Just a reminder to all that plan to apply for Wise Debit Card: I'm curious to know... When will we know whether credit card payment becomes a cash advance instead of a normal CC charge?DO NOT USE Credit Card to make payment for the Wise Debit Card. I got charge cash advance fee of RM18 for the Wise Debit Card which cost RM14.90. Does it depend on the merchant, or the FPX gateway? |

|

|

Nov 15 2022, 01:30 PM Nov 15 2022, 01:30 PM

|

Senior Member

1,184 posts Joined: May 2005 |

|

|

|

|

|

|

Nov 15 2022, 03:11 PM Nov 15 2022, 03:11 PM

Show posts by this member only | IPv6 | Post

#874

|

Senior Member

3,864 posts Joined: Jun 2022 |

Anyone has use WISE card overseas? When buying stuff, it will automatically charge to local currency or will the system ask you? Going to Japan next year.. Planning to pay most big purchases with WISE card (Hotel Accomodations). When not enough, then top up Yen from my Malaysia bank via FPX. I don't want to carry so much cash (lousy conversion rates for cash too). This will also prevent sudden buttseck by credit card with hidden charges and lousy exchange rates for sure.

|

|

|

Nov 15 2022, 05:43 PM Nov 15 2022, 05:43 PM

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(frankliew @ Nov 15 2022, 08:51 AM) I suggest apply rhb multi currency card better. Secure and no limit storage. Anything happen jz go back to rhb settle. Some more rate is better . Only con is Rm20 annual fee. Are you sure the rates better 🤦♀️ Bank FX spread is Min 2% btw CommodoreAmiga liked this post

|

|

|

Nov 15 2022, 09:55 PM Nov 15 2022, 09:55 PM

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(CommodoreAmiga @ Nov 15 2022, 10:11 AM) Anyone has use WISE card overseas? When buying stuff, it will automatically charge to local currency or will the system ask you? Going to Japan next year.. Planning to pay most big purchases with WISE card (Hotel Accomodations). When not enough, then top up Yen from my Malaysia bank via FPX. I don't want to carry so much cash (lousy conversion rates for cash too). This will also prevent sudden buttseck by credit card with hidden charges and lousy exchange rates for sure. In order:1. Deduct from local currency (e.g yen). 2. If not enough, deduct from other currency account with the best exchange rate. QUOTE When not enough, then top up Yen from my Malaysia bank via FPX. You should top up the Wise MYR account using MYR. Then convert from Wise MYR --> Wise Yen. If you're topping up Yen using local bank, wouldn't that be using the local bank's exchange rate and fees? But this step is optional. if you don't have Yen or insufficient Yen, it will always deduct from another currency account with the best exchange rate. |

|

|

Nov 15 2022, 10:41 PM Nov 15 2022, 10:41 PM

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(jonoave @ Nov 15 2022, 09:55 PM) In order: If I am not wrong, WISE works by taking your RM as it is and convert for you. Hence, local banks job is just to give RM to WISE. So it's the same as putting in RM, and then convert. I have done it multiple times before. The rates are better than banks. And only RM deducted.from.my bank. Right now my wise is mostly filled with Yen and little of other currencies....rest all add up less than RM100. Lol.1. Deduct from local currency (e.g yen). 2. If not enough, deduct from other currency account with the best exchange rate. You should top up the Wise MYR account using MYR. Then convert from Wise MYR --> Wise Yen. If you're topping up Yen using local bank, wouldn't that be using the local bank's exchange rate and fees? But this step is optional. if you don't have Yen or insufficient Yen, it will always deduct from another currency account with the best exchange rate. |

|

|

Nov 16 2022, 10:59 AM Nov 16 2022, 10:59 AM

|

All Stars

14,944 posts Joined: May 2015 |

QUOTE(Takudan @ Nov 15 2022, 11:59 AM) I'm curious to know... When will we know whether credit card payment becomes a cash advance instead of a normal CC charge? You will know it when it is "statement"-ed. Normally you need to pay 5% cash advance fee (minimum charge apply) + CC interest.Does it depend on the merchant, or the FPX gateway? Your card issuer will get a lot of info from a credit card transaction, not only the merchant name, amount, date and time but also category and nature of transaction. |

|

|

Nov 16 2022, 11:41 AM Nov 16 2022, 11:41 AM

|

Junior Member

53 posts Joined: Sep 2021 |

QUOTE(CommodoreAmiga @ Nov 15 2022, 10:41 PM) If I am not wrong, WISE works by taking your RM as it is and convert for you. Hence, local banks job is just to give RM to WISE. So it's the same as putting in RM, and then convert. I have done it multiple times before. The rates are better than banks. And only RM deducted.from.my bank. Right now my wise is mostly filled with Yen and little of other currencies....rest all add up less than RM100. Lol. i just add the Wise Bank Account to favorite, and perform transfer within AmBank, as no OTP SMS is required when oversea, very convenient and reduce the risk storing too much inside the card and get stolen or scammed. Also, using Wise digital card to buy ticket with oversea app is convenient too, as authentication on card payment can be done with WISE app, without the need to receive OTP SMS when oversea |

|

|

Nov 16 2022, 11:49 AM Nov 16 2022, 11:49 AM

|

Senior Member

3,864 posts Joined: Jun 2022 |

QUOTE(andrew98 @ Nov 16 2022, 11:41 AM) i just add the Wise Bank Account to favorite, and perform transfer within AmBank, as no OTP SMS is required when oversea, very convenient and reduce the risk storing too much inside the card and get stolen or scammed. Also, using Wise digital card to buy ticket with oversea app is convenient too, as authentication on card payment can be done with WISE app, without the need to receive OTP SMS when oversea Wise has a bank account no? Because everytime i transfer, i use WISE app, then FPX from my bank. So can do other way round? I didn't know! What is WISE bank account and no?Btw, if card lost, you can use the app to freeze it immediately. I only use the virtual card for online purchase. Once done, i will freeze the virtual card. But when you transfer from Ambank, also need OTP from Ambank right? Or they have solely use the secured verification? I can't remember. Like Maybank still use OTP for small amount and bigger amount only use the Secured Verification via app. Updated: Is it transfer to WISE bank from your bank like this? https://wise.com/help/articles/2559761/how-...y-bank-transfer This post has been edited by CommodoreAmiga: Nov 16 2022, 11:57 AM |

| Change to: |  0.0182sec 0.0182sec

0.68 0.68

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 10:28 PM |