Wast thinking of signing up, anyone can provide referral code? Thanks!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 26 2019, 03:33 PM Jun 26 2019, 03:33 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

659 posts Joined: May 2013 |

Wast thinking of signing up, anyone can provide referral code? Thanks!

|

|

|

|

|

|

Dec 10 2019, 10:34 PM Dec 10 2019, 10:34 PM

Return to original view | Post

#2

|

Junior Member

659 posts Joined: May 2013 |

|

|

|

Mar 11 2020, 04:27 PM Mar 11 2020, 04:27 PM

Return to original view | Post

#3

|

Junior Member

659 posts Joined: May 2013 |

|

|

|

Mar 14 2020, 04:26 AM Mar 14 2020, 04:26 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

659 posts Joined: May 2013 |

|

|

|

Mar 26 2020, 12:34 AM Mar 26 2020, 12:34 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(stormseeker92 @ Mar 25 2020, 05:44 PM) Buy low sell high. Now it's low so it's time to buy but nobody knows how low and how long it's gonna stay low. So DCA is the way. This is my plan too. Might slow down DCA a little bit to spread out the cash and pump a bit more when it continues to drop lower. |

|

|

Mar 26 2020, 12:36 AM Mar 26 2020, 12:36 AM

Return to original view | IPv6 | Post

#6

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(B500 @ Mar 25 2020, 06:52 PM) If you try to wait it out, it will be another classic case of market timing, in my opinion. Coz no one can accurately predict where is the bottom. Just when you think you saw bottom and want to reinvest, by the time your finds are invested, the index could have shot up (eg: 9% gains on S&P500 last night). I really don't get it - isn't it the best time to invest now? Buy low, sell high - that's the saying right. I guess just go into the markets based on your comfortable amount. And don't worry too much about getting the timing right. Coz I can tell you, nobody ever does. Buying now is red, but you'll stand to gain more when the markets bounce back. Who know is OP's wife can even make higher gains than OP later. |

|

|

|

|

|

Apr 17 2020, 04:58 AM Apr 17 2020, 04:58 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(afif737 @ Apr 16 2020, 09:08 PM) haha hopefully. I just replied in another thread that has something to do with this. Basically I do save but not every single sen of my income and to the extent of counting every money I spend on everything. This is not an advice, this is just me haha. I do have my savings but I do spend on things that I like. Coz I don't know for sure if I will even get to 65 year old QUOTE(awyongcarl @ Apr 16 2020, 09:35 PM) I strongly agree. What is the point of having so much money if you don't know how to utilize/enjoy them? Money is pointless and meaningless unless you make full use of it and make something meaningful out of it! But sure, I suppose some people will just feel happy and content and safe when they look at the numbers I also subscribe to this thinking. That's why I'm willing to spend some money to travel etc. I know some people will say "oh we want to save up money so when we retire we can travel around the world". But personally I feel that: 1. travel is exhausting. How much can you travel can you spend or cram within one period? Do you plan to travel or take vacation every month when you retire? 2. Age. Like I said, travel can be exhausting - all the walking around, sight-seeing and navigating in unfamiliar environments. Even now I can feel my stamina is not what it was when I was in my early 20s. I probably wouldn't have that much stamina to do long travels when I'm much older. Of course when I travel I try to keep a decent budget and not do shopping or fashion holidays. I also try to save for retirement but I see life as a journey, and we shouldn't focus so much on that end goal of "golden age of retirement' to enjoy life. But like you said, some people think differently and their priority is focused on achieving their target at the end. |

|

|

Jun 5 2020, 04:34 PM Jun 5 2020, 04:34 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(awyongcarl @ Jun 5 2020, 09:59 AM) Have two portfolio with risk index 36% and 22%. My 22% seems to be doing better than the 36% overall, both are invested at the same time around mid March right after the crash. Lol, pretty same here. I have 2 porfolios with the same risk and similar ratio.Maybe in the longer term I would see a more different numbers with the higher risk index portfolio, but my main is with 22%. The split ratio between my 36% and 22% is about 1:2. Return wise are as follow as of today in USD: 36% (MWR/TWR) vs 22% (MWR/TWR) 36% risk(19.17%/21.28%) vs 22% risk (23.64%/22.43%) The diff is marginal lol, but then again keep in mind these portfolios are barely 3 months old. Can't give you any recommendation though, as the name of the "risk" ratio implies, ask yourself how much loss can you stomach before you go mad? Stick with that and sleep well at night Only difference is that my 36% portfolio is doing slightly better. |

|

|

Jul 15 2020, 11:16 PM Jul 15 2020, 11:16 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(chichabom @ Jul 15 2020, 04:40 PM) really dont know why their processing time has increased so much. Back in 2019 if i deposit on a sunday night, buy order is executed on monday itself. nowadays i deposit sunday buy order is only executed on wed or thurs Strange. It's usually 2 days for me. Never went beyond 3 or even 4 days. I usually top up every week. Received next day, purchase shows up in portfolio the following day. |

|

|

Aug 11 2020, 02:03 PM Aug 11 2020, 02:03 PM

Return to original view | Post

#10

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(honsiong @ Aug 11 2020, 08:49 AM) I got 2, but unlike these ppl, I just use them how they are intended to be used. Proper risk level for target time horizons. I dont create multiple to see how they gonna behave over 1 month periods. QUOTE(gundamsp01 @ Aug 11 2020, 08:59 AM) II'm not sure if it's the same with the poster above, but I also have 2 portfolio. One at 22% (suggested risk) for long-term retirement.Another is my manual portfolio with higher risk 36%. Each time I DCA 2/3 to to 22% and 1/3 to the 36%. The 36% porfolio for me is flexible, and depending on market/mood might top up more or less. So far I've been topping up mostly consistent. If profit high, might also withdraw some to lock in profit. Right now my 36% is doing quite well, which lead me to think whether I should withdraw some to lock in some profits first. |

|

|

Aug 15 2020, 09:00 PM Aug 15 2020, 09:00 PM

Return to original view | Post

#11

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(Eurobeater @ Aug 15 2020, 12:51 PM) Oh, thats really nice of them to make sure your 6 months doesn't clash with existing referral Similar to mine. I had 2 referrals, the 2nd referral promo was added about 1.5 months after the first one, and they run concurrently. So in the end i got about 7.5 months from 2 referrals.I wish they did the same for me when I reviewed them on Google Play. They gave a 3 month free management promo, but it had to run concurrently with an existing referral promo I had and so wasted sia |

|

|

Aug 16 2020, 09:46 AM Aug 16 2020, 09:46 AM

Return to original view | Post

#12

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(thecurious @ Aug 15 2020, 04:40 PM) For the overlapping period of the 2 referral promotions, the amount invested with free management fee should be stacked right? or does it take the higher amount only? Well it's already free management fees, so I'm not sure how they can stack. What, they're gonna give me money instead?And the promotions are identical, there is no "higher". |

|

|

Jan 5 2021, 05:46 PM Jan 5 2021, 05:46 PM

Return to original view | Post

#13

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(tehoice @ Jan 5 2021, 11:44 AM) i have multiple, setting out different goals with different risk index (but mainly high risk). Lol, almost same as me. I have both Retirement (22%) and General Investing (36%).Portfolio I have: Retirement (this portion is something I will not withdraw until i retire) General investing (can be withdrawn for emergency use, hobby fund, or to fund any purchases etc). Rental income received (this portion is strictly set up to settle the housing loan only, instead of letting the money sit in the bank, grow here to settle the loan in some years time). The latter has no specific timeline. |

|

|

|

|

|

Jan 19 2021, 06:15 PM Jan 19 2021, 06:15 PM

Return to original view | Post

#14

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(cucumber @ Jan 19 2021, 01:08 PM) The market is at all time high, a correction could come anytime from now. I personally would just DCA. I park my money in SA Simple and auto deduct from Simple account to my portfolio every week. Safe and simple. I've started browsing a subreddit for personal finance in Europe and it's interesting to see the stark contrast of the attitude there.Seems like there the mindset is DCA only if you have a short time period or limited funds. If you have a long investment period and a lot of money, go lump sum if you believe your investment is good cos the market generally go up. Regardless if there is up or down, long run you'll still earn more from lump sum than DCA. |

|

|

Jan 19 2021, 06:52 PM Jan 19 2021, 06:52 PM

Return to original view | Post

#15

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(cucumber @ Jan 19 2021, 01:34 PM) Not disagreeing with what you say, but DCA is a risk management strategy. Yeah personally my thinking is more aligned to DCA and like you, for peace of mind cos I don't have so much money and so far I've always tended to start investing when the market is quite high (though I did try to top-up a bit more when it dips). And also yeah for peace of mind. I've personally have experienced my stock portfolio dropping 30% because i got in the wrong time, I was inexperienced at that time... and it's a terrible feeling to have, feeling anxious all the time & couldn't sleep at night. I realized I'm no warren buffett, so for me I will never do that again unless I'm trading & have the ability to set auto cut loss. To each his own i guess. Some ppl can handle it some ppl can't. It's just interesting for me to see the aggressive mindset of the Europeans. Or maybe it's just a small subset since it's a group of people who are really keen on personal finance and investing. I would like to start investing there, and I've no idea how since I don't speak the local language well that's why I'm trying to browse the reddit to learn a bit. |

|

|

Mar 19 2021, 04:36 PM Mar 19 2021, 04:36 PM

Return to original view | Post

#16

|

Junior Member

659 posts Joined: May 2013 |

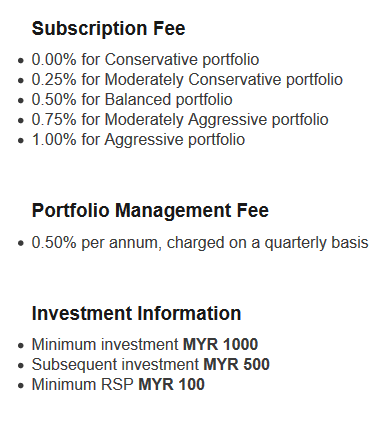

QUOTE(Hoshiyuu @ Mar 19 2021, 09:56 AM) So sales charge + 0.5% P.A.? Their advertised return is after deduction of all fees? I am surprised if more people are not subscribing if can have access to 6+ fund with only 0.5% annual fees, that's cheaper than SA(?)*. They had promotion I think last year in April if you activate Regular Savings Plan with them they will waive subscription fee for as long as RSP is active.. Interesting. Previoulsy I just put in money whenever (back then I think minimum is RM1 k per deposit), but that sounded like a really so I activated RSP at a lower rate. |

|

|

Apr 24 2021, 04:50 AM Apr 24 2021, 04:50 AM

Return to original view | IPv6 | Post

#17

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(X_hunter @ Apr 23 2021, 09:48 PM) Hi guys, You can change the risk level, and that is essentially realising your losess/profits since Stashaway will change the weightage of the funds in that portfolio to the new risk level. E.g you have 40% in equity funds in Portfolio A with 30% risk, then now you change it to 20% risk, so Stashaway will sell of the equity funds to say, make it 20% and buy more fixed income funds. I am a newbie in investing. Have only invested in FD and ASNB. Btw, I have read till page 128 of this thread, and am eager to try StashAway. I plan to start with RM1k and DCA RM100 weekly, say every Thursday. Planning to choose risk profile 18-20% and my plan it to just invest and keep it long term. Is it advisable to NOT change the risk profile and just maintain the same risk profile long term for better returns, no matter how the market it performing? A better way is to create several portfolios with different risk levels instead: e.g. 22% and 36%. Stasahway is essentially build to avoid timing the market or reactin in panic (by changing the risk levels often), so if you do that better you do manual investment in stocks or mutual funds. |

|

|

May 17 2021, 05:38 AM May 17 2021, 05:38 AM

Return to original view | IPv6 | Post

#18

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(pinksapphire @ May 16 2021, 10:18 PM) My redemption from SA Simple from 10th till now still processing...I know they'd be slow, but this can be too slow for comfort sometimes. I know I can do it faster through different route, but this is the way I'm sticking to, so just sayin', I wished they won't take more than a week for this route Could be due to the Raya Holidays. |

|

|

May 26 2021, 09:03 PM May 26 2021, 09:03 PM

Return to original view | Post

#19

|

Junior Member

659 posts Joined: May 2013 |

QUOTE(xander83 @ May 26 2021, 03:45 PM) Depends on your ownership but if you talking about compounding returns yes pooling all into a single and single portfolio will always gives you a better return in the long run how though? Shouldn't single account vs several accounts should have the same total return if the incoming funds and profit rates are identical?E.g. 1 account of RM10 k with RM100/month, vs 2 accounts of RM5k with RM50/month to both accounts Assuming the same profit rate, wouldn't the final returns be identical? This post has been edited by jonoave: May 26 2021, 09:03 PM |

|

|

May 26 2021, 09:59 PM May 26 2021, 09:59 PM

Return to original view | Post

#20

|

Junior Member

659 posts Joined: May 2013 |

|

| Change to: |  0.5995sec 0.5995sec

1.43 1.43

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 03:03 PM |