QUOTE(ClarenceT @ Jun 26 2019, 11:34 AM)

damn true...UOB's statement is much simpler

Credit Cards Maybankard 2 Gold & Platinum Cards V20, 5% M2 Amex on weekend spending (NOT ALL)

|

|

Jun 26 2019, 11:53 AM Jun 26 2019, 11:53 AM

|

Junior Member

706 posts Joined: May 2013 From: Batcave |

|

|

|

|

|

|

Jun 26 2019, 11:55 AM Jun 26 2019, 11:55 AM

|

Senior Member

1,180 posts Joined: Oct 2010 |

|

|

|

Jun 26 2019, 04:41 PM Jun 26 2019, 04:41 PM

|

Junior Member

106 posts Joined: Apr 2016 |

del

This post has been edited by Dead_Arrow: Jun 26 2019, 04:54 PM |

|

|

Jun 26 2019, 04:48 PM Jun 26 2019, 04:48 PM

|

Junior Member

471 posts Joined: Nov 2015 |

|

|

|

Jun 26 2019, 04:49 PM Jun 26 2019, 04:49 PM

|

Junior Member

106 posts Joined: Apr 2016 |

|

|

|

Jun 26 2019, 04:52 PM Jun 26 2019, 04:52 PM

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

|

|

|

Jun 26 2019, 04:56 PM Jun 26 2019, 04:56 PM

|

Junior Member

106 posts Joined: Apr 2016 |

sorry all, just ignore my question.thanks

|

|

|

Jun 26 2019, 10:36 PM Jun 26 2019, 10:36 PM

Show posts by this member only | IPv6 | Post

#5568

|

Junior Member

480 posts Joined: Oct 2010 |

Hi all,

wanna ask if all banks practice the same policy: COMBINED CREDIT LIMIT I just got approved my Maybank FCB and its credit limit is combined with my gold 2 cards. It is the same for my citibank cards as well. |

|

|

Jun 26 2019, 10:48 PM Jun 26 2019, 10:48 PM

|

|

Staff

72,862 posts Joined: Sep 2005 From: KUL |

QUOTE(icebryanchan @ Jun 26 2019, 10:36 PM) Hi all, Yes, but if it's an Islamic card then it will have different limit.wanna ask if all banks practice the same policy: COMBINED CREDIT LIMIT I just got approved my Maybank FCB and its credit limit is combined with my gold 2 cards. It is the same for my citibank cards as well. |

|

|

Jun 26 2019, 11:11 PM Jun 26 2019, 11:11 PM

Show posts by this member only | IPv6 | Post

#5570

|

Junior Member

480 posts Joined: Oct 2010 |

|

|

|

Jun 27 2019, 12:55 AM Jun 27 2019, 12:55 AM

|

Junior Member

119 posts Joined: Sep 2016 |

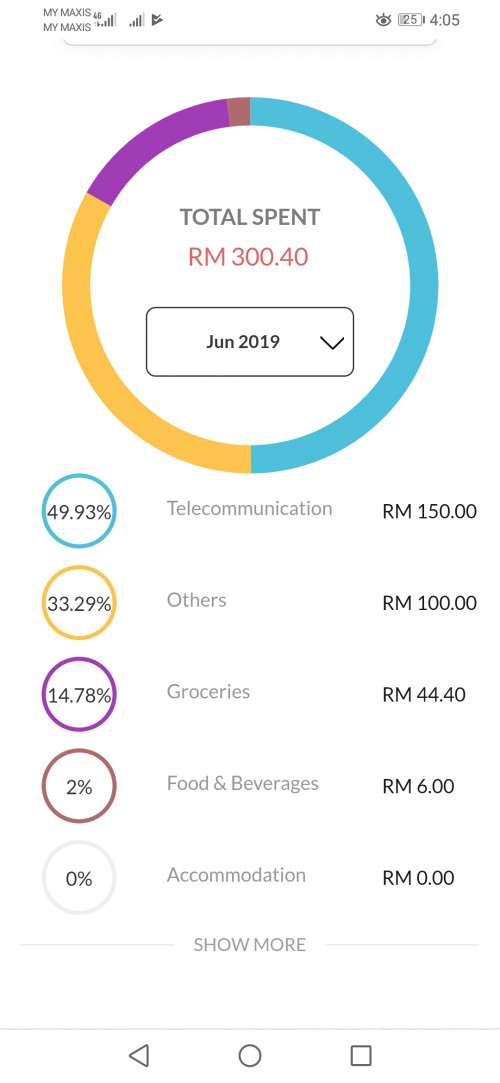

I was checking out the pie chart for my cards in modern M2U. From the category breakdown, it seems that:

- Boost App top-up is under (Telecommunications) [Top-up full using AMEX] - BigPay top-up (Financial Services) [Top-up full using Maybank FCB] - Agoda (Transportation) [AMEX] - Astro (Utilities) [AMEX] - Netflix (Utilities) [AMEX] These are all based on the amount I paid to the services. They all line-up together. FCB only used to top-up BigPay. I only use Amex for Agoda, Astro & Netflix autodeduct, for cashback, all to Boost App. The breakdowns should be accurate. Anything under Financial Services will be for e-wallets, right. Boost App is under Telecommunications though. So, maybe can still earn cashback from it? Some say Unifi/Astro still can earn cashback, but Astro seems to be listed as Utilities...hmm. Unless Maybank puts them in the categories, but still able to differentiate what is what within that category. This post has been edited by borneoman1: Jun 27 2019, 01:01 AM |

|

|

Jun 27 2019, 01:00 AM Jun 27 2019, 01:00 AM

|

Senior Member

3,100 posts Joined: Dec 2007 |

QUOTE(borneoman1 @ Jun 27 2019, 12:55 AM) I was checking out the pie chart for my cards in modern M2U. From the category breakdown, it seems that: Recently Boost has been moved to the "Others" category instead. For all we know, Maybank might be identifying eWallet transactions via name instead of MCC or category. All we can do now is just to speculate & the final results will be made known only on 2-AUG.- Boost App top-up is under (Telecommunications) - BigPay top-up (Financial Services) - Agoda (Transportation) - Astro (Utilities) - Netflix (Utilities) These are all based on the amount I paid to the services. They all line-up together, so the breakdowns should be accurate. Anything under Financial Services will be for e-wallets. Boost App is under Telecommunications though. So, maybe can still earn cashback from it? Some say Unifi/Astro still can earn cashback, but Astro seems to be listed as Utilities...hmm. |

|

|

Jun 27 2019, 01:03 AM Jun 27 2019, 01:03 AM

|

Junior Member

119 posts Joined: Sep 2016 |

QUOTE(talexeh @ Jun 27 2019, 01:00 AM) Recently Boost has been moved to the "Others" category instead. For all we know, Maybank might be identifying eWallet transactions via name instead of MCC or category. All we can do now is just to speculate & the final results will be made known only on 2-AUG. Oh, I see. My Boost top-up was in the beginning of the month, so if they moved it to Others already, then yeah, maybe they already thought how to close the loophole.Will see what category it is again when I top up Boost before 8th Jul. |

|

|

|

|

|

Jun 27 2019, 07:23 AM Jun 27 2019, 07:23 AM

Show posts by this member only | IPv6 | Post

#5574

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(borneoman1 @ Jun 27 2019, 12:55 AM) I was checking out the pie chart for my cards in modern M2U. From the category breakdown, it seems that: - Boost App top-up is under (Telecommunications) [Top-up full using AMEX] - BigPay top-up (Financial Services) [Top-up full using Maybank FCB] - Agoda (Transportation) [AMEX] - Astro (Utilities) [AMEX] - Netflix (Utilities) [AMEX] These are all based on the amount I paid to the services. They all line-up together. FCB only used to top-up BigPay. I only use Amex for Agoda, Astro & Netflix autodeduct, for cashback, all to Boost App. The breakdowns should be accurate. Anything under Financial Services will be for e-wallets, right. Boost App is under Telecommunications though. So, maybe can still earn cashback from it? Some say Unifi/Astro still can earn cashback, but Astro seems to be listed as Utilities...hmm. Unless Maybank puts them in the categories, but still able to differentiate what is what within that category. QUOTE(talexeh @ Jun 27 2019, 01:00 AM) Recently Boost has been moved to the "Others" category instead. For all we know, Maybank might be identifying eWallet transactions via name instead of MCC or category. All we can do now is just to speculate & the final results will be made known only on 2-AUG. QUOTE(borneoman1 @ Jun 27 2019, 01:03 AM) Oh, I see. My Boost top-up was in the beginning of the month, so if they moved it to Others already, then yeah, maybe they already thought how to close the loophole. Top up boost on 8/6/19 telecommunications Will see what category it is again when I top up Boost before 8th Jul. Top up boost 22/6/19 others  My suggestion: top up RM10 on 14/7, check whether you have received 50 sen on 2/8. |

|

|

Jun 27 2019, 08:04 AM Jun 27 2019, 08:04 AM

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Jun 27 2019, 09:26 AM Jun 27 2019, 09:26 AM

Show posts by this member only | IPv6 | Post

#5576

|

All Stars

18,455 posts Joined: Oct 2010 |

|

|

|

Jun 27 2019, 09:41 AM Jun 27 2019, 09:41 AM

|

All Stars

14,946 posts Joined: May 2015 |

QUOTE(MGM @ Jun 27 2019, 09:26 AM) This is M2 Thread, not FCB VS. Can use Amex to top up RM10 on Boost on 8/7, see if you get 50 Treatpoints by 11/7. Can use M2 Visa/MC to top up RM1 on Bigpay on 8/7, see if you get 1 treatpoint by 11/7. |

|

|

Jun 27 2019, 09:45 AM Jun 27 2019, 09:45 AM

Show posts by this member only | IPv6 | Post

#5578

|

Junior Member

68 posts Joined: May 2008 |

anyone know how to check which transaction and how many TP ?

|

|

|

Jun 27 2019, 09:53 AM Jun 27 2019, 09:53 AM

|

All Stars

14,946 posts Joined: May 2015 |

|

|

|

Jun 27 2019, 11:19 AM Jun 27 2019, 11:19 AM

|

Senior Member

6,689 posts Joined: Aug 2008 From: Malaysia |

For now ... i tried to max TP before they fill the hole by 7th

|

| Change to: |  0.0189sec 0.0189sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 11:03 PM |