QUOTE(DragonReine @ Oct 14 2021, 09:29 AM)

Please read again. The FAQ I pasted said "change the savings/current account that is linked to card", not change the debit card/add new debit card.

this is from FAQ for Islamic debit card, it's the same:

Q4 If I choose to change my Savings Account-i or Current Account-i linked to my RHB Debit Card-i (Visa/

MasterCard) / RHB Debit Card-i (Generic), what should I do?

A4 You have to go to the RHB Bank/RHB Islamic branch where you applied for the RHB Debit Card-i (Visa/

MasterCard) & RHB Debit Card-i (Generic) account. Fill up the RHB Services Form and indicate your intended

account number in the account link column.

From my knowledge they won't allow change of linked account online for security reasons, must go to branch and fill in service form to change. I'm not sure if they've changed their procedure (I only ever held one RHB account and one linked card).

I just called their customer service about my issue. this is from FAQ for Islamic debit card, it's the same:

Q4 If I choose to change my Savings Account-i or Current Account-i linked to my RHB Debit Card-i (Visa/

MasterCard) / RHB Debit Card-i (Generic), what should I do?

A4 You have to go to the RHB Bank/RHB Islamic branch where you applied for the RHB Debit Card-i (Visa/

MasterCard) & RHB Debit Card-i (Generic) account. Fill up the RHB Services Form and indicate your intended

account number in the account link column.

From my knowledge they won't allow change of linked account online for security reasons, must go to branch and fill in service form to change. I'm not sure if they've changed their procedure (I only ever held one RHB account and one linked card).

They told me that I need to go to RHB branch to linked the debit card and require verification.

Close account and maintain less than 1k will have penalty.

Another question that I would like to ask.

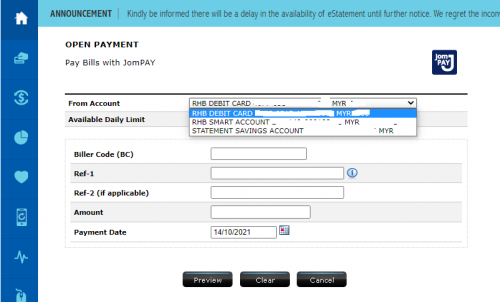

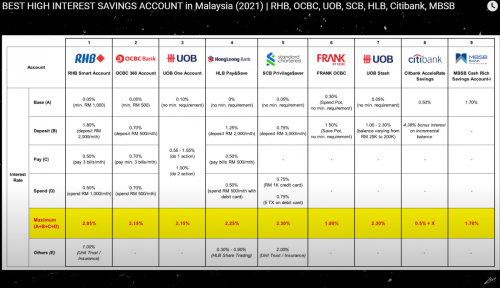

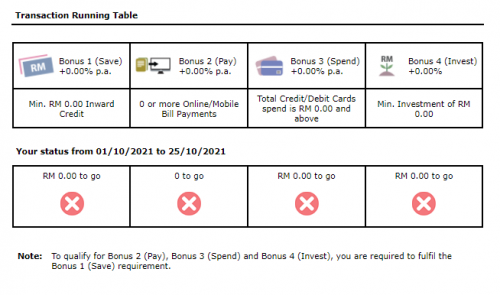

I am tried to pay utility bill using JomPay. We can select pay using debit card and from smart account. If I choose debit card does it consider under Spend category and if I pay using smart account, does it consider under Pay category?

Oct 14 2021, 09:25 AM

Oct 14 2021, 09:25 AM

Quote

Quote

0.0252sec

0.0252sec

0.57

0.57

6 queries

6 queries

GZIP Disabled

GZIP Disabled