QUOTE(cybermaster98 @ Feb 13 2024, 05:26 PM)

How do you transfer from USD in IBKR to a Malaysian bank account?

QUOTE(cybermaster98 @ Oct 17 2023, 10:09 AM)

QUOTE(earshore @ Oct 16 2023, 10:23 PM)

make cimb my account

next make cimb sg account

How to open SG bank account when im not residing or working in SG? Plus later still need to transfer to Malaysia.

QUOTE(Medufsaid @ Oct 17 2023, 11:12 AM)

CIMB sg allows u to open without leaving malaysia.

every one's been telling you how to do it since months ago

QUOTE(sp3d2 @ Feb 13 2024, 05:32 PM)

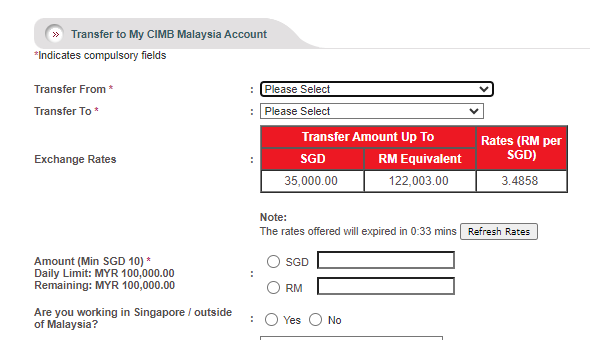

Convert USD in IBKR to SGD, then transfer to CIMB Singapore, then to Malaysia using Wise

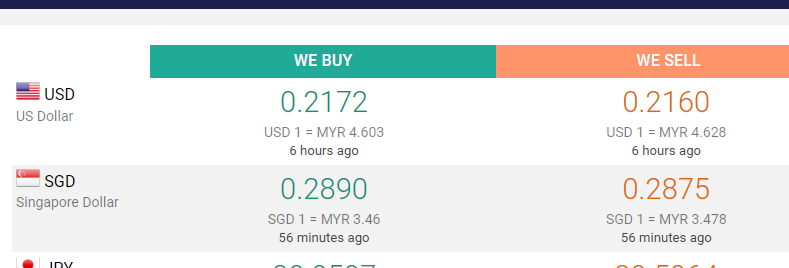

for some reasons, internal CIMB SG->MY rates are actually better than midvalley rates, just remember to transfer during office hours. click below for forex rates comparison

» Click to show Spoiler - click again to hide... «

QUOTE(Medufsaid @ Jan 4 2024, 05:39 PM)

satisfied with SGD->MYR since it's on par or better than midvalley. only thing is i'm still on the lookout for MYR->SGD that can provide rates on par with midvalley

This post has been edited by Medufsaid: Feb 14 2024, 11:28 AM

Feb 13 2024, 07:55 AM

Feb 13 2024, 07:55 AM

Quote

Quote

0.0199sec

0.0199sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled