QUOTE(AthrunIJ @ Apr 2 2022, 01:44 PM)

Err, if you don't mind explaining the after 11pm Malaysian time thingy?

I am new to this international stock buying thingy. 😅

Okay so, I am going to use some likely wrong words here and poorly explain it, so the resident stock sifus may want to correct me:

You are buying an ETF, which is a basket of stocks. So it has two values, a Market Value (The value of the ticker, the price you buy and sell it) and Net Asset Value, which is the sum of all the stock value under the ETF.

Market Value is determined by the traders but mostly market markers (they provide liquidity to anchor the price close to NAV) while the underlying stocks value is determined by traders who trade them. Hence inevitably, there will be difference in these values, we call them Premium and Discounts (e.g. SP500 all share prices total up for 500 for example, but the ETF currently is trading at 480, so you got a $20 discount if you bought it at that time)

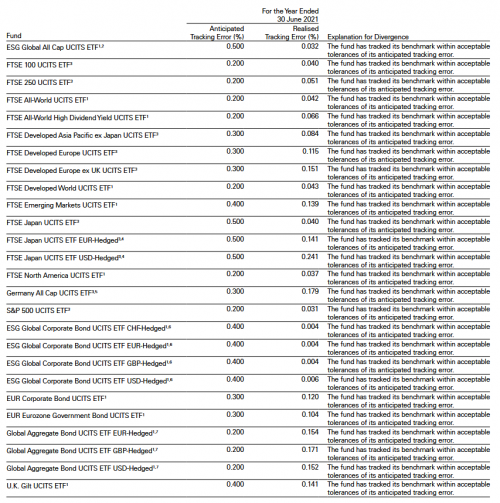

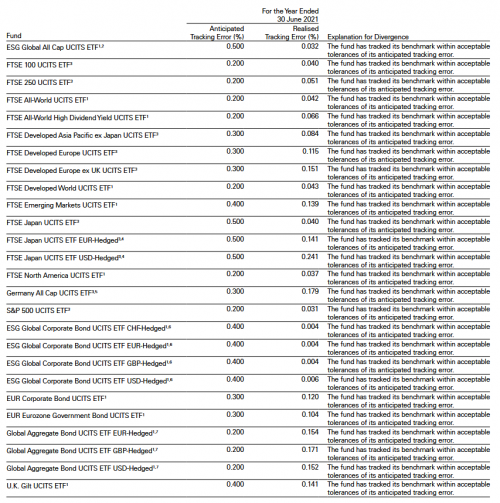

Now, market maker try to keep these value as close as possible, to minimize what we call tracking errors.

Further reading:

https://www.vanguardmexico.com/en/learn/exp...-discounts-workSo, when you buy VUAA when US market is not open, you are exposed to tracking error - the price you are paying, may not accurately reflect the real value of the underlying stocks. This could be good, could be bad, could mean nothing. It's just something to keep in mind.

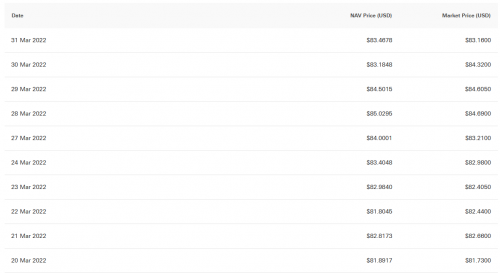

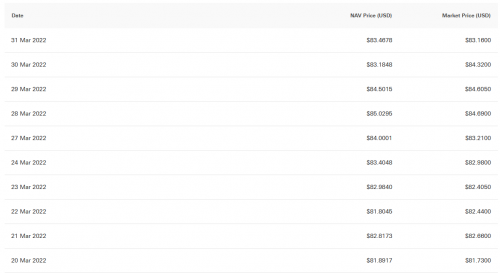

You can see the tracking error by checking the fund's page NAV information, and overall tracking error reported in the fund's annual report usually.

This post has been edited by Hoshiyuu: Apr 2 2022, 02:20 PM

This post has been edited by Hoshiyuu: Apr 2 2022, 02:20 PM

Apr 1 2022, 09:09 PM

Apr 1 2022, 09:09 PM

Quote

Quote

0.0541sec

0.0541sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled