QUOTE(xander83 @ Mar 26 2021, 01:55 PM)

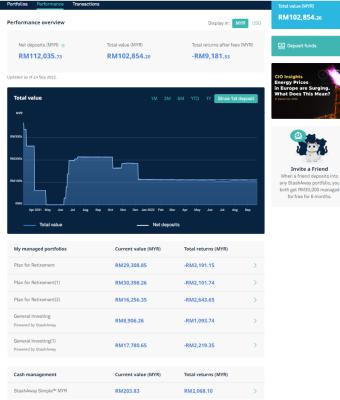

When you switch to USD losses are compounded ringgit dropped by 2% from 4.06 to 4.14 hence dollar now is rising which is why your loss so much compounded your the market fall hence your losses about close to 30k after the last withdrawal with forex losses around 8k itself and fund losses about 22k which is about right if you’re on 36% which already 15% dropped from it’s all time high

QUOTE(DragonReine @ Mar 26 2021, 01:58 PM)

You're actually looking at how MMF (and dividend paying shares) dividend payments+net asset value+reinvesting work, because Simple IS money market 😅😅 specifically it's tied to Eastspring Islamic Income Fund

Why you see variance in value:

1) As profit of the fund slowly increases, the profits reflect in the net asset value (NAV) of the units which goes up, this is usually calculated daily. So you see your investment value grow as profits increase.

2) on the 9th is when Eastsprings start payout their dividends, so what they do is subtract the profit from NAV to get money for dividend payment, so NAV goes down (value goes down) on 10th, and then the dividends are paid out based on the number of units you own. These dividends are then reinvested to buy new units at the lower NAV. So your value "drops" slightly but you actually now have more units then before, so in reality you've already profiting.

3) Repeat step #1 and 2#

4) You're actually profiting based on increasing number of units you get as StashAway Simple keeps reinvesting

Don't bother about the MYR/USD tab if you only invest in Simple, Simple is strictly MYR only, so no worries about USD (any difference in value you see in MYR/USD tab is based on current currency exchange rate, which goes up and down, since recently MYR value tank it gives false info that you're losing money on USD tab).

MYR/USD only becomes relevant if you invest in SAMY's portfolios because they're ETFs traded in USD

Thanks for shedding some light

QUOTE(bourse @ Mar 26 2021, 03:44 PM)

Stashaway Simple = Eastspring Investments Islamic Income Fund

https://www.fsmone.com.my/funds/tools/factsheet?fund=MYESIIF» Click to show Spoiler - click again to hide... «

https://www.stashaway.my/simpleIs StashAway Simple™ risky?

This is an investment, so there is a level of risk, but it’s incredibly low. The StashAway Risk Index for StashAway Simple™ is 1.8%. That means you have a 99% chance of not losing more than 1.8% of your AUM in a given year

StashAway Simple™ is as risky as investing in a fixed deposit issued by licensed financial institutions. The underlying fund in StashAway Simple™,

Eastspring Investments Islamic Income Fund, invests in Islamic money market instruments (fixed deposits) issued by financial institutions or their parent companies with a minimum credit rating of A3 or P1 by RAM Rating Services Berhad. Hence, the risk is the credit worthiness of the institutions such as AmBank Islamic Berhad, Public Islamic Bank Berhad and Maybank Islamic Berhad which were the top 3 holdings as of March 2020.

Ignore the USD performance as this MMF is MYR only. Unless you have SRI portfolio, then you might interest to view the whole performance (SRI + Simple).

The Value drop due to NAV diff each day.

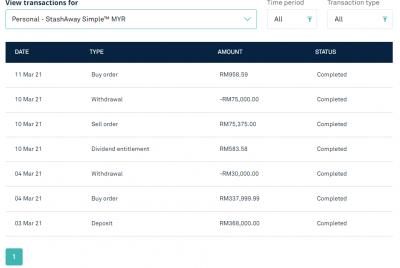

| date | net deposit | nav price | unit |

| 3.3.21 | 368k | 0.5192 | 708782.74 |

| 3.3.21 | WD 30k | 0.5192 | WD 57781.20 |

| 4.3.21 | 338k (368-30) | | |

| 8.3.21 | dividend 0.0008 x (708782.74-57781.20) |

| 9.3.21 | 338 | | |

| 9.3.21 | WD 75K? | 0.5185 | WD 144648.02 |

| 10.3.21 | 263 (338-75) | | |

| 12.3.21 | 263 | | |

| 16.3.21 | 263 | | |

| 22.3.21 | 263 | | |

| 23.3.21 | 263 | | |

net deposit = 368k - 30k - 75k

total value @ 23.3.21 = 0.5189 x (708782.74 - 57781.20 - 144648.02) + dividend

*sorry the total value not tally with the graph figure... please check back the transaction date and NAV then do the calculation again. This is how Simple work.

Thanks for your effort, now i can make sense out of those figures.

I used your info provided above, back calculate it seems SA gave me extra 604.71 units as ??dividend

or we calculated the dividend wrongly?

3.3.21 buy at RM0.5192 got 708 782.74 units,

4.3.21 sold RM30k = Balance 651 001.54 units

8.8.21 Dividend @ 0.0008 x 651 001.54 = 520.8 units = Total 651 522.34 units

9.3.21 Yes sold RM75k (i mistaken put RM45k there) -= 144 648.02 units---> Balance =506 874.32 units

If we use 506 874 units, subsequent amount all wont tally .

Add in extra 604.71 units all will tally perfectly, -> Balance 507 479.03 units

10.3.21 price RM0.5186 ->RM263 127.88

12.3.21 0.5186 = 263 178.63

16.3.21 0.5187 = 263 229.38

22.3.21 0.5188 = 263 280.13

23.3.21 0.5189 = 263 330.88

perfect

Jun 17 2020, 10:29 PM

Jun 17 2020, 10:29 PM

Quote

Quote

0.0700sec

0.0700sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled