QUOTE(DragonReine @ Feb 20 2021, 12:33 AM)

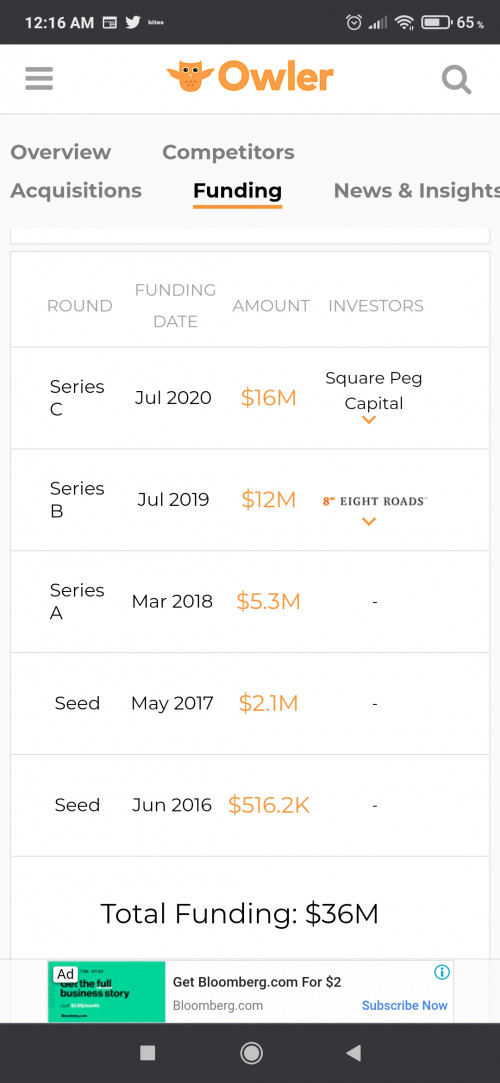

Actually, objectively speaking they're doing not bad at all if you at their funding timeline:

They only officially received over 10million funding injection in mid 2019, which was when economy was already showing signs of slowing down with the US-China trade war getting increasingly heated, and after that in 2020...well, pandemic hit.

Smartly didn't really get enough funding and their high management fees didn't help. I would argue that calling them "leading" back then is not really the same as leading now. Sure, one of the early pioneers of robo-advisors in Singapore, but they simply cannot keep up with lower fees and higher venture capital by other robo advisors.

SA's lucky that they have founders with investment banking connections which is probably why they're doing "better". Smartly and other early robo advisors paved the path for them, they just came in at the right time and just enough money driving them hahaha.

which is probably why they're doing "better". Smartly and other early robo advisors paved the path for them, they just came in at the right time and just enough money driving them hahaha.

Or you could look at the other side of coin, SA needs the almost annual fund injections just to keep the doors open and the lights on. Smartly was backed by a decently sized asset management firm. They had a lot of smart people look over the accounts and the numbers and decided it wasn't worth it. It's even worse if you consider Deloitte's estimates that it would 5 to 10 years just for a robo-advisor to break even, let alone make a profit. It's a lot worse when you consider Smartly's parting statement that the robo market had intense competition and was overcrowded, which is hilarious when less than a year later, the biggest regional robo and their main rival barely has over a $1b AUM.

They only officially received over 10million funding injection in mid 2019, which was when economy was already showing signs of slowing down with the US-China trade war getting increasingly heated, and after that in 2020...well, pandemic hit.

Smartly didn't really get enough funding and their high management fees didn't help. I would argue that calling them "leading" back then is not really the same as leading now. Sure, one of the early pioneers of robo-advisors in Singapore, but they simply cannot keep up with lower fees and higher venture capital by other robo advisors.

SA's lucky that they have founders with investment banking connections

Feb 20 2021, 12:52 AM

Feb 20 2021, 12:52 AM

Quote

Quote

0.0313sec

0.0313sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled