Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

thecurious

|

Apr 23 2021, 09:06 PM Apr 23 2021, 09:06 PM

|

|

QUOTE(DragonReine @ Apr 23 2021, 08:59 PM) Nett gains from compound dividends eventually pay off my management fees and still give me profit. Anyway by the time the dividends reach me as end user, it's already taxed, so I'm calculating based on what i get, not what it is before tax. https://www.stashaway.my/faq/115010107948-d...ends-get-taxed/Maybe I'm just not the kind to be that calculative, but if SA can (and already has) beat EPF gains after tax, I'm more than happy already, and I don't have the time or energy to buy "cheaper" through DIY  If that 30% tax is too much for you, feel free to invest elsewhere. Plenty of other options which "more bang for buck". You're completely misunderstanding my previous post but since you're too lazy to read it properly its fine. |

|

|

|

|

|

47100

|

Apr 23 2021, 09:15 PM Apr 23 2021, 09:15 PM

|

|

any 1 received call or email after you succesfully withdraw your investment from SA?

|

|

|

|

|

|

DragonReine

|

Apr 23 2021, 09:16 PM Apr 23 2021, 09:16 PM

|

|

QUOTE(thecurious @ Apr 23 2021, 09:06 PM) You're completely misunderstanding my previous post but since you're too lazy to read it properly its fine. Oh no, I get your issues with tax efficiency, but as mentioned in the link tax efficiency shouldn't the only factor to consider for performance. I understand what SA aims to do with their choices of ETFs and I'm ok with that, even if it's not great tax wise. https://www.stashaway.sg/r/etf-taxes-return...tracking-errors |

|

|

|

|

|

DragonReine

|

Apr 23 2021, 09:18 PM Apr 23 2021, 09:18 PM

|

|

QUOTE(47100 @ Apr 23 2021, 09:15 PM) any 1 received call or email after you succesfully withdraw your investment from SA? Like this, you mean?  never gotten call, but they sent me emails la This post has been edited by DragonReine: Apr 23 2021, 09:22 PM |

|

|

|

|

|

47100

|

Apr 23 2021, 09:22 PM Apr 23 2021, 09:22 PM

|

|

QUOTE(DragonReine @ Apr 23 2021, 09:18 PM) Like this, you mean?  no, as in actaul staff from SA called to find out why you withdraw.. |

|

|

|

|

|

thecurious

|

Apr 23 2021, 09:26 PM Apr 23 2021, 09:26 PM

|

|

QUOTE(DragonReine @ Apr 23 2021, 09:16 PM) Oh no, I get your issues with tax efficiency, but as mentioned in the link tax efficiency shouldn't the only factor to consider for performance. I understand what SA aims to do with their choices of ETFs and I'm ok with that, even if it's not great tax wise. https://www.stashaway.sg/r/etf-taxes-return...tracking-errorsoh you do get it lol...well its more on optimising cashflow and reducing unnecessary expenses but stashaway's choice of portfolio is so far still looking decent. as long as it performs well enough, the minor details like the dividend tax can be glossed over  |

|

|

|

|

|

bokbokchai

|

Apr 23 2021, 10:04 PM Apr 23 2021, 10:04 PM

|

|

QUOTE(ironman16 @ Apr 23 2021, 05:51 PM) Simple use to accumulate emergency fund ? or ........ why dun just use others platform to accumulate ? like Versa or .........  So true. Withdrawal from StashAway simple is too long for me. Requested withdrawal on 17th April, today only complete sells the units and waiting for transfer, taking more than a week to facilitate withdrawal. That’s a Nono for me in terms of storing money in as emergency fund, I rather move to VERSA. anyone can enlighten me whether OCBC frank has a limit towards interest earning? Eg, if I put 100k into saving pot, all 100k will earn the interest? |

|

|

|

|

|

honsiong

|

Apr 23 2021, 10:38 PM Apr 23 2021, 10:38 PM

|

|

With cheap brokers like Tiger and Moomoo, I am not sure if we even need StashAway anymore.

Doing Bogleheads' VTI + VXUS portfolios become affordable and feasible now.

Of course those brokers probably cannot get back 30% dividend tax for bond ETFs lah, hence I never say 3 funds portfolio.

|

|

|

|

|

|

SUSxander83

|

Apr 24 2021, 01:01 AM Apr 24 2021, 01:01 AM

|

|

QUOTE(bokbokchai @ Apr 23 2021, 10:04 PM) So true. Withdrawal from StashAway simple is too long for me. Requested withdrawal on 17th April, today only complete sells the units and waiting for transfer, taking more than a week to facilitate withdrawal. That’s a Nono for me in terms of storing money in as emergency fund, I rather move to VERSA. anyone can enlighten me whether OCBC frank has a limit towards interest earning? Eg, if I put 100k into saving pot, all 100k will earn the interest? If you mean OCBC by Frank yes all monies in the saving pot will be earning interest at 1.8%pa or following OPR rates |

|

|

|

|

|

DragonReine

|

Apr 24 2021, 01:57 AM Apr 24 2021, 01:57 AM

|

|

QUOTE(honsiong @ Apr 23 2021, 10:38 PM) With cheap brokers like Tiger and Moomoo, I am not sure if we even need StashAway anymore. Doing Bogleheads' VTI + VXUS portfolios become affordable and feasible now. Of course those brokers probably cannot get back 30% dividend tax for bond ETFs lah, hence I never say 3 funds portfolio. You gonna exit StashAway and realise those sweet earnings?  I think it's less "do we need StashAway" and more "does StashAway meet our needs". The passive investor who rather put their trust in robo rather than studying the funds out there for themselves will still go for robo. StashAway is for the ultimate lazy who just wants to save and stash, and trusts SA's management of the portfolio  Some people also don't trust the safety of a "foreign" brokerage like MooMoo/Tiger, but eh (shrug.jpg) I'm just speculating  |

|

|

|

|

|

DragonReine

|

Apr 24 2021, 01:59 AM Apr 24 2021, 01:59 AM

|

|

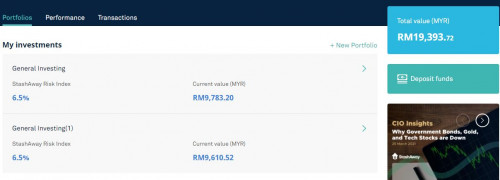

QUOTE(47100 @ Apr 23 2021, 09:22 PM) no, as in actaul staff from SA called to find out why you withdraw.. 🤔🤔 so far no, but my withdrawal is small, only a few Ks, and I didn't do a full withdrawal, only a bit to realise some of my earnings from KWEB ATH  I guess they'd be alarmed when you suddenly withdraw full amount for portfolios and close it. |

|

|

|

|

|

X_hunter

|

Apr 24 2021, 02:48 AM Apr 24 2021, 02:48 AM

|

Getting Started

|

Hi guys,

I am a newbie in investing. Have only invested in FD and ASNB. Btw, I have read till page 128 of this thread, and am eager to try StashAway. I plan to start with RM1k and DCA RM100 weekly, say every Thursday. Planning to choose risk profile 18-20% and my plan it to just invest and keep it long term.

Is it advisable to NOT change the risk profile and just maintain the same risk profile long term for better returns, no matter how the market it performing?

|

|

|

|

|

|

jonoave

|

Apr 24 2021, 04:50 AM Apr 24 2021, 04:50 AM

|

|

QUOTE(X_hunter @ Apr 23 2021, 09:48 PM) Hi guys, I am a newbie in investing. Have only invested in FD and ASNB. Btw, I have read till page 128 of this thread, and am eager to try StashAway. I plan to start with RM1k and DCA RM100 weekly, say every Thursday. Planning to choose risk profile 18-20% and my plan it to just invest and keep it long term. Is it advisable to NOT change the risk profile and just maintain the same risk profile long term for better returns, no matter how the market it performing? You can change the risk level, and that is essentially realising your losess/profits since Stashaway will change the weightage of the funds in that portfolio to the new risk level. E.g you have 40% in equity funds in Portfolio A with 30% risk, then now you change it to 20% risk, so Stashaway will sell of the equity funds to say, make it 20% and buy more fixed income funds. A better way is to create several portfolios with different risk levels instead: e.g. 22% and 36%. Stasahway is essentially build to avoid timing the market or reactin in panic (by changing the risk levels often), so if you do that better you do manual investment in stocks or mutual funds. |

|

|

|

|

|

ahkia

|

Apr 24 2021, 09:13 AM Apr 24 2021, 09:13 AM

|

New Member

|

Normally when SAMY will distribute the dividend to investors?

|

|

|

|

|

|

DragonReine

|

Apr 24 2021, 09:20 AM Apr 24 2021, 09:20 AM

|

|

QUOTE(ahkia @ Apr 24 2021, 09:13 AM) Normally when SAMY will distribute the dividend to investors? It depends on the underlying ETFs in each portfolio. Bond and fixed income ETFs distribute monthly. Equities based ETFs distribute yearly. |

|

|

|

|

|

ahkia

|

Apr 24 2021, 09:25 AM Apr 24 2021, 09:25 AM

|

New Member

|

QUOTE(DragonReine @ Apr 24 2021, 09:20 AM) It depends on the underlying ETFs in each portfolio. Bond and fixed income ETFs distribute monthly. Equities based ETFs distribute yearly. I see. Thank you. |

|

|

|

|

|

datolee32

|

Apr 24 2021, 10:17 PM Apr 24 2021, 10:17 PM

|

|

Hi, all sifu. If i want to transfer full investment from portfolio A to new portfolio B, can i retain the past performance history graph? As I set wrong goal in the very beginning.

|

|

|

|

|

|

honsiong

|

Apr 24 2021, 10:53 PM Apr 24 2021, 10:53 PM

|

|

QUOTE(datolee32 @ Apr 24 2021, 10:17 PM) Hi, all sifu. If i want to transfer full investment from portfolio A to new portfolio B, can i retain the past performance history graph? As I set wrong goal in the very beginning. No, the goal doesnt matter that much, just rename the portfolio and change the risk settings. |

|

|

|

|

|

emkay_2020

|

Apr 25 2021, 12:44 AM Apr 25 2021, 12:44 AM

|

Getting Started

|

Just wanna share my experienced transfer funds from Simple to my portfolio recently.

I scheduled recurring on 15th and i started receive email on 15th that my process to transfer funds from Simple to my portfolio.

The process only completed on 20th April.

It seems takes 4 business days to complete the entire process.

|

|

|

|

|

Apr 23 2021, 09:06 PM

Apr 23 2021, 09:06 PM

Quote

Quote

0.0485sec

0.0485sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled