Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

Relianne

|

Aug 18 2025, 01:24 PM Aug 18 2025, 01:24 PM

|

Getting Started

|

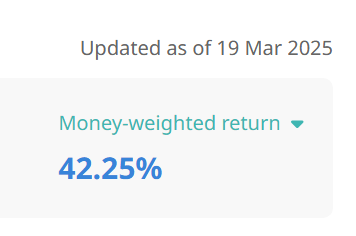

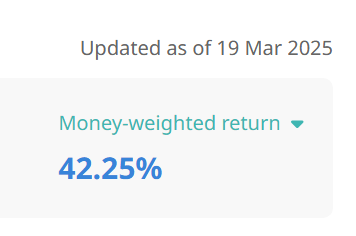

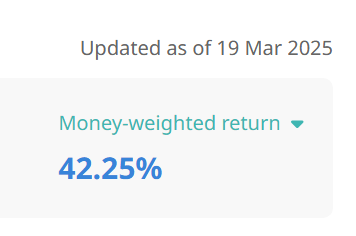

QUOTE(Xenopher @ Mar 19 2025, 11:53 AM) I have been DCA-ing consistently since 2020 and currently at 40%+ MWR/TWR. StashAway is not my only portfolio but so far it's relatively very worry-free for me (despite they classifies their portfolio as 'very aggressive').  My experience has been similar too. DCA since 2020, MWR 63% in MYR terms, 70% in USD terms. General investing SRI30% |

|

|

|

|

|

Relianne

|

Aug 20 2025, 09:26 AM Aug 20 2025, 09:26 AM

|

Getting Started

|

QUOTE(bourse @ Aug 19 2025, 07:32 PM) DCA since Jun2022, MWR 54% in MYR terms, 78% in USD terms. Flexible portfolio with IXJ, IVV and QQQ. Thank you SAMY. Time to go now. Dilemma is when to sell? |

|

|

|

|

|

Relianne

|

Aug 20 2025, 06:16 PM Aug 20 2025, 06:16 PM

|

Getting Started

|

QUOTE(frostfrench @ Aug 20 2025, 12:55 PM) My MWR is 48% in MYR terms My Dilemma is where to move funds to when I sell today  Yea.. continue DCA then? |

|

|

|

|

|

Relianne

|

Oct 30 2025, 12:29 PM Oct 30 2025, 12:29 PM

|

Getting Started

|

QUOTE(Jason @ Oct 30 2025, 12:06 PM) Anybody put money in Simple? Does it give the % as indicated? Or its BS only Yes been using Simple for a while now. I’d say returns are as per projected if not slightly higher. My October month return including dividend entitlement and rebates total to c. 3.59% p.a. Dividends typically paid out first half of the month. |

|

|

|

|

|

Relianne

|

Nov 2 2025, 06:00 AM Nov 2 2025, 06:00 AM

|

Getting Started

|

QUOTE(buffa @ Oct 31 2025, 12:28 PM) ETF itself is great. Now we can RSP into various good and popular ETF in FSMOne, it is even better. You can try with some small amount with those popular ETF if you never invest before. It will be better than unit trust. MooMoo seems like a good option for ETFs? No fee and RSP also possible |

|

|

|

|

Aug 18 2025, 01:24 PM

Aug 18 2025, 01:24 PM

Quote

Quote 0.4256sec

0.4256sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled