QUOTE(darksider_515 @ Feb 16 2019, 08:41 PM)

I have bought a AIA insurance 10years ago with R@B 100.

Recently, I receive a letter asking me to top up to prevent lapse. Is this a common issue that would happen for an old insurance plan?

It means ur premium you're paying not is not enough to cover the cost of insurance, if you don't top up = ur policy lapses

QUOTE(Xithyl @ Feb 17 2019, 09:10 PM)

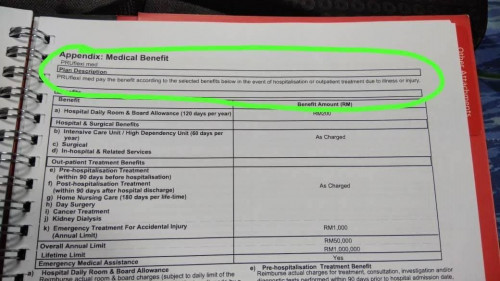

Any AIA agent can clarify this for me? Was approached by AIA agent in the hospital proposing lady plan to my wife. Since she is pregnant, agent said i can earn money from this. The lady plan witht the baby plan. The proposed coverage is 300k for the lady plan. Premium for everything is around 12k. So apparently i can get this 9k once all policy is approved. Then another 9k next year since my baby will be born this year. All i need to do is settle the first year 12k premium and i will get a total of 18k back. No other TnC?

well seems to me you're buying the insurance for the wrong reason if its just because of some cash reward, an insurance policy is a long term commitment to ensure you're covered for a long period of time.

Besides the cash reward, what other benefits do you see yourself worth taking up this policy ?

QUOTE(BFGWong @ Feb 18 2019, 10:35 AM)

Anyone can help with recommendation for travel insurance?

1 week Taiwan. Would like to get one with some compensation for "travel inconveniences", seems like most basic packages doesnt cover it

I use AIG personally, it's good enough

QUOTE(55665566 @ Feb 18 2019, 10:42 AM)

Hi,

I have an ILP with AIA and I thinking want to change the fund as my initial fund was suggested by the agent at 100%

Any suggestions or where to see the list of fund available?

You can refer to the AIA website for the list of it or contact ur agent for assistance.

QUOTE(- T - @ Feb 18 2019, 11:08 AM)

Any recommended AIA agent? Planning to get a medical insurance

I know someone who can help you

...pay 12K get back 9k, pay again 12k then get back 9k again,...then pay 12k every year again for the x number of years....

...pay 12K get back 9k, pay again 12k then get back 9k again,...then pay 12k every year again for the x number of years....

Feb 18 2019, 12:41 AM

Feb 18 2019, 12:41 AM

Quote

Quote

0.0284sec

0.0284sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled