Sifusss, should I move my FD to this account? FD rate: 3.25% 10 mth.

Scare after move then This SA reduce the rate 😢 please advise

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Jun 2 2020, 02:50 PM Jun 2 2020, 02:50 PM

Show posts by this member only | IPv6 | Post

#621

|

Junior Member

114 posts Joined: Dec 2019 |

Sifusss, should I move my FD to this account? FD rate: 3.25% 10 mth.

Scare after move then This SA reduce the rate 😢 please advise |

|

|

|

|

|

Jun 2 2020, 06:38 PM Jun 2 2020, 06:38 PM

|

Senior Member

773 posts Joined: Oct 2008 |

|

|

|

Jun 2 2020, 07:09 PM Jun 2 2020, 07:09 PM

|

Junior Member

255 posts Joined: Oct 2004 |

Hi smart savers, I'm interested to be a part of this saving program but a few questions - can I open this acc via walk-in? Went to website yesterday to key in info and was told to wait for appointment to be made. Maybe some staff will call?

Also not sure why but scb has rejected my cc applications twice preciously. No issues with other banks but not sure why kept failing their program. Need to check my ccris but I'm don't have hardcore credit utilisations so I find it funny. Worried this might happen again. |

|

|

Jun 2 2020, 08:45 PM Jun 2 2020, 08:45 PM

|

Junior Member

52 posts Joined: Sep 2018 |

QUOTE(Necromancer @ Jun 2 2020, 07:09 PM) Hi smart savers, I'm interested to be a part of this saving program but a few questions - can I open this acc via walk-in? Went to website yesterday to key in info and was told to wait for appointment to be made. Maybe some staff will call? Yes, you need to walk-in. I tried to appointment online previously, waited 2 months but no 1 call me and i manage to walk in open account before MCO.Also not sure why but scb has rejected my cc applications twice preciously. No issues with other banks but not sure why kept failing their program. Need to check my ccris but I'm don't have hardcore credit utilisations so I find it funny. Worried this might happen again. for CC application i think there is some cooldown period (diff bank might differ length). eg. apply on March get reject will have cooldown 3 months (any application before July will auto rejected) |

|

|

Jun 2 2020, 09:58 PM Jun 2 2020, 09:58 PM

|

Junior Member

769 posts Joined: Jul 2008 From: PJ~Damansara Utama |

QUOTE(GrumpyNooby @ Jun 1 2020, 07:09 AM) Guys, Base Interest and Save Bonus Interest for May 2020 are in. Wow...thanks ...great info for newbie like me.Card Spend Bonus Interest for May 2020 is expected to be credited by end of today (first working day of the following month) as per product T&C.  Deposit 3k on 15/May and received ~ rm4+ dividend & credit card spending bonus on 2/June ~RM4+ as well .. Return is much greater than MBB savers-i |

|

|

Jun 2 2020, 10:20 PM Jun 2 2020, 10:20 PM

Show posts by this member only | IPv6 | Post

#626

|

Junior Member

654 posts Joined: May 2020 |

Hi all. Wanna check the interest calculation of this account, if i transfer fresh fund by mid of the month, the interest calculation start from 1st day or the day after I transfer fresh fund?

|

|

|

|

|

|

Jun 2 2020, 10:24 PM Jun 2 2020, 10:24 PM

Show posts by this member only | IPv6 | Post

#627

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(datolee32 @ Jun 2 2020, 10:20 PM) Hi all. Wanna check the interest calculation of this account, if i transfer fresh fund by mid of the month, the interest calculation start from 1st day or the day after I transfer fresh fund? The system needs to compute MAB of the month. MAB = sum of daily balance of the day (cut off time is midnight) divided by number of days of the month |

|

|

Jun 2 2020, 10:56 PM Jun 2 2020, 10:56 PM

Show posts by this member only | IPv6 | Post

#628

|

Junior Member

654 posts Joined: May 2020 |

QUOTE(GrumpyNooby @ Jun 2 2020, 10:24 PM) The system needs to compute MAB of the month. Thank you for your reply. As long as I transfer 3k fresh fund in any date of the calendar month, the MAB interest will start counting by the 1st day of the month right?MAB = sum of daily balance of the day (cut off time is midnight) divided by number of days of the month |

|

|

Jun 2 2020, 10:59 PM Jun 2 2020, 10:59 PM

Show posts by this member only | IPv6 | Post

#629

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(datolee32 @ Jun 2 2020, 10:56 PM) Thank you for your reply. As long as I transfer 3k fresh fund in any date of the calendar month, the MAB interest will start counting by the 1st day of the month right? MAB starts from 1st till last day of the month.FF of RM 3k must reach in any day of the month. The earlier the better as your MAB will be higher. Base interest and bonus interest are applied on the MAB of the month. ??!! liked this post

|

|

|

Jun 2 2020, 11:22 PM Jun 2 2020, 11:22 PM

Show posts by this member only | IPv6 | Post

#630

|

Junior Member

654 posts Joined: May 2020 |

|

|

|

Jun 2 2020, 11:30 PM Jun 2 2020, 11:30 PM

|

Senior Member

1,702 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 2 2020, 10:59 PM) MAB starts from 1st till last day of the month. hi for fresh fund... i always have doubts. say i instant transfer out today 15k to pay credit cards of other banks. then mid of the month i transfer 3k in. is that fresh fund? or must be 15k + 3k = 18k? thanks.FF of RM 3k must reach in any day of the month. The earlier the better as your MAB will be higher. Base interest and bonus interest are applied on the MAB of the month. This post has been edited by cclim2011: Jun 2 2020, 11:30 PM |

|

|

Jun 2 2020, 11:32 PM Jun 2 2020, 11:32 PM

Show posts by this member only | IPv6 | Post

#632

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 2 2020, 11:41 PM Jun 2 2020, 11:41 PM

|

Senior Member

1,702 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jun 2 2020, 11:43 PM Jun 2 2020, 11:43 PM

|

Senior Member

2,600 posts Joined: Apr 2019 |

|

|

|

Jun 3 2020, 12:32 AM Jun 3 2020, 12:32 AM

Show posts by this member only | IPv6 | Post

#635

|

Senior Member

2,722 posts Joined: May 2015 |

|

|

|

Jun 3 2020, 12:33 AM Jun 3 2020, 12:33 AM

|

Senior Member

1,516 posts Joined: Oct 2005 |

QUOTE(jefftan4888 @ Jun 2 2020, 11:43 PM) So the best practice is always to deposit 3k on the first day of the month to maximize the interest. Am I right? no.bonus interest is based on MAB, monthly average balance. once you are valid for this bonus, you will get for whole month, not from the day you qualified. read the T&C on their mechanism. clearly explained |

|

|

Jun 3 2020, 06:55 AM Jun 3 2020, 06:55 AM

Show posts by this member only | IPv6 | Post

#637

|

All Stars

12,387 posts Joined: Feb 2020 |

Use back May 2020 as an example:

QUOTE Case 1 with MAB of above RM 100k If your opening balance on the 1st (end day) is RM 100000 and you deposit RM 3k on 2nd, your MAB is RM 102903.2258 If your opening balance on the 1st (end day) is RM 100000 and you deposit RM 3k on 31st, your MAB is RM 100096.7742 So, your base interest and deposit bonus interest will be calculated based on the MAB which is no cap. Difference of interest earned is RM 5.00 But your card spend bonus interest will be capped on the 1st RM 100k, so it won't have effect for MAB above RM 100k. Case 2 with MAB of below RM 100k If your opening balance on the 1st (end day) is RM 50000 and you deposit RM 3k on 2nd, your MAB is RM 52903.22581 If your opening balance on the 1st (end day) is RM 50000 and you deposit RM 3k on 31st, your MAB is RM 50096.77419 So, your base interest and deposit bonus interest will be calculated based on the MAB which is no cap. Difference of interest earned is still RM 5.00 As for your card spend bonus interest, the difference of interest earned will be RM 3.58 Total in difference of interest earned will be RM 8.58 Above scenarios are only true if and only if that there's no other transaction happened in between 3rd to 31st and your account activity is static. Correct me if my calculation is wrong. This post has been edited by GrumpyNooby: Jun 3 2020, 08:26 AM |

|

|

Jun 4 2020, 05:18 PM Jun 4 2020, 05:18 PM

|

Junior Member

465 posts Joined: Oct 2011 From: KL |

|

|

|

Jun 4 2020, 05:24 PM Jun 4 2020, 05:24 PM

Show posts by this member only | IPv6 | Post

#639

|

Junior Member

654 posts Joined: May 2020 |

|

|

|

Jun 5 2020, 09:59 AM Jun 5 2020, 09:59 AM

|

Junior Member

149 posts Joined: May 2017 |

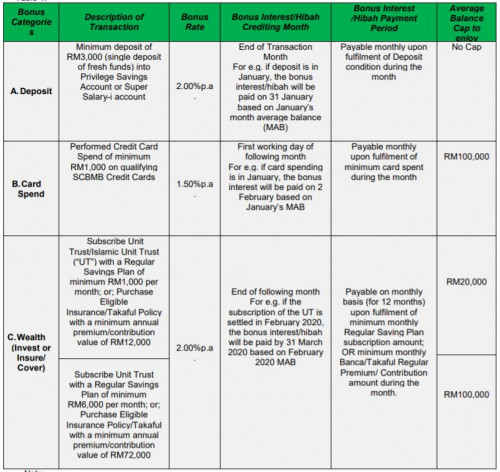

Hi, I am new to this account. Would like to ask, to be qualified of the 2% deposit bonus interest, I need to deposit min 3k fresh fund into this account every month?

Since I don't have 3k savings per month, can I deposit 10k the first month, end of first month I withdraw 3k and deposit back in the 2nd month to get the 2% bonus interest in 2nd month? |

| Change to: |  0.0285sec 0.0285sec

0.59 0.59

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 02:21 AM |