Next time will try CIMB SG to IBKR.

This post has been edited by Davidtcf: Mar 29 2022, 10:45 PM

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Mar 29 2022, 10:44 PM Mar 29 2022, 10:44 PM

Show posts by this member only | IPv6 | Post

#5361

|

Senior Member

3,520 posts Joined: Jan 2003 |

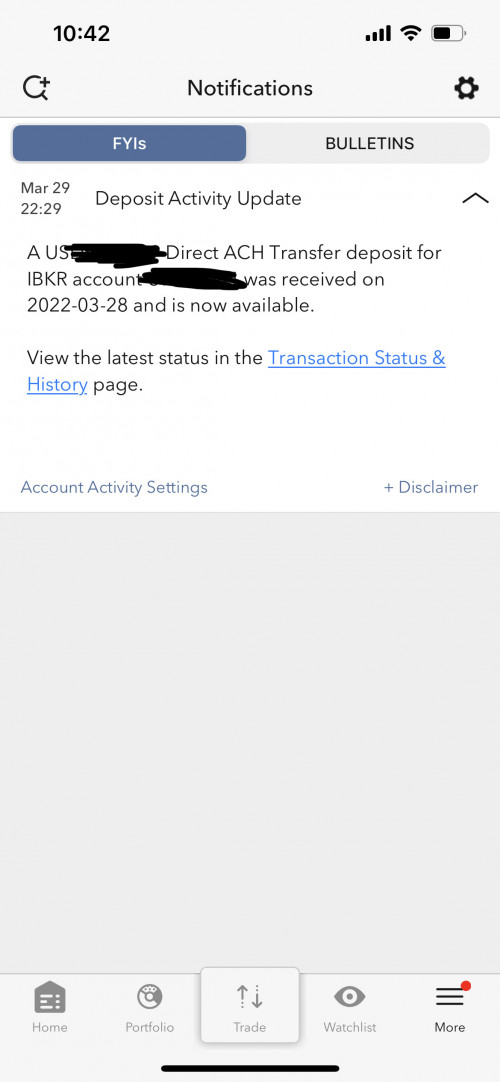

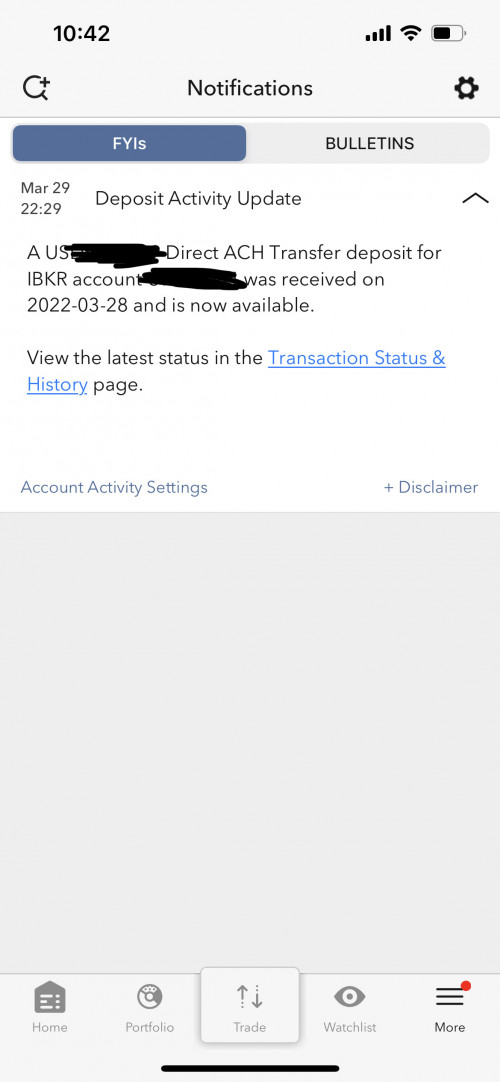

Finally got the money at 10.29pm. Longest wait for me for a Wise to IBKR transfer.  Next time will try CIMB SG to IBKR. This post has been edited by Davidtcf: Mar 29 2022, 10:45 PM TOS liked this post

|

|

|

|

|

|

Mar 30 2022, 04:09 AM Mar 30 2022, 04:09 AM

|

Junior Member

71 posts Joined: Dec 2021 |

|

|

|

Mar 30 2022, 08:13 AM Mar 30 2022, 08:13 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 30 2022, 08:32 AM Mar 30 2022, 08:32 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Knives Out in India: Zomato Needs to Expand the Menu, Quickly: https://www.wsj.com/articles/knives-out-in-...share_permalink

|

|

|

Mar 30 2022, 09:18 AM Mar 30 2022, 09:18 AM

|

Junior Member

71 posts Joined: Dec 2021 |

QUOTE(TOS @ Mar 30 2022, 08:13 AM) NQ Thanks. |

|

|

Mar 30 2022, 12:30 PM Mar 30 2022, 12:30 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 30 2022, 06:48 PM Mar 30 2022, 06:48 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

dwRK

https://www.reuters.com/business/finance/us...019-2022-03-29/ Does the yield curve inversion tell you anything from "TA" point of view? This post has been edited by TOS: Mar 30 2022, 10:54 PM |

|

|

Mar 30 2022, 06:58 PM Mar 30 2022, 06:58 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

Anyone have experience selling box spread for low interest loans?

https://www.lesswrong.com/posts/8NSKMMDXS8g...slightly-faster |

|

|

Mar 30 2022, 08:06 PM Mar 30 2022, 08:06 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Mar 30 2022, 06:48 PM) dwRK these are mostly noise...https://www.reuters.com/business/finance/us...019-2022-03-29/ Does the yield curve inversion tells you anything from "TA" point of view? few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... TOS liked this post

|

|

|

Mar 30 2022, 09:53 PM Mar 30 2022, 09:53 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Mar 30 2022, 08:06 PM) these are mostly noise... Which bond index are you watching? From FA point of view, stocks are priced in large part due to risk premium over the risk-free yield. So knowing the bond markets movementcan give a lot of hints actually.few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... Let me guess. You are watching the UST 10 year? From my experience, most professionals price stocks using the 10-year yield as the risk free rate (since you usually hold stocks for that long, hence bearing risk for a similar term). This post has been edited by TOS: Mar 30 2022, 10:11 PM |

|

|

Mar 30 2022, 10:50 PM Mar 30 2022, 10:50 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(dwRK @ Mar 30 2022, 08:06 PM) few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol Can I ask in real life how old are you? 2017 till now is too short. Wait it will come. I start invest from year 2000 until now 2022 met a few close call and that is 22 years. You wait another 20 years sure will kena I predict and your wish will be granted esyap liked this post

|

|

|

Mar 31 2022, 02:33 AM Mar 31 2022, 02:33 AM

Show posts by this member only | IPv6 | Post

#5372

|

All Stars

24,367 posts Joined: Feb 2011 |

QUOTE(dwRK @ Mar 30 2022, 08:06 PM) these are mostly noise... Same here. I can't wat for recession to pick things up in bargain. The last month sell off was quite tempting. Some things were on bargain.few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... QUOTE(sgh @ Mar 30 2022, 10:50 PM) Can I ask in real life how old are you? 2017 till now is too short. Wait it will come. I start invest from year 2000 until now 2022 met a few close call and that is 22 years. You wait another 20 years sure will kena I predict and your wish will be granted Don't be scared of recession. Fortuns made in a down market 8f you are brave to buy. I have been buying every dip when everyone was so fearful and it work out well.If I wait to buy in green market, my reurns is lower. esyap liked this post

|

|

|

Mar 31 2022, 09:38 AM Mar 31 2022, 09:38 AM

Show posts by this member only | IPv6 | Post

#5373

|

Junior Member

83 posts Joined: May 2009 |

QUOTE(Ramjade @ Mar 31 2022, 02:33 AM) Same here. I can't wat for recession to pick things up in bargain. The last month sell off was quite tempting. Some things were on bargain. Yup, buy on the dip and DCA works best for me so farDon't be scared of recession. Fortuns made in a down market 8f you are brave to buy. I have been buying every dip when everyone was so fearful and it work out well. If I wait to buy in green market, my reurns is lower. |

|

|

|

|

|

Mar 31 2022, 10:09 AM Mar 31 2022, 10:09 AM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Mar 30 2022, 09:53 PM) Which bond index are you watching? From FA point of view, stocks are priced in large part due to risk premium over the risk-free yield. So knowing the bond markets movementcan give a lot of hints actually. i watch 10yr futures...same lah ust10... sometimes the 20yr...Let me guess. You are watching the UST 10 year? From my experience, most professionals price stocks using the 10-year yield as the risk free rate (since you usually hold stocks for that long, hence bearing risk for a similar term). This post has been edited by dwRK: Mar 31 2022, 10:12 AM TOS liked this post

|

|

|

Mar 31 2022, 10:11 AM Mar 31 2022, 10:11 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 31 2022, 10:17 AM Mar 31 2022, 10:17 AM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Mar 31 2022, 10:11 AM) Nice! Thanks for info. futures is in name mostly... they track spot quite closely usually... the "sophistication" is just understanding the contract specification imho...Bond futures. That is very sophisticated. I only watch spot market yields. But you have a point, futures tell a lot about the future of yields at the present time. TOS liked this post

|

|

|

Mar 31 2022, 10:39 AM Mar 31 2022, 10:39 AM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(sgh @ Mar 30 2022, 10:50 PM) Can I ask in real life how old are you? 2017 till now is too short. Wait it will come. I start invest from year 2000 until now 2022 met a few close call and that is 22 years. You wait another 20 years sure will kena I predict and your wish will be granted in that case... i probably eat more salt... and humble pie... than you ar... hahaha... |

|

|

Mar 31 2022, 10:56 AM Mar 31 2022, 10:56 AM

|

Senior Member

6,230 posts Joined: Jun 2006 |

TOS missed out one point on "sophistication"... so while you can trade current contract like stocks... you can also do a calendar spread... this means, for example, you sell a current month contract and buy a future month contract as a combo... essentially you are trading the differences in contract price due to time value expectations... so slightly more sophisticated than stocks/etf... TOS liked this post

|

|

|

Mar 31 2022, 01:09 PM Mar 31 2022, 01:09 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 31 2022, 05:57 PM Mar 31 2022, 05:57 PM

Show posts by this member only | IPv6 | Post

#5380

|

Senior Member

2,992 posts Joined: Feb 2015 |

Well, my Maybank Singapore bank approval is still pending.

Anyways, is it possible to just straight transfer from Wise to IBKR? Anyone has a tutorial on how to do it, and any thing to take into consideration? This post has been edited by AthrunIJ: Mar 31 2022, 05:58 PM |

| Change to: |  0.0217sec 0.0217sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 04:57 PM |