QUOTE(watabakiu @ Sep 17 2023, 10:54 PM)

I have been sifting through the threads 1005-this page, and notice mentions on the '

KWEB debacle' - what was this about actually? my bad for not picking this up earlier, but I was caught completely unaware about this

QUOTE(xander2k8 @ Sep 18 2023, 09:10 AM)

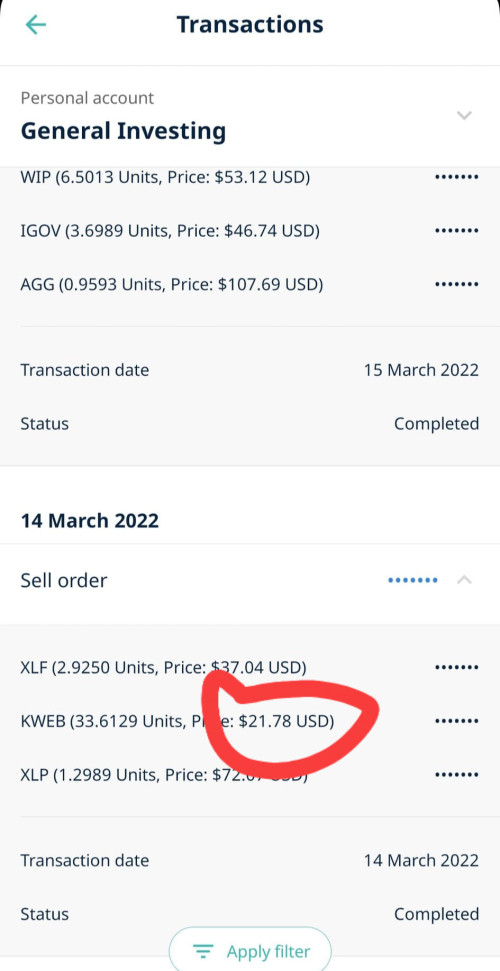

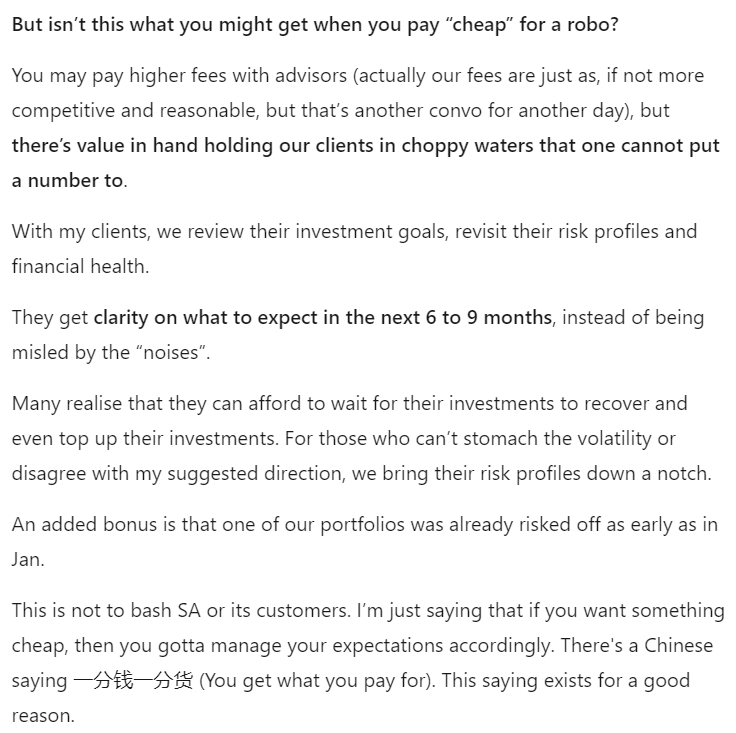

Got sucked into buying KWEB 🤦♀️ and then start panic selling during the start of Ukraine war due to sanctions and they force sell for everyone at the lowest 🤦♀️ and not even waiting for relief bounce

Thought these "

robo-adviors" means that they can act ojectively, and not making decisions based on "

noises" or have I completely gotten it wrong when it comes to what "

robo-adviors" actually does?

QUOTE(honsiong @ Sep 18 2023, 11:29 AM)

Sorry³ !!

QUOTE(dark_axl21 @ Sep 18 2023, 11:32 AM)

Quite a lot of people got

'burnt' by that and many pulled out their funds.

This is weird, coz aren't "

robo-adviors" meant to make sound decisions not based on market noises ? At best, they should know what positions to take, like on whether to continue holding poitions or to switch portfolios ? Or again, have I gotten what "

robo-adviors" actually does ?

QUOTE(Medufsaid @ Sep 18 2023, 02:19 PM)

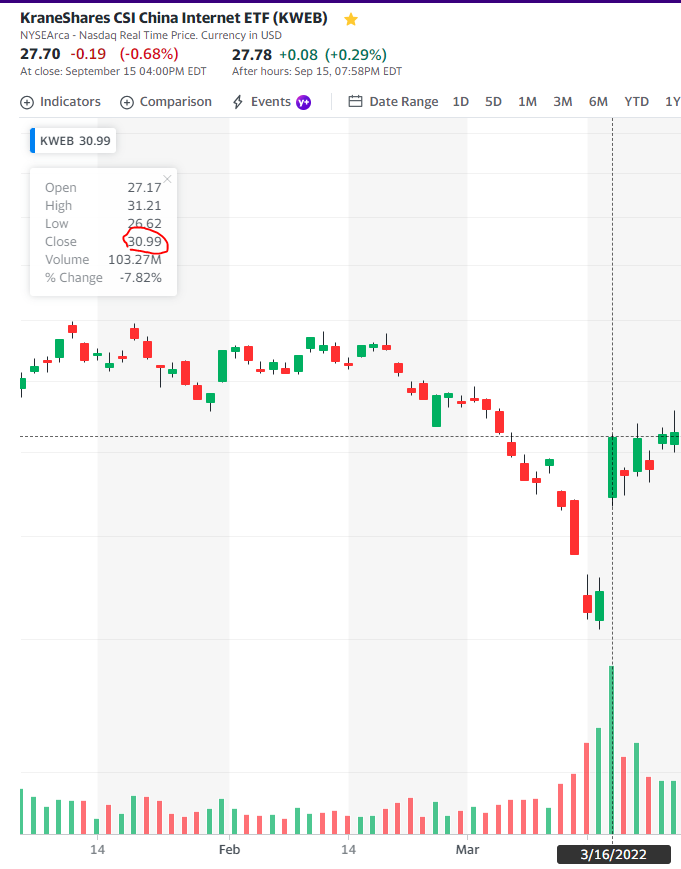

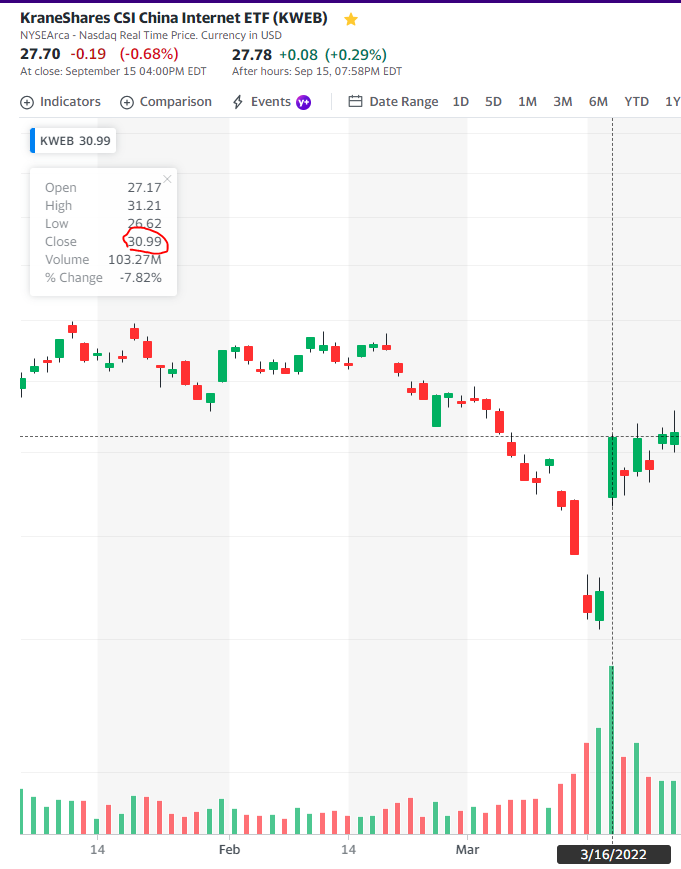

it's worse than that, they timed it at the worst possible day(s)

Uffff this has to hurt. But to be fair, the NAV is far below the highs of 2021 ? Like I think from the date they sold until now, the NAV hasn't reach the highs of 2021 ? Like making this decisions to leave not as bad - unless you meant to say they should have left in 2021 ?

Aug 27 2023, 04:13 PM

Aug 27 2023, 04:13 PM

Quote

Quote

0.0443sec

0.0443sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled