Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

ky33li

|

Jan 7 2023, 06:34 PM Jan 7 2023, 06:34 PM

|

|

QUOTE(gooroojee @ Jan 7 2023, 05:52 PM) Is the RM2,000 deposit only required as a transaction record? meaning we can withdraw or use those funds any time? Yes PS - CIMB also has a conditional high-yield account (up to 4.50% ) for those who sign up as their Prime customer - https://www.cimb.com.my/en/personal/promoti...d-campaign.htmlCIMB you need to spend RM2.5k, so i think RHB is a better deal. Bill payments can be made in minimum RM1. |

|

|

|

|

|

MGM

|

Jan 7 2023, 06:36 PM Jan 7 2023, 06:36 PM

|

|

How much is the annual fee n card fee for this rhb smart acc?

|

|

|

|

|

|

joice11

|

Jan 7 2023, 06:43 PM Jan 7 2023, 06:43 PM

|

|

QUOTE(contestchris @ Jan 7 2023, 03:55 PM) The Campaign is open to all new and existing RHB Smart Account/-i customers (both residents and non- residents) of Consumer Banking Segment only (“Eligible Participant(s)”). The participating account under this Campaign is the RHB Smart Account/-i (“Eligible Account”). what does" Consumer Banking Segment only" mean? i have shell credit card with RHB, can i just apply online? any fee charges? |

|

|

|

|

|

contestchris

|

Jan 7 2023, 06:48 PM Jan 7 2023, 06:48 PM

|

|

QUOTE(ky33li @ Jan 7 2023, 05:29 PM) Actually step 4 don't need to do. You can easily get 3.35% by maintaining 1,2 & 3 (6 bills instead of 3 bills). I have done that for past few months when it is 2.85% Yes which is exactly what I said in the final paragraph |

|

|

|

|

|

contestchris

|

Jan 7 2023, 06:48 PM Jan 7 2023, 06:48 PM

|

|

QUOTE(MGM @ Jan 7 2023, 06:36 PM) How much is the annual fee n card fee for this rhb smart acc? For me is nil as my debit card is the zero annual fee version. |

|

|

|

|

|

contestchris

|

Jan 7 2023, 06:58 PM Jan 7 2023, 06:58 PM

|

|

QUOTE(joice11 @ Jan 7 2023, 06:43 PM) what does" Consumer Banking Segment only" mean? i have shell credit card with RHB, can i just apply online? any fee charges? I presume consumer banking means individuals like us (as opposed to business/commercial banking). I'm not sure if you can apply online with just a credit card. I already had a RHB debit card (along with the Shell CC) and yes, I was able to apply online. They just retagged my primary for debit card from SA to CA. |

|

|

|

|

|

contestchris

|

Jan 7 2023, 07:00 PM Jan 7 2023, 07:00 PM

|

|

QUOTE(gooroojee @ Jan 7 2023, 05:52 PM) Is the RM2,000 deposit only required as a transaction record? meaning we can withdraw or use those funds any time? PS - CIMB also has a conditional high-yield account (up to 4.50% ) for those who sign up as their Prime customer - https://www.cimb.com.my/en/personal/promoti...d-campaign.htmlYes you can withdraw anytime. It's just a transaction record. But beware, need to have average balance of RM1k/month. In any case, if you don't even have a an average balance of even a thousand Ringgit, quite pointless cause at that point any difference in interest rates is just a matter of a few cents. This post has been edited by contestchris: Jan 7 2023, 07:00 PM |

|

|

|

|

|

gooroojee

|

Jan 8 2023, 10:26 AM Jan 8 2023, 10:26 AM

|

|

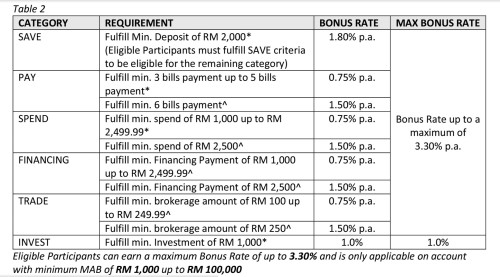

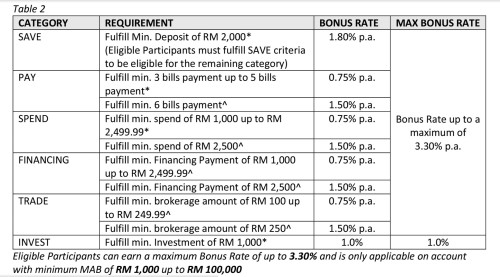

I've uploaded the conditional bonus rate for RHB here for easy reference:  |

|

|

|

|

|

ineser

|

Jan 10 2023, 10:07 AM Jan 10 2023, 10:07 AM

|

|

QUOTE(contestchris @ Jan 7 2023, 06:48 PM) For me is nil as my debit card is the zero annual fee version. Went to RHB to ask, they replied debit card cannot waive fee. Tried to find online the zero annual fee version but cant find. Able to share further on this? |

|

|

|

|

|

!@#$%^

|

Jan 10 2023, 10:12 AM Jan 10 2023, 10:12 AM

|

|

QUOTE(ineser @ Jan 10 2023, 10:07 AM) Went to RHB to ask, they replied debit card cannot waive fee. Tried to find online the zero annual fee version but cant find. Able to share further on this? long story short, get a basic savings account with no annual fee debit card. then open smart account via online (debit card with fees tagged to the account is optional). https://www.rhbgroup.com/personal/personal-...ount/index.html |

|

|

|

|

|

contestchris

|

Jan 10 2023, 10:24 AM Jan 10 2023, 10:24 AM

|

|

QUOTE(!@#$%^ @ Jan 10 2023, 10:12 AM) long story short, get a basic savings account with no annual fee debit card. then open smart account via online (debit card with fees tagged to the account is optional). https://www.rhbgroup.com/personal/personal-...ount/index.htmlYes bingo. Don't tell them anything about Smart Account. In my case I opened for my HL. Only later I created the Smart Account. See the two versions here: https://www.rhbgroup.com/personal/personal-...ount/index.htmlSometimes they will bodo2 don’t know about the zero annual fee version since the bank obviously cannot earn fees in such a scenario. Threaten to report them to BNM and suddenly they will remember and allow. This post has been edited by contestchris: Jan 10 2023, 10:28 AM |

|

|

|

|

|

MGM

|

Jan 10 2023, 04:18 PM Jan 10 2023, 04:18 PM

|

|

QUOTE(!@#$%^ @ Jan 10 2023, 10:12 AM) long story short, get a basic savings account with no annual fee debit card. then open smart account via online (debit card with fees tagged to the account is optional). https://www.rhbgroup.com/personal/personal-...ount/index.htmlI already got the BSA with debit card so can just open the Smart acc minus debit card online without the need to go d bank? |

|

|

|

|

|

!@#$%^

|

Jan 10 2023, 04:19 PM Jan 10 2023, 04:19 PM

|

|

QUOTE(MGM @ Jan 10 2023, 04:18 PM) I already got the BSA with debit card so can just open the Smart acc minus debit card online without the need to go d bank? i did previously. but not sure if they updated the latest application system. |

|

|

|

|

|

adele123

|

Jan 14 2023, 04:53 PM Jan 14 2023, 04:53 PM

|

|

for those using RHB smart account.

for 2023, the bonus interest is higher this year

1.8% for the deposit

pay 3 bills +0.5%

pay 6 bills +1.5%

within your online banking or app, after paying 6 bills, the pay bill part will still say +0.5%. is this consistent with what you are seeing? just comparing notes to make sure.

This post has been edited by adele123: Jan 14 2023, 04:53 PM

|

|

|

|

|

|

ky33li

|

Jan 14 2023, 05:13 PM Jan 14 2023, 05:13 PM

|

|

QUOTE(adele123 @ Jan 14 2023, 04:53 PM) for those using RHB smart account. for 2023, the bonus interest is higher this year 1.8% for the deposit pay 3 bills +0.5% pay 6 bills +1.5% within your online banking or app, after paying 6 bills, the pay bill part will still say +0.5%. is this consistent with what you are seeing? just comparing notes to make sure. it will pay 1.5% just that you receive it mid of next month. I have been getting paid for all so far |

|

|

|

|

|

contestchris

|

Jan 15 2023, 12:51 PM Jan 15 2023, 12:51 PM

|

|

QUOTE(adele123 @ Jan 14 2023, 04:53 PM) for those using RHB smart account. for 2023, the bonus interest is higher this year 1.8% for the deposit pay 3 bills +0.5% pay 6 bills +1.5% within your online banking or app, after paying 6 bills, the pay bill part will still say +0.5%. is this consistent with what you are seeing? just comparing notes to make sure. Yes. The BASIC Smart Sccount features is still rm2k deposit, 3 bills and rm1k card spend. The BONUS features of 6 bills, rm2.5k card spend, mortgage etc are NOT captured in the app. |

|

|

|

|

|

mamamia

|

Jan 17 2023, 04:51 PM Jan 17 2023, 04:51 PM

|

|

QUOTE(!@#$%^ @ Jan 10 2023, 10:12 AM) long story short, get a basic savings account with no annual fee debit card. then open smart account via online (debit card with fees tagged to the account is optional). https://www.rhbgroup.com/personal/personal-...ount/index.htmlIf I only have RHB smart acc, can I cancel the debit card? |

|

|

|

|

|

lovelyuser

|

Jan 17 2023, 05:14 PM Jan 17 2023, 05:14 PM

|

|

QUOTE(mamamia @ Jan 17 2023, 04:51 PM) If I only have RHB smart acc, can I cancel the debit card? I don't even apply a debit card when open RHB Smart account, I tell the cs I don't need one |

|

|

|

|

|

joice11

|

Jan 18 2023, 12:13 PM Jan 18 2023, 12:13 PM

|

|

QUOTE(lovelyuser @ Jan 17 2023, 05:14 PM) I don't even apply a debit card when open RHB Smart account, I tell the cs I don't need one so your smart account is 0 fee? same as basic saving acc? |

|

|

|

|

|

lovelyuser

|

Jan 18 2023, 12:36 PM Jan 18 2023, 12:36 PM

|

|

QUOTE(joice11 @ Jan 18 2023, 12:13 PM) so your smart account is 0 fee? same as basic saving acc? I remember I rrad the TnC, no charges for Smart acc alone, also double confirm with the officer who assist me on the account opening. 4 mths plus already, so far no abnormal charges |

|

|

|

|

Jan 7 2023, 06:34 PM

Jan 7 2023, 06:34 PM

Quote

Quote

0.0199sec

0.0199sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled