hope scb announce fast if they wanna change the rate. wanna decide whether to go open an account...

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

May 11 2020, 01:02 PM May 11 2020, 01:02 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,701 posts Joined: Feb 2011 |

hope scb announce fast if they wanna change the rate. wanna decide whether to go open an account...

|

|

|

|

|

|

May 15 2020, 08:00 PM May 15 2020, 08:00 PM

Return to original view | Post

#2

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

May 15 2020, 10:04 PM May 15 2020, 10:04 PM

Return to original view | Post

#3

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

May 16 2020, 01:20 PM May 16 2020, 01:20 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

May 22 2020, 11:26 PM May 22 2020, 11:26 PM

Return to original view | Post

#5

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

May 29 2020, 05:25 PM May 29 2020, 05:25 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,701 posts Joined: Feb 2011 |

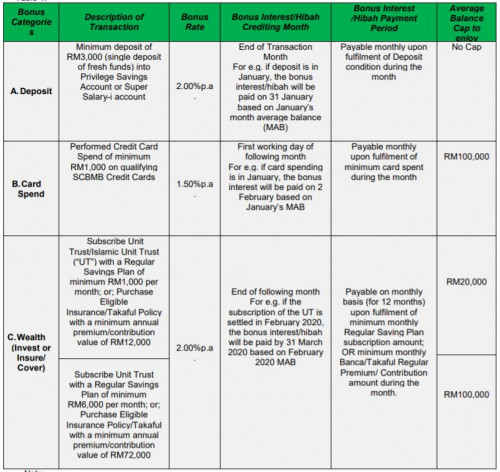

hi, managed to open an account today. transfered funds from ocbc and ambank into it. can i know if need to spend 1k if i already spent enough with my jop or liverpool card this month? alos the 3k requirement, is it incremental or as long as i transfer 3k into it monthly (ie doesnt care hiw much i traansfer out). sorry i think sute these questions have been asked before. tia

|

|

|

|

|

|

May 29 2020, 07:41 PM May 29 2020, 07:41 PM

Return to original view | Post

#7

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

Jun 1 2020, 12:46 PM Jun 1 2020, 12:46 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 1 2020, 07:09 AM) Guys, Base Interest and Save Bonus Interest for May 2020 are in. aiya. my boost transaction 1k on saturday still unposted...Card Bonus Spend Interest 2020 is expected to be credited by end of today (first working day of the following month) as per product T&C.  |

|

|

Jun 1 2020, 07:15 PM Jun 1 2020, 07:15 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 1 2020, 12:51 PM) i got it. 1k transaction unposted yet (shown unposted). but before opening the psa i did other spending. so not sure which qualified me to the card spend bonus.but number a bit weird. I have base 0.6, card spend 11.53, saving 12.13 11.53 is a bit weird. shouldnt it be ~9.07 my three days balances is 61k, 80k, 80.5k. average 73833.3. This post has been edited by cclim2011: Jun 1 2020, 07:40 PM |

|

|

Jun 1 2020, 09:21 PM Jun 1 2020, 09:21 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 1 2020, 08:48 PM) I went to double check the calculation and you're right that the Card Spend Bonus Interest is more than what I calculated. oh really... i see. let's see if they retractYours is 27.12% more than entitlement and mine is 26.67% more I tried to play with the numbers in Excel and the Card Spend Bonus Interest Rate is at 1.9% pa (0.4% pa more). Not sure if it's an error in their system because of the 0.4% reduction in the base interest rate recently. So coincident! |

|

|

Jun 1 2020, 09:34 PM Jun 1 2020, 09:34 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

Jun 2 2020, 11:30 PM Jun 2 2020, 11:30 PM

Return to original view | Post

#12

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 2 2020, 10:59 PM) MAB starts from 1st till last day of the month. hi for fresh fund... i always have doubts. say i instant transfer out today 15k to pay credit cards of other banks. then mid of the month i transfer 3k in. is that fresh fund? or must be 15k + 3k = 18k? thanks.FF of RM 3k must reach in any day of the month. The earlier the better as your MAB will be higher. Base interest and bonus interest are applied on the MAB of the month. This post has been edited by cclim2011: Jun 2 2020, 11:30 PM |

|

|

Jun 2 2020, 11:41 PM Jun 2 2020, 11:41 PM

Return to original view | Post

#13

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jun 7 2020, 01:11 AM Jun 7 2020, 01:11 AM

Return to original view | IPv6 | Post

#14

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 5 2020, 10:03 AM) Would like to ask, to be qualified of the 2% deposit bonus interest, I need to deposit min 3k fresh fund into this account every month? FF = fresh fund? if come from other bank, under what condition it is not considered FF? Within same day? Thanks.Yes, min RM 3k as in FF from other banks Since I don't have 3k savings per month, can I deposit 10k the first month, end of first month I withdraw 3k and deposit back in the 2nd month to get the 2% bonus interest in 2nd month? Yes, ensure that the RM 3k comes from other banks as FF |

|

|

Jun 7 2020, 12:39 PM Jun 7 2020, 12:39 PM

Return to original view | Post

#15

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(GrumpyNooby @ Jun 7 2020, 08:04 AM) If you transferred within accounts under SC and SC Saadiq, it is not considered as fresh fund. alright got it. thanks. at least 1-time min 3k from other banks or via cdm (and recorded) anytime within the month. the word fresh is a lil confusing haha.Alternatively, you can make a single deposit of RM 3k with cash at SC or SC Saadiq branches OTC or using CDM/CRM. That will be counted as FF. |

|

|

Jun 27 2020, 11:03 PM Jun 27 2020, 11:03 PM

Return to original view | Post

#16

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(wjleong15 @ Jun 25 2020, 04:29 PM) Got this email from SC wah my first mth with sc... just three days though. "For the month of May 2020, we inadvertently credited an additional 0.40% bonus interest on top of the actual 1.5% bonus interest on your credit card spend. As a gesture of goodwill, we will not be reversing the additional bonus interest credited. We apologise for this error and have taken measures to avoid reoccurrence." sc so generous. surely no goodwill if from ocbc 😅 but i never received emails hehe This post has been edited by cclim2011: Jun 27 2020, 11:03 PM |

|

|

Jun 28 2020, 09:59 AM Jun 28 2020, 09:59 AM

Return to original view | Post

#17

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(wjleong15 @ Jun 27 2020, 11:48 PM) My ocbc 365 already frozen 😂 really? i have left like 10ish everytime haha. ok will transfer out also One good thing for ocbc is can have 0 balance So no need waste time go branch close it but i am still using its batch future transfer for credit cards. anyone knows can sc online can do this in one page or must do one transfer at a time? |

|

|

Jun 29 2020, 10:58 AM Jun 29 2020, 10:58 AM

Return to original view | IPv6 | Post

#18

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(wjleong15 @ Jun 28 2020, 09:23 PM) no batch oopss haha gotta stick with ocbc360 then. anyhow max 100k in psa if more then ocbc360 liaoonly 1 each time sometimes will failed at least 4 times failed in this year in my experience the thing I don't like is when failed, the message show in mailbox but no alert only successful transfer will get sms so have to remember ourselves to check else self bear late payment charges |

|

|

Jun 29 2020, 11:29 PM Jun 29 2020, 11:29 PM

Return to original view | Post

#19

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(wjleong15 @ Jun 29 2020, 07:39 PM) ocbc360 will failed also oh really. ocbc future payment has been ok for me all these while. can do batch in one page which i really like too...it depends whether is paynet issue or receiving bank got issue just I don't like is sc do not actively notify you if failed only a message in mailbox but no notification that there is unread message in mailbox the designer for this function brain bang wall sc not bad jor. u try affinonline then u shld know what is bad. 🤭 may be u can feedback to sc on that lacking. This post has been edited by cclim2011: Jun 29 2020, 11:30 PM |

|

|

Jul 13 2020, 07:04 PM Jul 13 2020, 07:04 PM

Return to original view | Post

#20

|

Senior Member

1,701 posts Joined: Feb 2011 |

hi guys, i think someone mentioned on how to delete future recurring bank transfer (from psa) but couldnt search it. can anyone help? thanks.

|

| Change to: |  0.0513sec 0.0513sec

0.30 0.30

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 10:24 AM |