QUOTE(cclim2011 @ May 29 2020, 05:25 PM)

hi, managed to open an account today. transfered funds from ocbc and ambank into it. can i know if need to spend 1k if i already spent enough with my jop or liverpool card this month? alos the 3k requirement, is it incremental or as long as i transfer 3k into it monthly (ie doesnt care hiw much i traansfer out). sorry i think sute these questions have been asked before. tia

QUOTE(datolee32 @ May 29 2020, 06:39 PM)

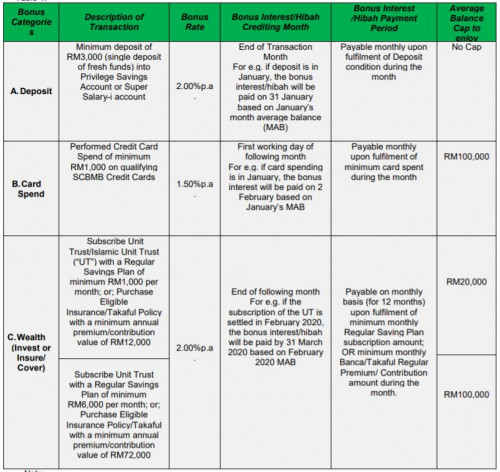

It is minimum fresh fund RM 3k to PSA account without consider transfer out amount, i understand from forum that if you open account today, the credit card expenses will be counting starting today also.

QUOTE(zenquix @ May 29 2020, 09:21 PM)

Please note the 3k has to be a fresh fund single deposit. You don't have to maintain it. I normally use it to pay for my JOP bill

QUOTE(!@#$%^ @ Jun 1 2020, 02:04 AM)

2% interest for wealth category will be credited at the end of the following month, in ur case june i believe.

Same for me I opened my PSA early May, deposited >RM3K, spend >RM3K on JOP and LFC mostly on ewallet, n saw 2 interest transactions credited 1 is CR INTEREST, 1 is BONUS INTEREST. Is that correct? I tot should be 3 transactions, basic, save & spend.

This post has been edited by MGM: Jun 1 2020, 06:08 AM

May 26 2020, 06:21 PM

May 26 2020, 06:21 PM

Quote

Quote

0.1012sec

0.1012sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled