QUOTE(prophetjul @ Jun 1 2021, 12:43 PM)

When i first invested in gold in 2002, my goal was simple. Beat the FD rates of 5 to 6%. Which i believe it would.

AND it did.

So what is one's goal in investing via SA? 8% as many have indicated? So i brought in the issue of gold, which is a major part of SA's portfolio.

So i am sharing my experience of gold's return over 19 years. With that in mind, do we still wish for 8% from SA?

Discuss.

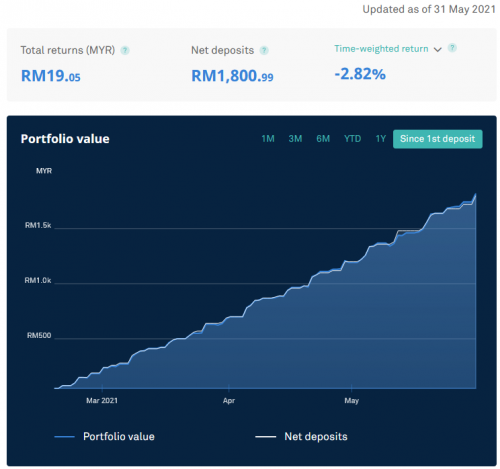

My investment goal in general is just to be average, so 6~8% sounds great for me. 90% of all my investment is on boring "beat EPF rates" stuff - half of it is on a broad based ETF, half of it is in SA, so if either disappear overnight, however unlikely, I'd still have half. The remaining 10% is my thrillseeking allocation - speculations, cryptos, over commiting to china, etc, to keep me in check and not touching the real important part.

I'd like to think gold prices are just arbitrary value that

other people holding it give them and JP Morgan decides, while every ringgit in stocks is behind a company that is trying it's best to not get eliminated by market competition.

That's why I don't like the idea of holding exclusively or majority gold. SA portfolio having 20% of my money in gold is just enough for me (~9% of total portfolio) as inflation hedge.

Probably a very pessimistic goal and outlook for someone who is just hitting his 30s, haha, so I know my line of thought won't be popular among others.

This post has been edited by Hoshiyuu: Jun 1 2021, 02:00 PM

May 31 2021, 10:52 PM

May 31 2021, 10:52 PM

Quote

Quote

0.0223sec

0.0223sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled