Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

watabakiu

|

Mar 20 2025, 04:14 PM Mar 20 2025, 04:14 PM

|

|

QUOTE(MUM @ Mar 19 2025, 11:45 AM) How does the "RED" impacted you emotionally? Will the "RED" impact you financially IF it still stayed "RED" in the next 12 months or more? After having considered the above, if you still hv confidence in the selected ETFs and their individual's % of allocation in SRI36, Buying while at "RED" will be "cheaper" than buying at "GREEN" To be perfectly frank, the deposited amount are money I do not mind losing. It is meant for diversification and not to be used immediately for mortgage, bills or anything. As is the case, I will continue DCA-ing, regardless of whether green or red. Thanks! |

|

|

|

|

|

watabakiu

|

Apr 5 2025, 01:29 PM Apr 5 2025, 01:29 PM

|

|

So, the idea about roboadvisor is to weed through the noise, access credible sources, and be agile to respond to the market.

Quote:

“The system continuously monitors the markets’ behaviors, and is built to REACT IMMEDIATELY TO ANY UNEXPECTED SHOCK. Through the use of a few technical analysis techniques such as death crosses, ERAA®’s framework is able to acknowledge if the markets cease to follow economic data and is able to REACT PROMPTLY BEFORE A SIGNIFICANT CRASH HAPPENS.”

So if this is the idea, why hasn't it responded to the news on tariffs imposed by Uncle Sam? I dunno, maybe portfolio re-optimization or something?

I have yet to see SA doing it this time around, not before the news were rumors, nor when it jas become real.

Thoughts?

This post has been edited by watabakiu: Apr 5 2025, 01:29 PM

|

|

|

|

|

|

SUSboyboycute

|

Apr 5 2025, 03:26 PM Apr 5 2025, 03:26 PM

|

|

QUOTE(watabakiu @ Mar 20 2025, 04:14 PM) To be perfectly frank, the deposited amount are money I do not mind losing. It is meant for diversification and not to be used immediately for mortgage, bills or anything. As is the case, I will continue DCA-ing, regardless of whether green or red. Thanks! Unker is extremely touched and emotional reading your bold statement. You have my respect for having 2 balls of steel. Unker will just buy popcorn and watch the show |

|

|

|

|

|

watabakiu

|

Apr 5 2025, 07:59 PM Apr 5 2025, 07:59 PM

|

|

QUOTE(boyboycute @ Apr 5 2025, 03:26 PM) Unker is extremely touched and emotional reading your bold statement. You have my respect for having 2 balls of steel. Unker will just buy popcorn and watch the show I hope unker is not too emotional touching yourself, unker. On my point then yes, the portion of money I put into SA are ones I do not mind losing. Because the amount is minimal oni |

|

|

|

|

|

jutamind

|

Jul 13 2025, 04:18 PM Jul 13 2025, 04:18 PM

|

|

Stashaway SG seems to launch new ETF platform. Check out on the FAQ: https://www.stashaway.sg/help-center/etf-investingProbably will be available in MY in the near future |

|

|

|

|

|

Drian

|

Jul 20 2025, 01:06 PM Jul 20 2025, 01:06 PM

|

|

I find that their blackrock version is doing better than their own version.

|

|

|

|

|

|

guy3288

|

Jul 23 2025, 06:24 PM Jul 23 2025, 06:24 PM

|

|

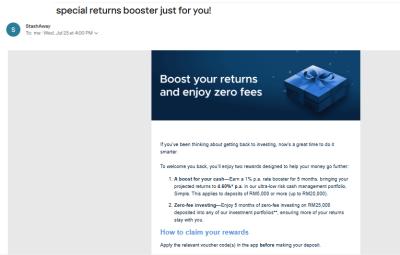

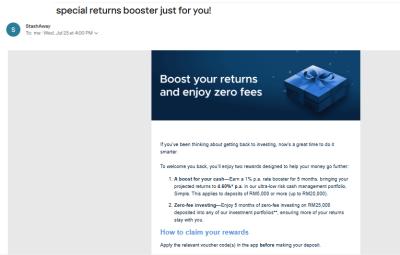

Stash Away tried to attract us with 4.6% and 0 fee Attached thumbnail(s)

|

|

|

|

|

|

onthefly

|

Jul 25 2025, 12:06 AM Jul 25 2025, 12:06 AM

|

|

QUOTE(guy3288 @ Jul 23 2025, 06:24 PM) Stash Away tried to attract us with 4.6% and 0 fee Didnt receive. U were inactive in SA ? |

|

|

|

|

|

guy3288

|

Jul 25 2025, 12:09 PM Jul 25 2025, 12:09 PM

|

|

QUOTE(onthefly @ Jul 25 2025, 12:06 AM) Didnt receive. U were inactive in SA ? yeah sold off some time ago |

|

|

|

|

|

poooky

|

Jul 25 2025, 02:11 PM Jul 25 2025, 02:11 PM

|

|

QUOTE(guy3288 @ Jul 23 2025, 06:24 PM) Stash Away tried to attract us with 4.6% and 0 fee Good what, can park excess from atlas here |

|

|

|

|

|

guy3288

|

Jul 25 2025, 02:15 PM Jul 25 2025, 02:15 PM

|

|

QUOTE(poooky @ Jul 25 2025, 02:11 PM) Good what, can park excess from atlas here ganjaran SSPNi better last day 31.7.25 effective 6% +3.5-4% |

|

|

|

|

|

onthefly

|

Jul 26 2025, 12:59 PM Jul 26 2025, 12:59 PM

|

|

QUOTE(guy3288 @ Jul 25 2025, 02:15 PM) ganjaran SSPNi better last day 31.7.25 effective 6% +3.5-4% still got the code ? Possible for me to utilize it  |

|

|

|

|

|

guy3288

|

Jul 26 2025, 01:51 PM Jul 26 2025, 01:51 PM

|

|

QUOTE(onthefly @ Jul 26 2025, 12:59 PM) still got the code ? Possible for me to utilize it  which code? Stashaway? |

|

|

|

|

|

Relianne

|

Aug 18 2025, 01:24 PM Aug 18 2025, 01:24 PM

|

Getting Started

|

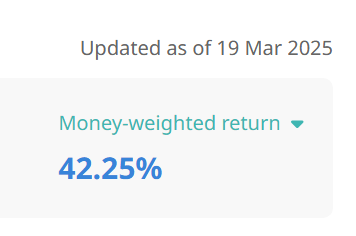

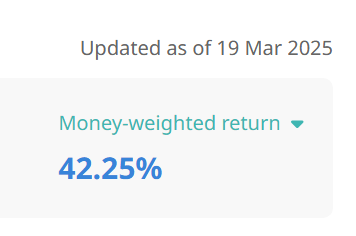

QUOTE(Xenopher @ Mar 19 2025, 11:53 AM) I have been DCA-ing consistently since 2020 and currently at 40%+ MWR/TWR. StashAway is not my only portfolio but so far it's relatively very worry-free for me (despite they classifies their portfolio as 'very aggressive').  My experience has been similar too. DCA since 2020, MWR 63% in MYR terms, 70% in USD terms. General investing SRI30% |

|

|

|

|

|

onthefly

|

Aug 19 2025, 12:35 AM Aug 19 2025, 12:35 AM

|

|

its pretty quiet here. i guess mostly in the green

|

|

|

|

|

|

bourse

|

Aug 19 2025, 07:32 PM Aug 19 2025, 07:32 PM

|

|

DCA since Jun2022, MWR 54% in MYR terms, 78% in USD terms.

Flexible portfolio with IXJ, IVV and QQQ.

Thank you SAMY.

Time to go now.

|

|

|

|

|

|

Relianne

|

Aug 20 2025, 09:26 AM Aug 20 2025, 09:26 AM

|

Getting Started

|

QUOTE(bourse @ Aug 19 2025, 07:32 PM) DCA since Jun2022, MWR 54% in MYR terms, 78% in USD terms. Flexible portfolio with IXJ, IVV and QQQ. Thank you SAMY. Time to go now. Dilemma is when to sell? |

|

|

|

|

|

frostfrench

|

Aug 20 2025, 12:55 PM Aug 20 2025, 12:55 PM

|

|

My MWR is 48% in MYR terms My Dilemma is where to move funds to when I sell today  |

|

|

|

|

|

Relianne

|

Aug 20 2025, 06:16 PM Aug 20 2025, 06:16 PM

|

Getting Started

|

QUOTE(frostfrench @ Aug 20 2025, 12:55 PM) My MWR is 48% in MYR terms My Dilemma is where to move funds to when I sell today  Yea.. continue DCA then? |

|

|

|

|

|

bourse

|

Aug 25 2025, 10:33 AM Aug 25 2025, 10:33 AM

|

|

QUOTE(Relianne @ Aug 20 2025, 09:26 AM) portfolio close with nice return  |

|

|

|

|

Mar 20 2025, 04:14 PM

Mar 20 2025, 04:14 PM

Quote

Quote

0.0215sec

0.0215sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled