QUOTE(SwarmTroll @ Mar 20 2021, 01:39 AM)

Is there a minimum amount for every batch of investment you guys make? i.e. RM10K, 12k, etc.? As in to make it cost effective since there is quite a bit of transaction costs to consider

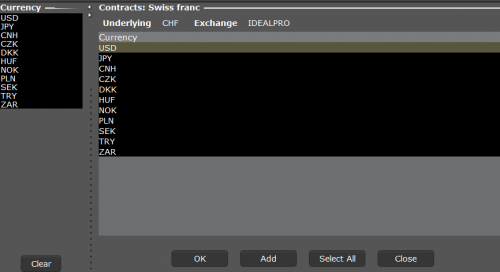

Adding on to Ziet's answer to your previous question: Fractional shares are not allowed for TSG-IBKR users, so you need to buy in "full lots". For US stocks it's all 1 share each, but HKSE in particular you have to buy in specific amount, e.g. for 1810 (xiaomi) it's in 200s.

For your question, I guess you're looking for an advice what's a good amount? I think this answers it very well:

QUOTE(polarzbearz @ Mar 14 2021, 01:16 PM)

Thanks for the support!!

My general thumb of rule (similar to your calculations) is to keep the cost of moving funds at 1% or lower so I generally only move funds overseas

when I accumulate more than RM5K and try to limit it to a maximum of 2 trades per conversion @ ~1.08% (though sometimes I make up to 4 trades based on RM5k basket size @ ~1.34%) for US long term holdings. For HK holdings I get the currency conversion advantages - since I have my HK bank account (means I don't incur any additional currency conversion fees aside from the ones in TransferWise). Plus HK's commission is cheap at HKD20 (~RM10) for most of my trade sizes.

Going with your example of RM2k basket size, it'll cost approximately ~1.46%, example calculations below:

TransferWise (SGD 648.11) vs. Google Rate (SGD 652.99): ~SGD4.88 = ~USD 3.63

IBKR Spot Rate Conversion: USD 2

Commissions for 1 trade: USD 1.5 = total USD 7.13 in fees or ~MYR 29.36 in fees (~1.49%)

Commissions for 2 trades: USD 3 = total USD 8.63 in fees or ~MYR 35.34 in fees (~1.80%)

As you can see, it adds up very quickly and is already on-par with FSM sales charge

hence the reason why I try to keep my basket size to be RM5k minimum, and as interim I typically store it either in StashAway or my mortgage account (3+ months emergency buffer cum opportunity funds).

Another way is, for smaller trades, I also redirected it to my Trading212 account but the holdings there are mostly experimental (just to test my analysis and decision making process and build up my confidence over long run. Demo account may work as well but I just don't get the same "accountability" feeling with real money.)

Mar 1 2021, 12:35 AM

Mar 1 2021, 12:35 AM

Quote

Quote

0.2547sec

0.2547sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled