QUOTE(prophetjul @ Feb 19 2021, 01:44 PM)

If you want details of each ETF, go dig into respective ETF factsheet. https://www.etf.com/

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Feb 19 2021, 01:48 PM Feb 19 2021, 01:48 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(prophetjul @ Feb 19 2021, 01:44 PM) If you want details of each ETF, go dig into respective ETF factsheet. https://www.etf.com/ |

|

|

|

|

|

Feb 19 2021, 01:48 PM Feb 19 2021, 01:48 PM

Show posts by this member only | IPv6 | Post

#11982

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Feb 19 2021, 01:49 PM Feb 19 2021, 01:49 PM

Show posts by this member only | IPv6 | Post

#11983

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(GrumpyNooby @ Feb 19 2021, 01:48 PM) Right now i have not actually invested yet. And i cannot see the ETFs that they are in. |

|

|

Feb 19 2021, 01:49 PM Feb 19 2021, 01:49 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 19 2021, 01:50 PM Feb 19 2021, 01:50 PM

Show posts by this member only | IPv6 | Post

#11985

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Feb 19 2021, 01:50 PM Feb 19 2021, 01:50 PM

Show posts by this member only | IPv6 | Post

#11986

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Feb 19 2021, 01:48 PM) when opening new portfolio, you can click directly on each of the type of asset class during the page where you choose risk (scroll to bottom), they also tell you which ETFs they invest in, with a detailed description of each ETF.However they do not provide statistics on performance or current NAV.  This post has been edited by DragonReine: Feb 19 2021, 01:51 PM |

|

|

|

|

|

Feb 19 2021, 01:51 PM Feb 19 2021, 01:51 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 19 2021, 01:51 PM Feb 19 2021, 01:51 PM

Show posts by this member only | IPv6 | Post

#11988

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Feb 19 2021, 01:54 PM Feb 19 2021, 01:54 PM

Show posts by this member only | IPv6 | Post

#11989

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Feb 19 2021, 01:54 PM Feb 19 2021, 01:54 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(prophetjul @ Feb 19 2021, 01:51 PM) Here's list of all ETFs available in SAMY:https://www.stashaway.my/r/stashaways-etf-selection Based on your risk %, the ETF may or may not available to your portfolio. |

|

|

Feb 19 2021, 01:55 PM Feb 19 2021, 01:55 PM

Show posts by this member only | IPv6 | Post

#11991

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Feb 19 2021, 01:56 PM Feb 19 2021, 01:56 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Feb 19 2021, 01:56 PM Feb 19 2021, 01:56 PM

Show posts by this member only | IPv6 | Post

#11993

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

|

|

|

Feb 19 2021, 03:43 PM Feb 19 2021, 03:43 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

our resident oracle @xander83 was correct, thursday + Friday correction. This may extend if people want to compound the bad news with Texas harsh winter and oil prices shoot up. Up to you to decide to top up or just close your eyes for few days / weeks / months. DragonReine liked this post

|

|

|

Feb 19 2021, 06:06 PM Feb 19 2021, 06:06 PM

Show posts by this member only | IPv6 | Post

#11995

|

Junior Member

236 posts Joined: Apr 2011 |

Do the transfer duration from simple to risk portfolio same as direct deposit from bank to risk portfolio?

|

|

|

Feb 19 2021, 06:07 PM Feb 19 2021, 06:07 PM

Show posts by this member only | IPv6 | Post

#11996

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 19 2021, 08:06 PM Feb 19 2021, 08:06 PM

Show posts by this member only | IPv6 | Post

#11997

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(skyvisionz @ Feb 19 2021, 06:06 PM) Do the transfer duration from simple to risk portfolio same as direct deposit from bank to risk portfolio? Simple to Risk portfolio is likely the slowest possible method considering they need to sell Simple's investment before transferring. honsiong liked this post

|

|

|

Feb 19 2021, 08:44 PM Feb 19 2021, 08:44 PM

Show posts by this member only | IPv6 | Post

#11998

|

Junior Member

236 posts Joined: Apr 2011 |

|

|

|

Feb 19 2021, 11:50 PM Feb 19 2021, 11:50 PM

|

Senior Member

1,594 posts Joined: Feb 2006 |

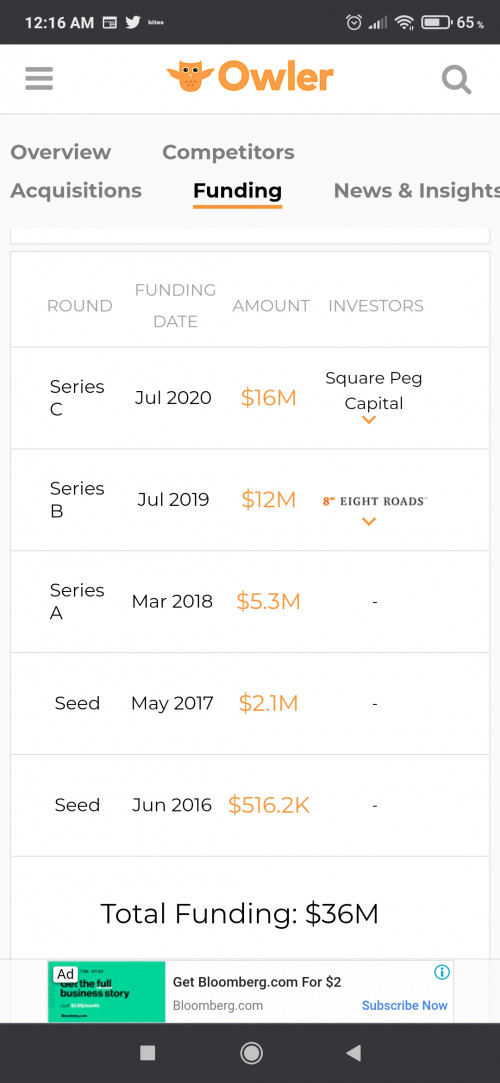

QUOTE(stormseeker92 @ Feb 19 2021, 10:06 AM) What about other roboadvisors who first launched around SAMY. They also have 1b+ USD AUM? You're already making a losing argument by comparing it with others instead of letting the market leader stand on their own merits, after blowing their own horn. After years of leading the market and burning through tens millions in startup funding, they still failed to capture a significant chunk of retail investors' money. If this is the level of their success after 4 years of existence then I can see why Smartly (one of the top 3 robos in the region not too long ago) shut down. Assuming everyone pays the highest rate of 0.8%, as an simple example, they only make roughly $8 million per year in revenue. This is with over a hundred employees earning relatively high wages in USD/SGD.Can't compare SAMY w other big established companies as they are relatively new. |

|

|

Feb 20 2021, 12:33 AM Feb 20 2021, 12:33 AM

Show posts by this member only | IPv6 | Post

#12000

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(red streak @ Feb 19 2021, 11:50 PM) You're already making a losing argument by comparing it with others instead of letting the market leader stand on their own merits, after blowing their own horn. After years of leading the market and burning through tens millions in startup funding, they still failed to capture a significant chunk of retail investors' money. If this is the level of their success after 4 years of existence then I can see why Smartly (one of the top 3 robos in the region not too long ago) shut down. Assuming everyone pays the highest rate of 0.8%, as an simple example, they only make roughly $8 million per year in revenue. This is with over a hundred employees earning relatively high wages in USD/SGD. Actually, objectively speaking they're doing not bad at all if you at their funding timeline: They only officially received over 10million funding injection in mid 2019, which was when economy was already showing signs of slowing down with the US-China trade war getting increasingly heated, and after that in 2020...well, pandemic hit. Smartly didn't really get enough funding and their high management fees didn't help. I would argue that calling them "leading" back then is not really the same as leading now. Sure, one of the early pioneers of robo-advisors in Singapore, but they simply cannot keep up with lower fees and higher venture capital by other robo advisors. SA's lucky that they have founders with investment banking connections Quazacolt liked this post

|

| Change to: |  0.0224sec 0.0224sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 07:23 AM |