QUOTE(jaslina2 @ Jan 13 2023, 09:33 AM)

if transfer from own wise account to own local bank account will definitely not trigger? i remember there is like 10k then bank will call you

It is bank dependent policies as every banks has different AMLA policies and procedures

As long as your source of funds is legit and documented why worry so much 🤦♀️

QUOTE(il0ve51 @ Jan 13 2023, 01:11 PM)

do you have the list of bank recipient fee?

You need to check with your receipant bank as every Bank charges differently

QUOTE(jonoave @ Jan 13 2023, 01:47 PM)

No need for your aunt to trouble. Transfer of Euro within EU is free.

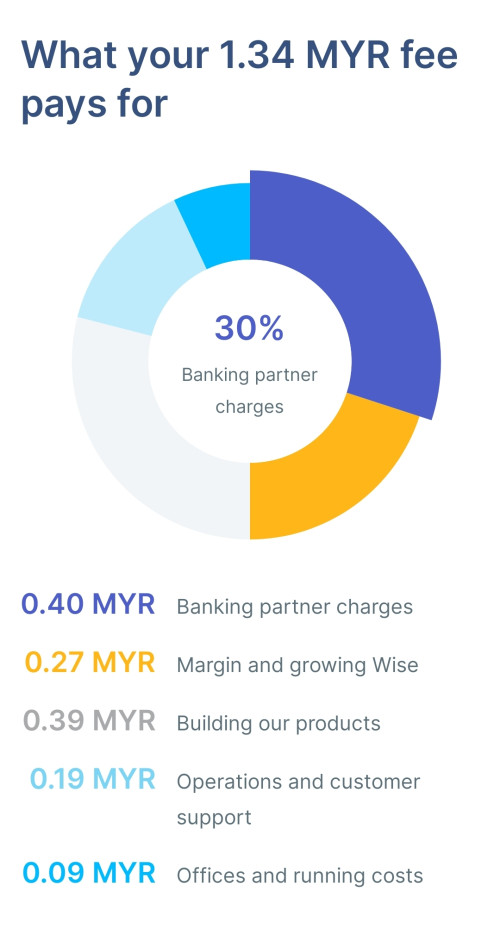

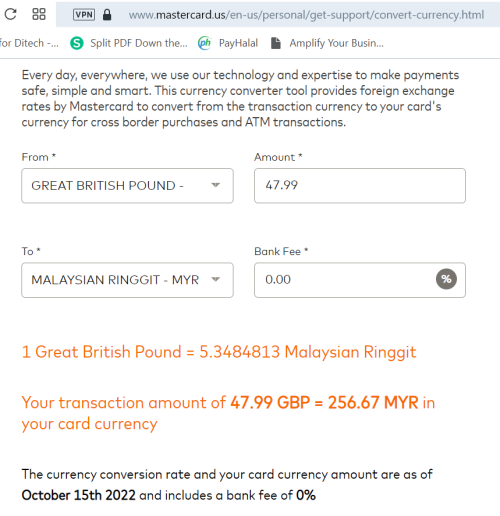

You sign up for a Wise account, then open a WISE Euro account. Give the details of you Wise Euro account to your aunt, mainly the IBAN number. Then you'll receive the full amount of Euro in your Wise Euro account. After that, you can transfer the money from your Wise Euro account to a local Malaysian bank, with the conversion rate and fees charged by Wise (which is typically cheaper than banks). The app will clearly show much fees and conversion rate, and the amount of MYR you will receive - there is no additional charges imposed by banks.

The problems is not Euro but RM wallet can hold of up to 20k

And if do multiple withdrawal troublesome and withdrawal charges apply 🤦♀️

Nov 15 2022, 05:43 PM

Nov 15 2022, 05:43 PM

Quote

Quote

0.0715sec

0.0715sec

0.22

0.22

7 queries

7 queries

GZIP Disabled

GZIP Disabled