QUOTE(Ramjade @ Sep 17 2022, 06:40 PM)

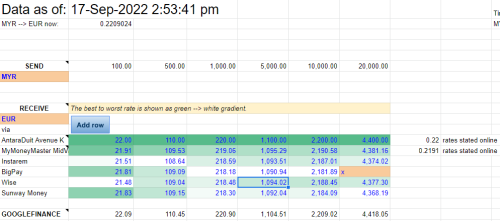

Midvalley money changer rates are one of the best.

QUOTE(TOS @ Sep 17 2022, 08:09 PM)

Do not forget that cash option requires you to travel to Mid-Valley etc. Some opportunity costs are not immediately obvious.

The rates may change over time. Last time Wise is better than Instarem, but these days, Instarem seems to truimph Wise in total cost. It's hard to draw a conclusion based on one day observation. The best way is to compare just before you want to transfer.

And your examples are highly theoretical. What makes you think it must be exactly 21.84 EUR every transaction?

That's very exact.

--------------------------

I have not tried depositing EUR to IBKR from Wise before. I only tried CHF (without account details). So far no issues from IB for CHF despite not having any account details.

Wise's EUR balance has account details, so you can transfer money from there theoretically.

https://wise.com/help/articles/2827505/how-...account-detailsBe mindful of outgoing transfer charges of 0.37 EUR for SEPA (EUR-EUR transfer).

https://wise.com/gb/pricing/send-money?sour...etCcy=EUR&tab=0As IBKR accepts SEPA transfer, you should be fine using the EUR account balance details from Wise.

» Click to show Spoiler - click again to hide... «

Thanks both for the mid valley tips. I'm not going to stay in the city centre and my colleague who's a local remarked that it's still kinda 50/50 with regards to card vs cash... That's why I'm looking into getting some cash too. It's going to be a big group of us so might be able to share the opportunity cost.. let's see!

You're right about changing rates, hence my decision to get Wise card to open up more options. My bigpay physical so ngam is expiring next year after all

Actually the examples were meant to compare EUR and MYR accounts directly and confirm my understanding of which rates would be used, wasn't meant to be realistic haha...

QUOTE(dwRK @ Sep 18 2022, 11:18 AM)

business trip means company pays for everything... including exchange rate fees and losses when exchange back to myr... yes? then find the most expensive money changer to exchange a small amount and use that rate as record for your claims lor... and find the cheapest for your actual spend... hahaha... personally i don't do this... just put everything on company card and enjoy... small incidental i don't even claim...

as for option 1 or 2... if myr is strengthening then option 2 may end up better... personally i would just load some eur for draw down and not worry about rates... btw wise website (without logging in) shows option 2 to be better... 0.55% fee vs 0.58% fee... so better check properly after login... (avernue k is 0.5537%)

yes you'll get a proper iban account number once you create the eur account... i have received eur from ibkr... ts has send eur to ibkr...

80% correct... I'm extending my stay on weekends for personal travel also, which will not be covered. I am indeed going with convenience for the ones I know my company's paying... E.g. my hotel stay, just gonna swipe CC

I don't think I can

cheat my company audit your way... As our claims are itemised, I'm afraid will kena reject if they see the receipt I'm only getting a small amount at that rate, but claim so much more.

» Click to show Spoiler - click again to hide... «

thankfully, I need to specify the conversion rate, or use company default rate...

potential free coffee if my conversion rate is better. So yeah, it is still in my interest to get best conversion rate..

Last 2 questions about account opening:

1. It requires me to deposit like RM 101 -- is that a permanent amount to park there, just like how we need to park a minimal amount in our bank accounts to prevent closure?

2. It warned that any amount entering the EUR account needs to be of my own name, to prevent money laundering yadayada, kinda like IBKR. Have you tried using different fintech to transfer into Wise account? (Relevant if Wise offers worse rate)

Thank you all for very detailed answers. I am inclined to proceed with EUR account on Wise as I like that I can channel the excess into IBKR as investment, without another round of forex loss.

Sep 17 2022, 05:46 PM

Sep 17 2022, 05:46 PM

Quote

Quote

0.1365sec

0.1365sec

1.06

1.06

7 queries

7 queries

GZIP Disabled

GZIP Disabled