Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Jun 1 2020, 06:11 PM Jun 1 2020, 06:11 PM

|

|

QUOTE(GrumpyNooby @ Jun 1 2020, 07:09 AM) Guys, Base Interest and Save Bonus Interest for May 2020 are in. Card Spend Bonus Interest for May 2020 is expected to be credited by end of today (first working day of the following month) as per product T&C.  Card Spend Bonus Interest for May 2020 is in! |

|

|

|

|

|

ncool15

|

Jun 1 2020, 06:37 PM Jun 1 2020, 06:37 PM

|

|

Guys, i got this Privelege saver account debit card in November 2019. So do i just transfer in rm3000 to thr account monthly to enjoy 2% interest PA? Also how does the investing works? Appreciate any help.

|

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 06:41 PM Jun 1 2020, 06:41 PM

|

|

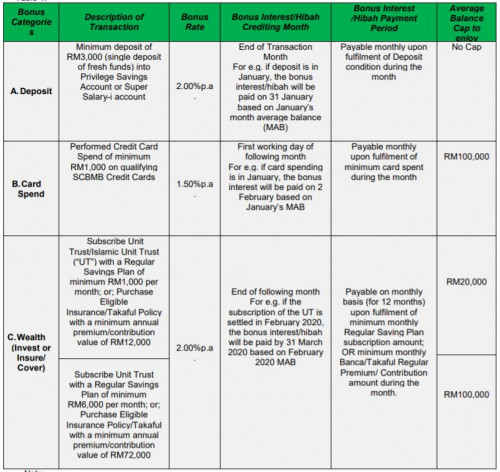

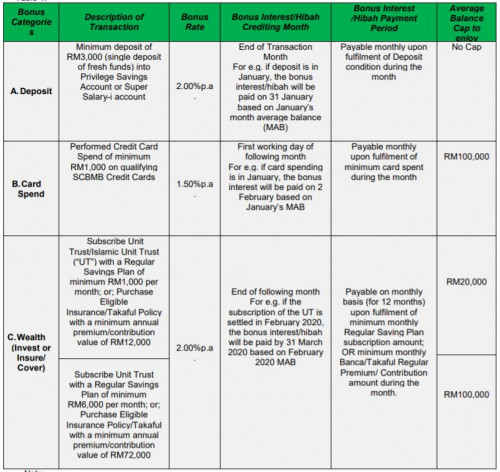

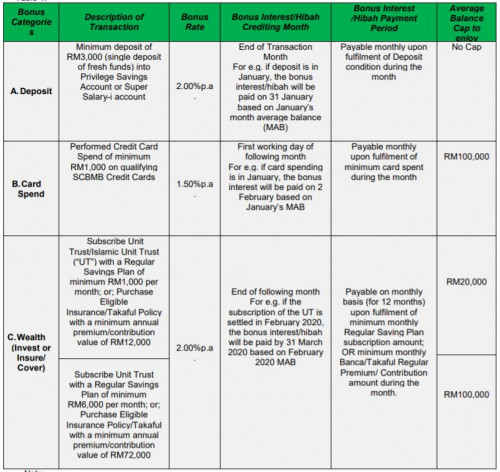

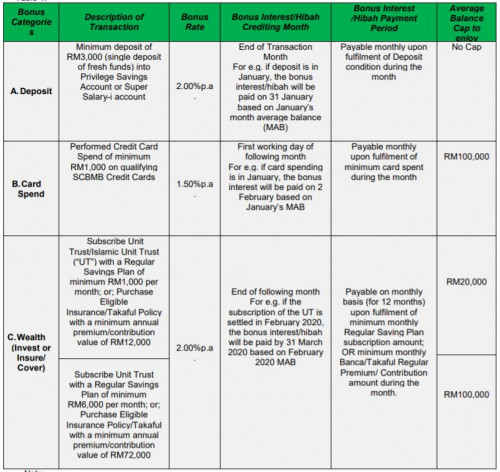

QUOTE(ncool15 @ Jun 1 2020, 06:37 PM) Guys, i got this Privelege saver account debit card in November 2019. So do i just transfer in rm3000 to thr account monthly to enjoy 2% interest PA? Also how does the investing works? Appreciate any help. 2.1% pa to be exact. For the Invest Bonus Interest of 2% pa, you need to buy qualified UT with monthly topup of RM 1k or insurance policy with annual premium of RM 12k. The bonus interest is only applicable to first RM 20k of MAB in your PSA.  T&C: https://av.sc.com/my/content/docs/campaign-tc-psa.pdf |

|

|

|

|

|

cclim2011

|

Jun 1 2020, 07:15 PM Jun 1 2020, 07:15 PM

|

|

QUOTE(GrumpyNooby @ Jun 1 2020, 12:51 PM) Very likely, you won't be getting the Card Spend Bonus Interest: i got it. 1k transaction unposted yet (shown unposted). but before opening the psa i did other spending. so not sure which qualified me to the card spend bonus. but number a bit weird. I have base 0.6, card spend 11.53, saving 12.13 11.53 is a bit weird. shouldnt it be ~9.07 my three days balances is 61k, 80k, 80.5k. average 73833.3. This post has been edited by cclim2011: Jun 1 2020, 07:40 PM |

|

|

|

|

|

datolee32

|

Jun 1 2020, 07:26 PM Jun 1 2020, 07:26 PM

|

|

QUOTE(datolee32 @ May 29 2020, 06:39 PM) It is minimum fresh fund RM 3k to PSA account without consider transfer out amount, i understand from forum that if you open account today, the credit card expenses will be counting starting today also. Hi, I just want to update about the interest of credit card spending. Although I open the account after credit card spending, I receive its interest too! |

|

|

|

|

|

cute_boboi

|

Jun 1 2020, 08:19 PM Jun 1 2020, 08:19 PM

|

|

QUOTE(datolee32 @ Jun 1 2020, 07:26 PM) Hi, I just want to update about the interest of credit card spending. Although I open the account after credit card spending, I receive its interest too! Same with me. However I'm confused as the "deposit 3k get 2%" amount, is lower than "CC spend 1k 1.5%" amount  calculated at daily-rest-interest How is it possible 1.5% returns is higher than 2% ? Anyone knows the detail calculation method ?  |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 08:48 PM Jun 1 2020, 08:48 PM

|

|

QUOTE(cclim2011 @ Jun 1 2020, 07:15 PM) i got it. 1k transaction unposted yet (shown unposted). but before opening the psa i did other spending. so not sure which qualified me to the card spend bonus. but number a bit weird. I have base 0.6, card spend 11.53, saving 12.13 11.53 is a bit weird. shouldnt it be ~9.07 my three days balances is 61k, 80k, 80.5k. average 73833.3. I went to double check the calculation and you're right that the Card Spend Bonus Interest is more than what I calculated. Yours is 27.12% more than entitlement and mine is 26.67% more I tried to play with the numbers in Excel and the Card Spend Bonus Interest Rate is at 1.9% pa (0.4% pa more). Not sure if it's an error in their system because of the 0.4% reduction in the base interest rate recently. So coincident! This post has been edited by GrumpyNooby: Jun 1 2020, 08:50 PM |

|

|

|

|

|

cclim2011

|

Jun 1 2020, 09:21 PM Jun 1 2020, 09:21 PM

|

|

QUOTE(GrumpyNooby @ Jun 1 2020, 08:48 PM) I went to double check the calculation and you're right that the Card Spend Bonus Interest is more than what I calculated. Yours is 27.12% more than entitlement and mine is 26.67% more I tried to play with the numbers in Excel and the Card Spend Bonus Interest Rate is at 1.9% pa (0.4% pa more). Not sure if it's an error in their system because of the 0.4% reduction in the base interest rate recently. So coincident! oh really... i see. let's see if they retract |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 09:22 PM Jun 1 2020, 09:22 PM

|

|

QUOTE(cclim2011 @ Jun 1 2020, 09:21 PM) oh really... i see. let's see if they retract They may issue an adjustment entry. Who knows! By the way, your May MAB is RM 7145.16129 not RM 73833.3 (as in your earlier post). |

|

|

|

|

|

cclim2011

|

Jun 1 2020, 09:34 PM Jun 1 2020, 09:34 PM

|

|

QUOTE(GrumpyNooby @ Jun 1 2020, 09:22 PM) They may issue an adjustment entry. Who knows! By the way, your May MAB is RM 7145.16129 not RM 73833.3 (as in your earlier post). haha yeah... i use daily just now... 3/366 not so accurate just to be quick haha |

|

|

|

|

|

cucikaki

|

Jun 2 2020, 03:20 AM Jun 2 2020, 03:20 AM

|

|

Spend criteria i got 1.91% instead of 1.50%. So happy. If this were ocbc i would have move all my money.

|

|

|

|

|

|

mitodna

|

Jun 2 2020, 07:26 AM Jun 2 2020, 07:26 AM

|

|

new to this account (less than 1 month), didn't get the deposit bonus, saw the card spend bonus, is it it will credit later or i just missed the criteria? thank you.

|

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 07:29 AM Jun 2 2020, 07:29 AM

|

|

QUOTE(mitodna @ Jun 2 2020, 07:26 AM) new to this account (less than 1 month), didn't get the deposit bonus, saw the card spend bonus, is it it will credit later or i just missed the criteria? thank you. Did you deposit in min RM 3k as single deposit of fresh funds from other bank in the month of May? The Deposit or Save Bonus Interest is credited in on the same day as Base Interest. This post has been edited by GrumpyNooby: Jun 2 2020, 07:39 AM |

|

|

|

|

|

mitodna

|

Jun 2 2020, 07:43 AM Jun 2 2020, 07:43 AM

|

|

QUOTE(GrumpyNooby @ Jun 2 2020, 07:29 AM) Did you deposit in min RM 3k as single deposit of fresh funds from other bank in the month of May? The Deposit or Save Bonus Interest is credited in on the same day as Base Interest. Oh, thank you. I didn't from other bank, from same bank I has, I will now do it. |

|

|

|

|

|

datolee32

|

Jun 2 2020, 08:46 AM Jun 2 2020, 08:46 AM

|

|

I saw there is hibah and hibah bonus in my account, may i know what are them refer to?

|

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 08:51 AM Jun 2 2020, 08:51 AM

|

|

QUOTE(datolee32 @ Jun 2 2020, 08:46 AM) I saw there is hibah and hibah bonus in my account, may i know what are them refer to? Hibah is Islamic Banking term for interest. Your account is Super Salary-i (Payroll) from SC Saadiq. This post has been edited by GrumpyNooby: Jun 2 2020, 08:51 AM |

|

|

|

|

|

datolee32

|

Jun 2 2020, 08:54 AM Jun 2 2020, 08:54 AM

|

|

QUOTE(GrumpyNooby @ Jun 2 2020, 08:51 AM) Hibah is Islamic Banking term for interest. Your account is Super Salary-i (Payroll) from SC Saadiq. I see, is Hibah and Hibah bonus refer to the saving 0.1% interest? |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 08:59 AM Jun 2 2020, 08:59 AM

|

|

QUOTE(datolee32 @ Jun 2 2020, 08:54 AM) I see, is Hibah and Hibah bonus refer to the saving 0.1% interest? Hibah should be Base Interest (0.1%) Hibah Bonus For The Month XXXX should be Deposit or Save Bonus Interest (2%) Bonus-Hibah-Card Spend should be Card Spend Bonus Interest (1.5%) |

|

|

|

|

|

LostAndFound

|

Jun 2 2020, 10:07 AM Jun 2 2020, 10:07 AM

|

|

QUOTE(GrumpyNooby @ Jun 2 2020, 08:59 AM) Hibah should be Base Interest (0.1%) Hibah Bonus For The Month XXXX should be Deposit or Save Bonus Interest (2%) Bonus-Hibah-Card Spend should be Card Spend Bonus Interest (1.5%) My descriptions with a Saddiq account look like this:- HIBAH CREDIT - 0.1% BONUS HIBAH FOR THE MONTH 0520 - 2% BONUS INTEREST-CARD SPEND - 1.9% (dunno where the 0.4% came from this month) Surprised to see Interest word there, checked back even past month also had the same description. Haram wei =p |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 10:10 AM Jun 2 2020, 10:10 AM

|

|

QUOTE(LostAndFound @ Jun 2 2020, 10:07 AM) My descriptions with a Saddiq account look like this:- HIBAH CREDIT - 0.1% BONUS HIBAH FOR THE MONTH 0520 - 2% BONUS INTEREST-CARD SPEND - 1.9% (dunno where the 0.4% came from this month) Surprised to see Interest word there, checked back even past month also had the same description. Haram wei =p Obviously you're accurate since you're holding that account. I was merely giving him a rough idea of what to expect from the transaction description. |

|

|

|

|

Jun 1 2020, 06:11 PM

Jun 1 2020, 06:11 PM

Quote

Quote 0.0248sec

0.0248sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled