Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

Batusai

|

Sep 15 2021, 10:56 AM Sep 15 2021, 10:56 AM

|

|

Would like to know for RHB Smart account.

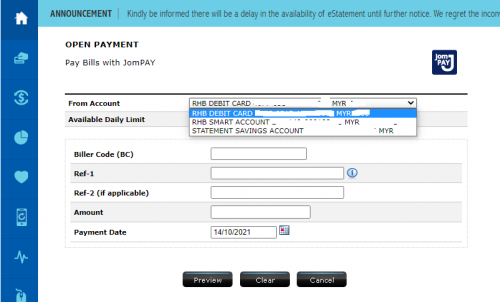

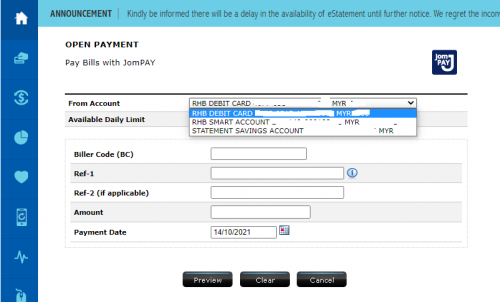

Fund transfer to credit card payment is it considered as bill payment to fulfill the 3x bonus.

Or it is only limited to Jompay or biller in the online banking side.

|

|

|

|

|

|

Batusai

|

Oct 16 2021, 11:19 AM Oct 16 2021, 11:19 AM

|

|

QUOTE(rocketm @ Oct 14 2021, 09:25 AM) I am tried to pay utility bill using JomPay. We can select pay using debit card and from smart account. If I choose debit card does it consider under Spend category and if I pay using smart account, does it consider under Pay category?  I tried using my debit card to pay bill but its not reflected as pay bill category. Only when I select direct from my smart account to pay bill via pay bill category or jompay, then its considered under bill payment catergory (3x) |

|

|

|

|

|

Batusai

|

Oct 20 2021, 04:34 PM Oct 20 2021, 04:34 PM

|

|

QUOTE(rocketm @ Oct 18 2021, 09:10 AM) If using debit card to pay then it should record as Spend category after 2 working days. I have not linked my debit card to smart account so cannot verify this. yes its considered as Spend catergory but not the Bill payment category. |

|

|

|

|

|

Batusai

|

Oct 20 2021, 04:36 PM Oct 20 2021, 04:36 PM

|

|

QUOTE(contestchris @ Oct 18 2021, 10:21 AM) Currently have a OCBC 360 account. I hit 2 of the 3 pillars usually (DEPOSIT and PAY, but not SPEND). Reason not hitting spend is because I do not have OCBC CC. Meanwhile, I already use RHB credit card. Is RHB Smart objectively better than OCBC 360? I see with the RHB Smart account, I could easily get 2.85%, while with OCBC 360 I'm getting usually 1.45%. Thanks! Since you have a RHB credit card, you can enjoy the 2.85% with 2k deposit and 3 bill payments online. only hassle to setup an account with RHB and get the cards and acc linked up. RHB's customer service is so so only. |

|

|

|

|

|

Batusai

|

Oct 29 2021, 05:41 PM Oct 29 2021, 05:41 PM

|

|

QUOTE(contestchris @ Oct 29 2021, 10:42 AM) Credit card / loans / fund transfer TO OTHER BANKS, are these classified as "Pay" (like OCBC 360)? How about if pay 3x to the same Syabas or TNB account, is that considered as 3x Pay? Thanks! First question: Answer is no Second question: yes qualified. I do 3x RM1 pay to my same TNB account. |

|

|

|

|

|

Batusai

|

Oct 29 2021, 05:48 PM Oct 29 2021, 05:48 PM

|

|

QUOTE(contestchris @ Oct 28 2021, 10:56 PM) Anyways, this matter can be easily put to rest by a forumer who had a free BSA DC tagged to Smart account. What was the outcome? I am a recent new user for this Smart Account. The debit card fee can be waived if you sign up as the 'Joy @work" account. Basically salary crediting account try to talk to your bank officer regarding this and see if they can put you under this campaign. I got enrolled under this campaign according to my bank officer and so far no charge for the debit card. |

|

|

|

|

|

Batusai

|

Nov 1 2021, 10:54 AM Nov 1 2021, 10:54 AM

|

|

QUOTE(rocketm @ Nov 1 2021, 10:31 AM) The 'Joy @work" account will need employer letter or form from RHB for the HR to fill then can open this account right? If sign up for 'Joy @work" account then cannot get Smart account benefit. It is 2 different accounts. joy@work itself is not an account, its a campaign to use your RHB acc as the salary crediting account So technically you open a smart account then sign up this joy@work campaign to enjoy some extra benefits. for myself, the bank manager automatically enroll me into this when I asked if any waiver of the card fees. He told me as long as I credit my salary in here monthly then it should be ok. |

|

|

|

|

|

Batusai

|

Nov 1 2021, 04:32 PM Nov 1 2021, 04:32 PM

|

|

QUOTE(contestchris @ Nov 1 2021, 11:14 AM) 1RHB Visa Infinite Credit Card, RHB Visa Signature Credit Card and RHB World MasterCard Credit Card will be waived for first 3 years while other credit cards annual fee waiver is subject to a minimum of 12x swipes in a year. Debit cards annual fee waiver is subject to minimum of 6 retail transactions in a year. https://www.rhbgroup.com/personal/deposits/...work/index.htmlyes you're right. 6x swipes for the debit card then can waive the annual fees. |

|

|

|

|

|

Batusai

|

Nov 8 2021, 03:22 PM Nov 8 2021, 03:22 PM

|

|

QUOTE(ky33li @ Nov 7 2021, 03:51 PM) Hi anyone calculated RHB Smart Account of 2.85% based on average monthly balance? I calculated mine for month of of October 2021, it is less than the 2.85% stipulated. you only receive 0.05% at the end of the month and the remainder 2.8% (if you fulfill all criteria) is credited on the 15th of the next month. So for month of Oct 2021, you'll have to wait till 15th of Nov only can see it being credited |

|

|

|

|

|

Batusai

|

Feb 7 2023, 01:51 PM Feb 7 2023, 01:51 PM

|

|

QUOTE(rae0724 @ Feb 6 2023, 03:58 PM) oh at first i was looking to open ocb360, because their credit card is good not for rhb because their credit card is not suitable for my usage but now it seems interesting here so for the 6 bills, if i only got 1 Umobile bill, i can pay 6 times to get the rate? any certain date period i need to follow? just double check, i am confused haha too many products in the market after deposit rm2000 every month, then i take it out or transfer to other bank later, will it affect? So correct pay 6 times of RM1 also possible. Must do it during the month itself. No specific date. After deposit RM2000, can take out or transfer out. no issues. |

|

|

|

|

Sep 15 2021, 10:56 AM

Sep 15 2021, 10:56 AM

Quote

Quote

0.0526sec

0.0526sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled